How to Apply Porter’s Five Forces to Industry / Business: Step-By-Step Simple Detail Guide with Examples

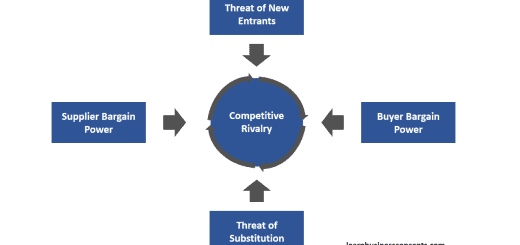

Michael Porter invented Porter’s Five Forces framework to analyze how an industry or business is competitive with certain dynamics. A business in any industry can assess the attractiveness and profitability of entering or operating within a specific industry by having a deep understanding of these forces. The framework consists of five key forces: competitive rivalry, supplier power, buyer power, the threat of new entrants, and the threat of substitute products.

Step-by-Step Detail Guide to Apply Porter’s Five Forces to Any Industry / Business

Below is the 8-step detail guide on how to apply Porter’s Five Forces to analyze any industry,

Step 1: Identify the Industry

You need to define the industry you want to analyze. Carefully consider the products or services your business is offering, the market segment, key customer groups, and other factors to determine the industry correctly.

Step 2: Analyze the Threat of New Entrants

You need to analyze the barriers to entry for potential new competitors who are entering new to the industry. Identify the potential threats those new entrants have and their likelihood to cope with those and be successful. Consider the barriers to entry factors like industry regulations, compliance requirements, initial capital required, economies of scale of key players, brand loyalty of key players, and distribution channels. You can research whether existing competitors have established cost or differentiation strategies that would deter new entrants.

Some examples of this step are given below,

Threat of New Entrants in the Fast Food Restaurants Industry: It is required certain capital, a good location, a suitable chef, satisfactory suppliers, and marketing o establish a fast food restaurant. It will be very challenging for a newcomer to enter the market if existing fast-food chains benefit from economies of scale, strong brand recognition, established supply chains, and customer loyalty. The threat of new entrants in the Food Restaurants industry is relatively medium.

Threat of New Entrants in the Clothing Industry: Adequate suppliers, the right distributors, creativity, identifying fashion trends, and marketing efforts are required to establish a clothing brand. The rise of e-commerce platforms and social media has facilitated the entry of small-scale and direct-to-consumer brands. The threat of new entrants in the clothing industry is relatively high.

Threat of New Entrants in the Banking Industry: The banking industry has high regulatory requirements. Also, a significantly high capital is needed to start a new bank. Established banks benefit from economies of scale, strong brand recognition, vast customer bases, and established networks. The threat of new entrants in the banking industry is relatively high.

Step 3: Evaluate Supplier Power

You need to analyze the power of suppliers within the industry. Identify the key suppliers and determine their concentration in the market. You need to assess their ability to control prices, availability of inputs, and potential for forward integration. You need to consider factors like the uniqueness of supplier’s products or services and the cost of switching to alternative suppliers.

Some examples of this step are given below,

Supplier Power in the Fast Food Restaurants Industry: There is limited power with the Suppliers in the fast food industry. Supplies like food ingredients, packaging materials, and equipment are widely available from multiple suppliers. Despite this, suppliers may exert influence regarding quality, delivery, and pricing. Hence, suppliers in the fast food industry typically have minimum power.

Supplier Power in the Clothing Industry: The bargaining power of suppliers depends on the availability of raw materials, manufacturing capacity, and uniqueness of fabrics. Numerous suppliers worldwide are available to provide options. Hence, suppliers in the clothing industry typically have moderate power.

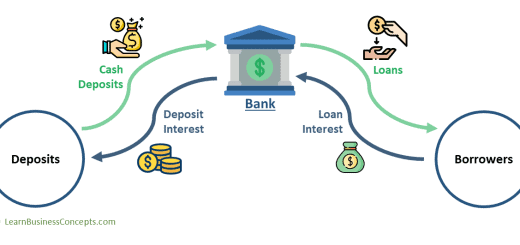

Supplier Power in the Banking Industry: suppliers of the Banking industry typically are providers of funds, such as depositors and institutional investors. Institutional investors can exert influence when banks require significant capital. Hence, suppliers in the Banking industry typically have high power.

Step 4: Assess Buyer Power

You need to determine the power of buyers in the industry. You need to analyze and identify the major customer groups and assess their purchasing behavior. You need to evaluate factors like the size of buyers, their ability to negotiate prices, and the cost of switching to alternative buyers. Note that to consider any factors that may increase buyer power like easy access to information or low switching costs.

Some examples of this step are given below,

Buyer Power in the Fast Food Restaurants Industry: Customers have many options and can easily switch between fast food chains based on price, menu preferences, and convenience. Hence buyer power is relatively high in the fast food industry.

