Economies of Scale: Definition, Types, Internal, and External

Economies of scale is an important concept in economics and business strategy, offering companies the opportunity to achieve significant cost advantages as they expand their output. This occurs due to the strong relationship between production output volume and per-unit cost. As production scales up, fixed cost such as rent, salaries, or machinery are spread over a larger number of goods. This leads to a reduction in the per-unit fixed cost. Additionally, operational efficiencies and synergies achieved through larger-scale production further lower average variable costs, enhancing overall profitability.

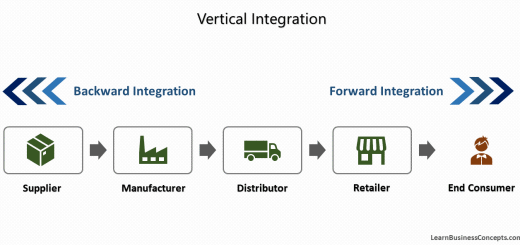

Economies of scale are not limited to a single phase of production. It is harnessed throughout various stages of the production process. These stages include procurement of raw materials, manufacturing, storage, logistics, and even intermediate steps that occur before a product reaches the final consumer. Companies can unlock these efficiencies, creating competitive advantages that foster growth and market dominance by strategically optimizing the entire value chain.

Deep understanding of economies of scale is essential for businesses seeking sustainable growth. In this article, we will explore how economies of scale work, their different types, and practical ways companies leverage them to remain competitive in a dynamic market landscape.

- Explanation of Economies of Scale

- Impact of Economies of Scale on Production Costs

- Factors Determine the Economies of Scale

- Sources of Economies of Scale

- Real World Examples

- Types of Economies of Scale

- Advantages (Pros / Benefits)

- Limits / Disadvantages

- Importance

- What Causes Economies of Scale?

- History of Economies of Scale

- Dis-economies of Scale

- Is it better for a Company to Grow Bigger and Bigger?

- Frequently Asked Questions

Explanation of Economies of Scale

Economies of scale is the concept which the cost decreases experienced by companies when it increases its level of output. Simply when the scale of production increases, the average cost of production per unit decreases.

Economies of scale reduce both per-unit fixed cost and per-unit variable cost. Fixed costs, such as the expenses associated with facilities, equipment, and infrastructure, remain constant regardless of the level of production. The fixed cost gets spread over a larger output than before when production increases. Also, the variable cost gets deducted with the efficiency of the production process when expanding the scale of production. However, the total fixed cost of production will remain unchanged.

Larger firms usually benefit from increased specialization and division of labor. As the scale of operations grows, companies can allocate resources more efficiently and will allow the specialization of tasks and the utilization of specialized skills. This specialization results in heightened productivity and reduced per-unit costs.

Also the larger firms enjoy greater bargaining power with suppliers and distributors, enabling them to negotiate lower prices for raw materials, components, and distribution services. Bulk purchasing discounts and favorable contract terms contribute to lower input costs, further enhancing economies of scale.

Investments in advanced technology and capital-intensive production methods are another key factor driving economies of scale. Larger firms can afford to invest in state-of-the-art machinery, automation, and production systems, which increase efficiency and output capacity. These technological advancements lead to higher productivity levels and lower average production costs per unit.

Furthermore, as firms expand their market reach, they can spread marketing and distribution expenses over a larger volume of sales. This results in reduced average marketing and distribution costs per unit, as well as increased efficiency in reaching customers and delivering products or services.

As a summary,

- Larger production spreads fixed costs over more units, reducing average fixed cost per unit.

- Increased scale allows for specialization and division of labor, boosting productivity and reducing per-unit costs.

- Larger firms enjoy greater bargaining power with suppliers and distributors, securing lower input and distribution costs.

- Investments in advanced technology and capital-intensive methods increase efficiency and lower production costs per unit.

- Expanded reach enables spreading marketing and distribution expenses over a larger sales volume, reducing average costs per unit.

