Porter’s Five Forces: Applied To Banking Industry with Real World Examples

Porter’s Five Forces was developed by Michael Porter, a professor at Harvard Business School. The analysis is used to understand the competitive environment of an industry by examining five key factors: the threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitute products, and intensity of competitive rivalry.

This analysis is useful for businesses as it provides a framework for understanding the competitive landscape of their industry. By examining each of the five forces, businesses can identify potential risks and opportunities, and develop strategies to succeed in the market.

Banking is a known industry for all of us. All of us have visited a bank at least one time to get their service. It is a very competitive industry in many aspects like interest rates, fees, product offerings, customer service, technological innovation, and geographic reach. This intense competition is enhanced by factors such as globalization, deregulation, advances in technology, and the increasing demands and expectations of customers.

The American banking industry is highly competitive, driven by established national banks, emerging fintech disruptors, and regional/community banks. Competition is fueled by technological advancements, regulatory factors, evolving customer preferences, and the quest to provide superior financial services and customer experiences. For example, JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup are among the largest banks in the United States, competing for market dominance.

By using Porter’s Five Forces analysis, we can gain a better understanding of the competitive environment in this industry. Following is a detailed description of each force aligned with the Banking Industry.

1. The Threat of New Entrants

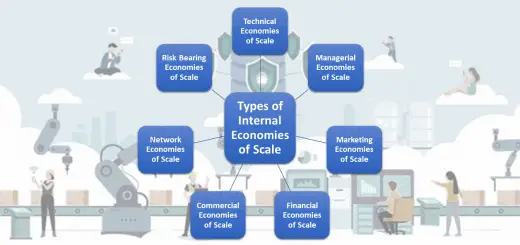

This force refers to the ease or difficulty with which new companies can enter the market. High barriers to entry, such as high capital requirements, regulatory restrictions, and economies of scale, can make it difficult for new companies to enter the market. In contrast, low barriers to entry, such as low startup costs, easy access to technology, and low regulatory restrictions, can make it easier for new companies to enter the market.

The threat of new entrants in the banking industry is relatively high due to the regulatory barriers and capital requirements involved. Banks face stringent regulations and oversight, making it challenging for new players to enter the market. Additionally, established banks benefit from economies of scale, strong brand recognition, extensive customer bases, and established networks, acting as barriers for new entrants. However, technological advancements and fintech startups are disrupting traditional banking models and increasing the threat of new entrants.

Operating a bank in the USA requires a quite large amount of initial capital which includes deposits with a reserve bank. This means that the entry costs are so high that only a few new entrants can survive in the US banking industry. This starting capital requirement is one more barrier to new entrants to the banking industry. Existing commercial banks have a cost advantage over new entrants regardless of economies of scale and capital investment required. This is the result of the low cost of recruitment, marketing, and advertising and cost efficiencies arising from economies of learning in the banking industry. An existing bank spends less on recruitment as compared to a new entrant-bank, and this difference is also a barrier to entry into the industry (Source: Threat of New Entrants to Commercial Banking Industry - By ivypanda.com)

2. The Bargaining Power of Suppliers

This force refers to the power that suppliers have over the industry. Suppliers can exert power by controlling the supply of critical inputs, charging high prices, or limiting the quality of their products.

In the banking industry, suppliers primarily mean the providers of funds, such as depositors and institutional investors. Individual depositors have limited power as a supply of funds. But institutional investors have a greater influence when banks require significant capital or funding. Banks rely on these suppliers of funds to finance their operations and lending activities. However, regulatory oversight and the availability of alternative sources of funds can reduce supplier power to some extent.

3. The Bargaining Power of Buyers

This force refers to the power that buyers have over the industry. Buyers can exert power by demanding low prices, high quality, or other favorable terms. In industries where buyers have many options or where the products are not highly differentiated, buyers have more power.

Buyer power in the banking industry varies depending on the type of customer. Individual consumers have relatively lower buyer power due to limited options and the complexity of switching banks. However, corporate clients and large institutional customers have higher bargaining power due to their significant financial resources and the potential for long-term relationships. They can negotiate better terms and seek competitive offers from multiple banks.

Customers who pay bank fees are three times more likely to consider switching banks, only 61% either do not know or are unsure whether their bank has made any changes to their overdraft fee policy. Notably, many big banks have introduced fee relief plans this year (Source: U.S. Retail Banks Struggle to Differentiate, Deliver Meaningful Customer Experience as Economy Sours, J.D. Power Finds - By jdpower.com)

4. The Threat of Substitute Products or Services

This force refers to the threat of substitutes, or alternative products or services that can fulfill the same customer need. The availability of substitutes can limit the pricing power of companies in the industry, as customers can choose to switch to substitutes if prices become too high.

