10 Smart Investment Tips For Beginners [2025 Guide]

Investing is a great way to put your cash to build wealth. Smart investors get the returns from their investments which easily outpace inflation and reduce the risk of failure.

You can see a greater wealth growth due to compounding. Compound earnings are applicable when you reinvested your returns to grow your portfolio and earn more returns.

Many people quickly jump in with investing and are excited to put their money to work. But quickly, they can find themselves losing money. Also, investing isn’t gambling. If you make a wrong bet, you will lose all of your money. All this happens because of the lack of investment-related knowledge.

Below Are The 10 Smart Investment Tips For Beginners,

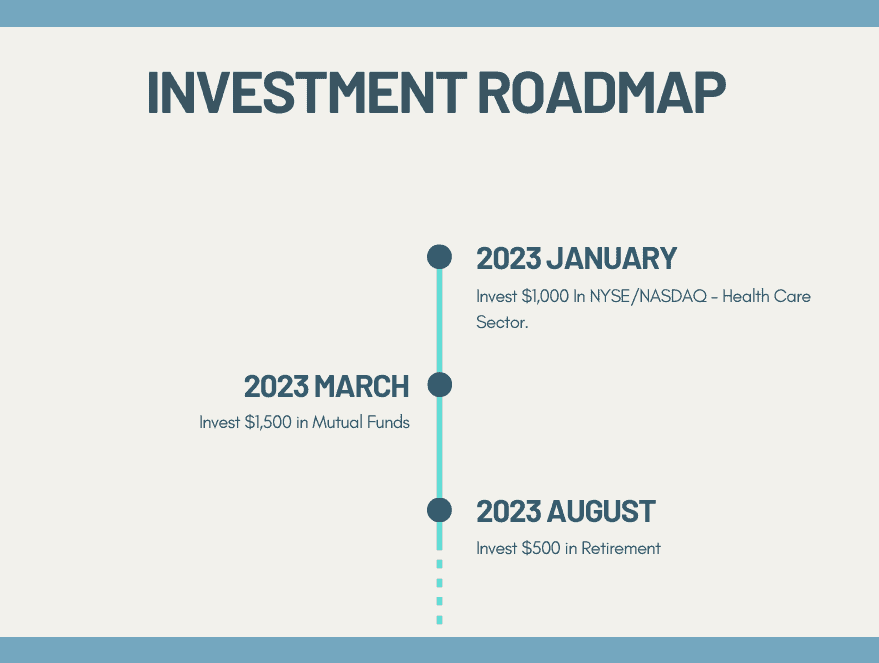

1. Have An Investment Roadmap

Investment is a journey from where you start to the achievement of what you want. It could be a two-year, five-year, ten-year, or else a lifetime of a continuous journey.

An investment roadmap is a simple visual guide to sketch your financial priorities and long-term goals. You should have a long-term investment plan to maximize your returns while minimizing risk and this will help you prioritize long-term goals to achieve the ultimate destination.

We all have daily challenges in our lives and it is easy to lose the correct direction to go. You need a financial roadmap to help you to make decisions towards the right financial direction.

2. Establish Correct Objectives

Investment is usually a long-term objective. But you need to understand the objective of your investment. It could be either to purchase a new house, purchase a vehicle, save for your retirement, for your child’s higher education, etc.

Establishing a correct objective will help you better the importance of what kind of investment will be applicable to achieve the objective. Choosing the correct investment depends on the capital, tenure, potential annual earnings, and risk level.

3. Evade High Leverage

Leverage results from using borrowed capital to find the investments. This is a usual practice of top investors who make sure that they make an annual return percentage more than the annual borrowing interest percentage. But this is inbuilt with a risk factor too.

As an example, you can compare which you invest money you have saved versus invest money you have borrowed. Borrowing has a liability of re-payment where if the investment does not succeed, you will end up in big trouble. Hence why it is advised for beginners to avoid high leverage.

4. Analyze The Risk Appetite Of Your Investment Portfolio

Risk is always bound with any kind of investment. The risk of an investment is where the chance of an actual gain will differ from the expected return. As an example, let’s say you have invested $10,000 in the stock market and expect a 20% share price increase within this year. But the share price has dropped by -5%. The change of differing the expected result is known as the risk.