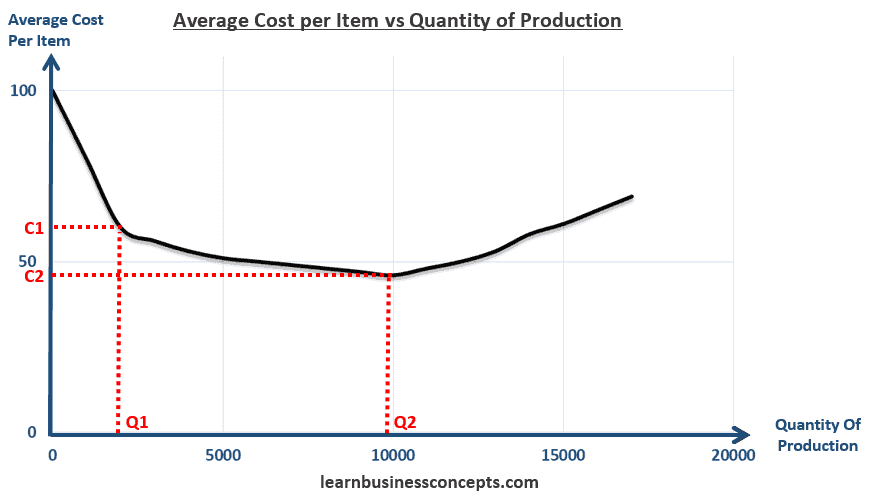

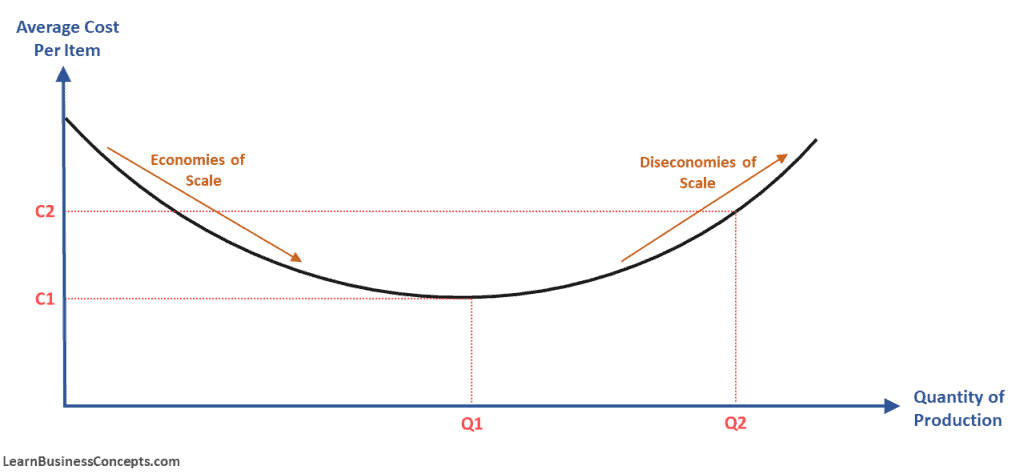

Please refer below diagram for the relationship between average cost per item and production quantity

This diagram shows that if a company increases output from Q1 to Q2, the average cost decreases from C1 to C2.

Impact of Economies of Scale on Production Costs

Economies of scale reduces both per-unit fixed cost and variable cost,

- Lower Fixed Costs per Unit – As production increases, fixed costs like rent and machinery are spread across more units, reducing the cost per unit.

- Reduced Variable Costs – Bulk purchasing of materials and efficient processes lower the variable costs associated with production.

Also the economies of scale impacts to reduce the production costs as following,

- Operational Efficiency – Larger production scales enable more streamlined workflows, saving time and resources.

- Specialization Benefits – Larger operations allow workers and machinery to specialize in specific tasks, enhancing productivity and reducing costs.

- Technological Advancements – Bigger companies often afford better technology, which enhances efficiency and reduces production expenses.