Buyer Power in the Clothing Industry: Consumers have a wide range of choices and can easily switch between brands based on price, style, and quality. Hence, it has a significant high buyer power in the clothing industry.

Buyer Power in the Banking Industry: Individual consumers have relatively lower buyer power due to limited options and it is not easy to switch. Corporate clients and large institutional customers have higher bargaining power due to their significant financial resources and the potential for long-term relationships. Buyer power in the banking industry varies depending on the type of customer.

Step 5: Evaluate the Threat of Substitute Products

You need to assess the availability and attractiveness of substitute products or services. Identify potential substitutes and analyze their advantages and disadvantages compared to the industry’s offerings. You need to note that to consider factors like price, performance, customer preferences, and switching costs. Determine the likelihood of customers switching to substitutes and the potential impact on the industry’s profitability.

Some examples of this step are given below,

Threat of Substitute Products in the Fast Food Restaurants Industry: Customers have various alternatives for fast foods, various other restaurants, home-cooked meals, meal delivery services, and more nutritious options. The fast food industry faces a very high threat from substitute products.

Threat of Substitute Products in the Clothing Industry: The clothing industry has many options like second-hand apparel, rental services, and online marketplaces for pre-owned clothing. But established clothing brands can differentiate themselves through brand recognition, quality control, and exclusive designs, reducing the threat from substitutes. The clothing industry faces a moderate threat from substitute products.

Threat of Substitute Products in the Banking Industry: Due to technological advancements like fintech, there are many alternative financial services available like mobile wallets, online payment platforms, and peer-to-peer lending. These substitutes offer convenience, lower costs, and innovative features, attracting a segment of customers (especially the young generation). The banking industry faces a moderate/high threat from substitute products and services.

Step 6: Determine the Intensity of Competitive Rivalry

You need to assess the level of competition within the industry. You need to identify the major competitors and their market shares. Don’t miss to evaluate factors such as pricing strategies, product differentiation, marketing efforts, and customer loyalty. You can also think of conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) for each competitor to understand their position in the market.

Some examples of this step are given below,

Intensity of Competitive Rivalry in the Fast Food Restaurants Industry: There are numerous well-established global brands, regional chains, and independent local fast food restaurants. Fast food companies constantly strive to attract customers and increase market share through aggressive marketing campaigns and product innovation. The fast food industry is characterized by very high intense competition.

Intensity of Competitive Rivalry in the Clothing Industry: There are numerous brands, both global and local, competing for market share. Fast fashion brands often engage in intense rivalry, frequently releasing new collections and offering competitive prices. Differentiation strategies, such as unique designs, sustainable practices, and brand loyalty programs, can help brands maintain a competitive advantage. The clothing industry is highly competitive.

Intensity of Competitive Rivalry in the Banking Industry: There are numerous banks, including large multinational institutions, regional banks, and local community banks. Also due to the rise of technology, new competitors are added like apple pay, google pay, mobile wallets, etc. Banks compete for customers and market share through aggressive marketing strategies and differentiation in terms of offerings and customer experience. The banking industry has a very high competitive rivalry.

Step 7: Summarize and Interpret the Findings

You need to compile the information gathered for each force (from step 2 to step 6) and summarize the key findings. Identify the forces with the most significant impact on the industry’s profitability and competitiveness. Consider the interrelationships between the forces and how changes in one force may influence others. Interpret the overall attractiveness of the industry based on the balance of the forces.

Step 8: Develop strategies and Recommendations Based on the Findings

You need to develop strategies and recommendations for businesses operating within the industry. Consider ways to leverage strengths, mitigate weaknesses, exploit opportunities, and counter threats. Identify areas where competitive advantages can be gained and potential risks that need to be addressed.

It’s important to note that the analysis of Porter’s Five Forces should consider industry-specific data, market research, and insights into consumer preferences, trends, and the impact of new technologies. Each industry has its own dynamic nature and evolving consumer behaviors require continuous monitoring and adaptation to maintain a competitive advantage.

Final Thoughts

Remember that the application of Porter’s Five Forces should be an iterative process, continuously reviewed and updated as the industry evolves. You need to gather data and information from various sources, including market research, industry reports, and competitor analysis to apply Porter’s Five Forces effectively.

Read More About Porter’s Five Forces,

- Porter’s Five Forces: Explanation with Industry Examples

- Porter’s Value Chain: Primary & Support/Secondary Activities

- Porter’s Five Forces: Advantages and Disadvantages

- Porter’s Five Forces Model: Applied To Airline Industry with Real World Examples

- Porter’s Five Forces: Applied To Fast Food Restaurants Industry with Real World Examples

- Porter’s Five Forces: Applied To Starbucks with Examples

- Porter’s Five Forces: Applied To Banking Industry with Real World Examples

- Porter’s Five Forces: Applied To Clothing / Fashion Industry with Real World Examples