Every investment has a general risk level. As an example, there are two investment types either invest in a bank through a certificate of deposit or else invest in the stock market. Generally, investing in the stock market is riskier than investing in a bank certificate of deposit since with the possibility of deviating from the expected results. On another side, high-risk investment generally has the capability of the highest earning potential.

Risk appetite is the level of risk that you are accepting in your investments. The best advice given by successful investors is to strike a balance in your investment portfolio. There should be certain high-risk investments, medium-risk investments, and low-risk investments in your portfolio to balance your return fluctuations, based on your risk appetite.

Read More: How to Determine Your Investment Risk Appetite – Article Published by Regions.com

5. Know Your Cash Flow Well

As an investor, it is important to know the monthly cash flow. You could be a part-time investor who does the day job to cover expenses, or else fully depend on investment returns. In any aspect, you should have a clear idea of how much you are getting every month and how much money is expensed every month.

Understanding the cash flow will help you to plan your savings and investments well. This will ensure that the investment will be a continuous one to maximize the returns more and more.

6. Understand Future Is Not Fully Certain

You don’t have a 100% certain guarantee on what will happen for your investment in the next year. The future of investment holds at least some level of uncertainty. This should be understood well, otherwise, you will mentally fall if in case your investment fails.

7. Don’t Be Emotional

Especially when it comes to stock market-related investment, the sentiment of investors plays a huge relationship in the share price. When more investors sell their shares of a listed company, the share price of the company tends to fall. On another side, if more investors buy the shares, the share price of a company tends to increase. This is the behavior of the stock market where the share price depends on investor confidence in the company’s future.

You should carefully decide based on systematic analyses of the prospects to buy/sell the stock market shares, not based on rumors and emotions. Stock prices keep changing in a short term based on speculations, and long term based on investor confidence. Since your actions could be primarily driven by emotions, you must ensure to analyze all factors carefully before making a final investment decision.

8. Diversify the Investments In Your Portfolio

The world’s greatest investor and one of the top richest people in the world, Warren Buffett, once said “Do not put all eggs in one basket”. You should simply be advised to diversify your investments to minimize the risk.

Diversification of stocks can be done based on the risk associated with their investment, liquidity, and also with the tenure of investment based on your objectives. You can diversify your investments between investment types like stocks, bonds, mutual funds, bank products, retirement, etc.

Diversification can be done based on the stock market investment portfolio as well. You can invest in diversified business sectors like healthcare, airlines, hotels, food, transportation, etc.

As an example let’s say you have three stock market investments in airlines, healthcare, and food-related companies. Due to the covid pandemic that happened last year, all the airline stocks have been dropped drastically. But it was vice versa in healthcare companies where we see a boost in the share price. Diversification of the investment can help you to minimize the negative impact of an investment to the portfolio level.

9. Understand The Risk Level

The level of risk linked with the investment must be carefully analyzed before you put your hard-earned cash into something. The best way to identify the risks is to compare the investment options you have. You will be able to figure out what level of risk each option holds.

10. Have an Emergency Fund

Emergencies could happen to any of us in an unavoidable sudden way. You should make sure that some cash is reserved which you can easily tap into before withdrawing from your long team investments. No one wants to compromise their investment strategy by selling an investment pre-mature basis.

Want to Start Your Own Business?

Check out below other Articles to get Resourceful Information,

- 40 Most Profitable Art Business Ideas

- 15 Most Lucrative Party Rental Business Ideas

- 16 Easy Ways To Make Money While You Sleep

- 22 Easy-To-Start Online Business Ideas for Beginners

- 36 Home Businesses To Start With Zero Dollar Investment

- 12 Most Easy to Start Passive Income Ideas

- Profitable Home Based Business Ideas

- Most Guaranteed Small Business Ideas For Ladies At Home

- Best 20 Online Money Making Ideas For A Housewife

- 22 Lucrative Business Ideas For a Stay At Home Mom

- 30 Best Money Earning Ideas Not Require Laptop or Computer