- Supply Chain Advantages – Higher output can lead to better deals with suppliers and lower transportation costs.

- Competitiveness – By cutting costs, firms can offer competitive pricing, gaining an edge in the market.

Factors Determine the Economies of Scale

Following is the list of factors that determine economies of scale,

1. Level of Production

Economies of scale typically increase as the level of production rises. Higher production volumes allow fixed costs to be spread over more units, reducing the average cost per unit.

2. Scope of Operations

The scope of operations refers to the range of products or services a firm produces. Economies of scale can be achieved by producing a broader range of products or services, allowing for shared resources, expertise, and infrastructure.

3. Technology and Innovation

Advancements in technology and innovation can enhance economies of scale by increasing efficiency, productivity, and automation in production processes. Investments in technology enable firms to produce more output with fewer resources, driving down costs per unit.

4. Division of Labor and Specialization

Division of labor and specialization allow firms to allocate tasks to specialized workers or departments, leading to efficiency gains and cost reductions. Specialized workers can focus on specific tasks, increasing productivity and reducing per-unit costs.

5. Size and Utilization of Facilities

Larger facilities and equipment can lead to economies of scale by allowing firms to achieve greater efficiency in production processes. Fully utilizing capacity and optimizing resource utilization contribute to cost savings and economies of scale.

6. Supply Chain Efficiency

Efficient supply chain management enables firms to reduce costs associated with procurement, transportation, and inventory management. Streamlining supply chain processes and negotiating favorable terms with suppliers contribute to economies of scale.

7. Marketing and Distribution Efforts

Marketing and distribution efficiencies can contribute to economies of scale by spreading expenses over a larger volume of sales. Larger firms may have greater bargaining power with suppliers and distributors, allowing them to negotiate lower costs and achieve cost savings.

8. Regulatory Environment

Regulatory factors, such as government policies, industry regulations, and trade barriers, can influence economies of scale. Regulatory compliance costs, licensing requirements, and legal constraints may impact production costs and economies of scale.

9. Globalization and Market Reach

Globalization enables firms to access larger markets and achieve economies of scale through increased sales volumes and market diversification. Expanding market reach allows firms to leverage economies of scale more effectively and reduce costs per unit.

10. Industry Structure and Competition

Industry characteristics and competitive dynamics play a role in determining economies of scale. Concentrated industries with few competitors may have higher barriers to entry and greater opportunities to achieve economies of scale through market dominance and cost leadership strategies.

Economies of scale are influenced by a combination of factors including production levels, scope of operations, technology, division of labor, facility size, supply chain efficiency, marketing and distribution efforts, regulatory environment, globalization, and industry structure. Firms that effectively manage these factors can achieve cost efficiencies and leverage economies of scale to enhance competitiveness and profitability.

Sources of Economies of Scale

1. Technical

Enterprises conducting bulk production can afford to invest in technically advanced capital machinery. These types of machinery eliminate waste, reduce energy consumption, reduce raw material requirements, reduce production with defects, increase quality, etc.. For example, large vehicle manufacturers such as Toyota, General Motors, and Volkswagen can invest in technological streamlining the entire product life cycle. Also, for example, supermarkets like Walmart and Carrefour can easily invest in technology that improves the entire supply chain.

2. Purchasing

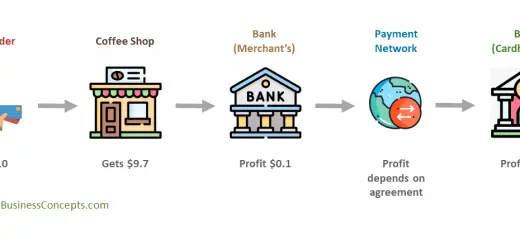

Enterprises doing bulk purchasing can demand their suppliers on large discounts. Suppliers tend to provide discounts on these enterprises to secure future sales and also with the possibility of obtaining a decent profit due to higher quantity. These enterprises will follow on the tendering process on sourcing which leads to offering the contract to the supplier who provides the lowest price with quality standards. For example, there are many suppliers for aircraft production companies who build the electronic equipment, mechanical equipment that needs an aircraft. Aircraft production companies can easily demand discounts on supply since with the recurring supply needed for them.