The banking industry faces a moderate threat from substitute products and services. Technological advancements and the rise of fintech have introduced alternative financial services, such as online payment platforms, peer-to-peer lending, and digital wallets. These substitutes offer convenience, lower costs, and innovative features, attracting a segment of customers. However, traditional banks still maintain their competitive edge through their comprehensive range of financial services, established trust, and regulatory compliance.

UK banks see fintech startups as a major threat to the business models of traditional financial companies and institutions. To find out the attitude of banks to fintechs, about 600 representatives of the financial sector were interviewed. According to 81% of respondents, quality of service outpaces customer trust in a brand in the race to acquire and retain users. 79% of participants believe that fintech startups have the most attractive brands. 59% see fintechs as a global competitor to banks that can replace traditional forms of providing financial services. (Source: The Impact of Fintech on the Future of Banks and Financial Services - By geniusee.com)

5. The Intensity of Competitive Rivalry

This force refers to the intensity of competition among existing companies in the industry. The level of competition depends on factors such as the number of competitors, the level of differentiation, and the degree of price competition. High levels of competition can lead to lower prices, reduced profitability, and higher marketing costs.

The banking industry is facing intense competition. There are numerous banks, including large multinational institutions, regional banks, and local community banks. Competitive factors include interest rates, fees, range of products and services, customer service, and technological innovation. Banks compete for customers and market share through aggressive marketing strategies and differentiation in terms of offerings and customer experience.

Key Takeaways

In summary, Porter’s Five Forces analysis highlights the highly competitive environment of the banking industry, with potential opportunities for new entrants due to technological advancements, and moderate threat of substitute products. Regulatory and compliance factors heavily influence the banking industry, making it essential to consider the legal and regulatory framework in which banks operate.

Competition of the American and Global Banking Industry

The global banking industry is highly competitive. There are many local and global banks including various financial institutions competing in the industry to grow the market share. Banks compete on various aspects like interest rates, fees, product offerings, customer service, technological innovation, and geographic reach. This intense competition is powered by factors such as globalization, deregulation, advances in technology, and the increasing demands and expectations of customers.

The competition in the American banking industry is particularly heightened due to the presence of numerous large national banks, regional banks, community banks, and credit unions. These institutions compete to attract deposits, lend to businesses and consumers, provide investment and wealth management services, and offer a wide range of financial products.

For example, JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup are among the largest banks in the United States, competing for market dominance. These banks have extensive branch networks, robust digital banking platforms, and diverse product portfolios, allowing them to cater to various customer segments. They invest heavily in technology to improve customer experiences, enhance operational efficiency, and stay ahead of emerging fintech competitors.

However, the American banking industry also features competition from non-traditional players, including fintech startups and tech giants. Companies like PayPal, Apple, Square, and Google have entered the financial services space, offering innovative payment solutions, digital wallets, and online lending platforms. These disruptions leverage their technological prowess, agility, and ability to provide seamless user experiences adding a new challenge for traditional banks.

Additionally, regional and community banks in the United States compete by focusing on personalized service, local expertise, and niche markets. These banks often have strong relationships within their communities and can tailor their offerings to cater to the unique needs of their customer base.

Regulatory factors also shape the competitive landscape of the American banking industry. Regulations such as the Dodd-Frank Act and the Consumer Financial Protection Bureau (CFPB) oversight aim to promote fair competition, consumer protection, and stability in the financial system. Compliance with these regulations adds layer of complexity for banks, creating challenges and influencing competitive dynamics.

Overall, the American banking industry is highly competitive, driven by established national banks, emerging fintech disruptions, and regional/community banks. Competition is fueled by technological advancements, regulatory factors, evolving customer preferences, and the quest to provide superior financial services and customer experiences. Staying competitive in this industry requires continuous innovation, investment in technology, personalized offerings, and a focus on customer needs and satisfaction.

Read More About Porter’s Five Forces,

- Porter’s Five Forces: Explanation with Industry Examples

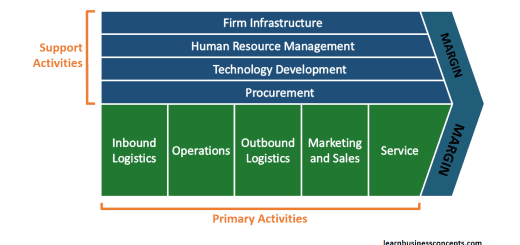

- Porter’s Value Chain: Primary & Support/Secondary Activities

- Porter’s Five Forces: Advantages and Disadvantages

- How to Apply Porter’s Five Forces to Industry / Business: Step-By-Step Simple Detail Guide with Examples

- Porter’s Five Forces: Applied To Airline Industry with Real World Examples

- Porter’s Five Forces: Applied To Fast Food Restaurants Industry with Real World Examples

- Porter’s Five Forces: Applied To Starbucks with Examples

- Porter’s Five Forces: Applied To Clothing / Fashion Industry with Real World Examples