The value chain is a good business concept to understand how purchasing activity relates to the product/service life cycle.

3. Managerial

Enterprises conducting bulk production or service offering could lower the average cost by recruiting highly skilled management. Large businesses can easily hire better skilled and experienced staff in their organizational hierarchy. Better management leads to cost reduction programs, quality improvement programs, production efficiency increasing programs, etc. For example, an IT service delivery company could hire skilled managers having experience in software development methodologies such as agile, scrum, and SAFe. These managers will help with their skills to manage the entire software development process which will lead to efficient delivery while increasing customer satisfaction.

In Detailed Explanation about the Types of Internal Economies of Scale with Industry Examples: Link

Real World Examples of Economies of Scale

Following are some real-world examples of Economies of Scale,

Manufacturing Industry

Automobile manufacturing provides a classic example of economies of scale. Large automakers such as Toyota, Volkswagen, Tesla, and General Motors benefit from mass production techniques, where the cost per vehicle decreases as production volumes increase. By spreading fixed costs, such as factory overhead and equipment costs, over a larger number of units, these companies achieve lower average production costs per vehicle. Some real world examples provided below,

- General Motors was the largest automaker in the world primarily by a brand-focused strategy that maximized economies of scale. Key elements of that automaker’s strategy have historically included an aggressive international expansion effort and a broad product line which draws heavily on shared platforms and other major components in order to maximize economies of scale.

Read More: Economies of scale: Finding the balance between too small and too big – by indieauto.org - Tesla produces more than 300,000 vehicles each quarter. Tesla’s market capitalisation is far higher than any other carmaker and it continues to have a strong lead in electric vehicle production. With each model and each factory, the learning process improves causing unit costs for Tesla to fall. This is known as “learning by doing” or “moving down the experience curve.”

Read More: Business Costs and Profits – Economies of Scale at Tesla – By tutor2u.net

Retail Industry

Retail giants like Walmart and Amazon leverage economies of scale in their operations. Walmart, for instance, benefits from bulk purchasing discounts by buying products in large quantities from suppliers. This allows Walmart to negotiate lower prices, reducing its cost of goods sold and offering competitive prices to consumers. Amazon’s vast distribution network and high sales volumes enable it to optimize shipping costs and achieve efficiency in fulfillment operations, contributing to cost savings. Some real world examples provided below,

- The retail giant Walmart has been able to leverage economies of scale to become one of the largest companies in the world. With over 11,000 stores in 27 countries, Walmart has been able to achieve a scale that few other companies can match. Walmart’s success can be attributed to a number of factors, including its ability to keep costs low, its efficient supply chain, and its massive purchasing power.

Read More: Walmart And Economies Of Scale – by fastercapital.com

Technology Industry

In the technology industry, companies like Apple and Samsung benefit from economies of scale in the production of consumer electronics, such as smartphones and tablets. These companies invest heavily in research and development (R&D) to develop innovative products, but the cost per unit of R&D decreases as sales volumes increase. Additionally, the cost of producing electronic components, such as microchips and displays, decreases with larger production volumes, allowing these companies to achieve lower average production costs per device.

- Apple’s size and the fact that most of Apples products e.g. iphone, ipad share the same components the company can buy parts such as processing chips and display screens at lower prices due to buying in bulk. Any company that wants to make a tablet computer that matches the ipad’s low starting price of $499 would have to endure higher production costs. Due to this Apple has 70% of the tablet computer market. Furthermore due to the large amount of products being produced by Apple the research and development undertaken by the company is essentially free.

Read More: Apple- Economies and Diseconomies of Scale – by fayblack.wordpress.com

Fast Food Industry

Fast-food chains like McDonald’s, Taco Bell, Dominos, and Burger King benefit from economies of scale in their restaurant operations. By standardizing menu items, processes, and ingredients, these chains achieve efficiencies in food preparation, inventory management, and labor utilization. This standardization allows them to streamline operations, reduce waste, and lower per-unit costs across their network of restaurants.

- Taco Bell used economies of scale to mass produce as many components as possible as cheaply as possible, Taco Bell is able to limit the amount of employee time that is dedicated to the task of cooking at its restaurants. To increase this effect, assembly is made as efficient as possible. The only recent sacrifice that Taco Bell has made is that in order to change the perception of their guacamole, they stopped dispensing it from an apparatus resembling a caulking gun in 2012. They do, however, continue to employ this device for sour cream.

Read More: Taco Bell and Cost Leadership – by medium.com - McDonald’s has a business model that allows its franchisee-members, management and shareholders to share the risks and rewards from the discovery and exploitation of new business opportunities—McDonald’s model has become the norm for other franchise organizations. The franchise model helps McDonald’s attain economies of scale and scope without the traditional problems of monitoring and control associated with large and diverse business organizations.

Read More: How McDonald’s Keeps Bouncing Back by forbes.com

Utilities Industry

Utilities such as electricity generation and water treatment often benefit from economies of scale. Building larger power plants or water treatment facilities allows utilities to spread fixed costs, such as infrastructure and equipment, over a larger volume of output. This leads to lower average costs per unit of electricity or water produced, resulting in cost savings for consumers.

The above examples illustrate how economies of scale contribute to cost efficiencies, competitive advantages, and value creation across various industries. Companies can enhance profitability, market share, and long-term sustainability by leveraging scale advantages effectively.

Types of Economies of Scale

1. Internal Economies of Scale

This refers to the types that are unique within the firm. These are purely based on the management decisions and the capabilities of the enterprise. As an example, an enterprise could have a patent for a production technology which leads to lower the average cost of production compared with similar competitors. This can occur in multiple areas of business operation.

2. External Economies of Scale

This refers to an industry as a whole. As the IT services delivery industry grows larger, then the demand for the individual company also grows. Also, another example is that, if the average cost of raw material gets lower, the cost of production will reduce on all similar companies that require this supply.

Detailed Comparison of Internal Economies of Scale and External Economies of Scale: Link

Advantages (Pros / Benefits) of Economies of Scale

Economies of scale offer several pros to the businesses as follows,

- Cost Reduction

Larger-scale production allows businesses to spread fixed costs over more units. This enable the company to lower average costs per unit. This cost reduction enhances profitability and competitiveness in the market. - Increased Efficiency

Larger firms can achieve greater efficiency through specialization, division of labor, and investments in technology and automation. These efficiency gains result in higher productivity and lower per-unit production costs. - Competitive Pricing

Lower production costs enable firms to offer products or services at competitive prices, attracting more customers and gaining market share. Economies of scale allow businesses to achieve economies of scope, producing a wider range of products or services at lower average costs. - Market Dominance

Firms that leverage economies of scale effectively can establish dominant positions in their industries. By offering lower prices, higher quality, or superior features than competitors, these firms can capture a larger market share and maintain a competitive advantage. - Barriers to Entry

Economies of scale create barriers to entry for potential competitors, as new entrants may struggle to achieve the same cost efficiencies and compete effectively on price. This helps established firms protect their market position and sustain profitability over the long term. - Investment Opportunities

Profitability resulting from economies of scale provides firms with resources to invest in innovation, research and development, expansion into new markets, or other strategic initiatives. This facilitates growth and diversification, further enhancing competitive advantage. - Risk Mitigation

Larger firms may be better positioned to weather economic downturns, industry disruptions, or other external shocks due to their scale and financial resources. Economies of scale can provide a buffer against risks and uncertainties, increasing business resilience. - Enhanced Bargaining Power

Large firms often enjoy greater bargaining power with suppliers, customers, and other stakeholders. This allows them to negotiate more favorable terms, such as lower prices for raw materials, longer payment terms, or exclusive distribution agreements, further reducing costs and increasing profitability.

Overall, economies of scale enable businesses to achieve cost efficiencies, enhance competitiveness, and drive sustainable growth and profitability. Companies can create significant value for shareholders, customers, and other stakeholders by leveraging scale advantages effectively.

Limits / Disadvantages to Economies of Scale

While economies of scale offer significant advantages to businesses, there are limits to how much these benefits can be realized. Below are some key limits of economies of scale,

- Diseconomies of Scale

As firms grow too large, they may encounter diseconomies of scale, where the per-unit costs start to increase due to inefficiencies. Factors such as increased bureaucracy, communication challenges, and difficulty in coordinating operations across a large organization can lead to diminishing returns and higher average costs. - Resource Constraints

There are physical and logistical limits to how much production can be scaled up. Constraints related to raw materials, production capacity, labor availability, and infrastructure may restrict further expansion and limit the benefits of economies of scale. - Complexity and Coordination Challenges

Managing a large-scale operation becomes increasingly complex and challenging. Coordinating activities across multiple locations, divisions, and departments can lead to inefficiencies, delays, and increased administrative costs, offsetting the advantages of scale. - Innovation and Flexibility

Large firms may struggle to innovate and adapt quickly to changing market conditions due to organizational inertia, bureaucracy, and resistance to change. Smaller, more agile competitors may exploit niche markets or emerging opportunities more effectively, limiting the benefits of scale. - Market Saturation and Competition

In mature or saturated markets, further expansion may yield diminishing returns as competition intensifies and pricing pressures increase. Large firms may find it challenging to maintain market share and profitability, especially if competitors can match or exceed their economies of scale. - Regulatory and Legal Constraints

Regulatory requirements and legal constraints may limit the extent to which firms can scale their operations. Antitrust regulations, environmental regulations, labor laws, and other regulatory hurdles may impose costs or restrict growth opportunities for large firms. - Risk Concentration

Large-scale operations may be more susceptible to systemic risks, such as supply chain disruptions, economic downturns, or geopolitical instability. Concentrated production facilities or centralized operations can increase vulnerability to external shocks, posing risks to business continuity and profitability.

Importance of Economies of Scale

Economies of scale are crucial for businesses for several reasons as below,

- Cost Efficiency: Economies of scale allow businesses to produce goods or services at lower average costs per unit as production volumes increase. This cost efficiency enhances profitability, enabling firms to offer competitive prices, maximize margins, or reinvest savings into growth initiatives.

- Competitive Advantage: Lower production costs resulting from economies of scale provide businesses with a competitive advantage in the marketplace. Firms can offer products or services at lower prices than competitors, attract more customers, and gain market share. Additionally, cost advantages can serve as barriers to entry for new competitors, protecting market position and sustaining profitability.

- Profit Maximization: By achieving cost efficiencies through economies of scale, businesses can maximize profits and shareholder value. Lower production costs increase profit margins, allowing firms to generate higher returns on investment and enhance financial performance.

- Market Expansion: Economies of scale enable businesses to expand into new markets and reach a larger customer base. Lower costs per unit make it feasible to offer products or services in new geographic regions, target new customer segments, or introduce new product lines. Market expansion drives revenue growth and diversification, contributing to long-term sustainability.

- Innovation and Investment: Profitability resulting from economies of scale provides businesses with resources to invest in innovation, research and development (R&D), and strategic initiatives. Investments in new technologies, product development, or market expansion initiatives facilitate growth, enhance competitiveness, and drive long-term value creation.

- Resilience to External Shocks: Larger firms with economies of scale may be better equipped to withstand economic downturns, industry disruptions, or other external shocks. Cost efficiencies provide a buffer against revenue declines, enabling businesses to maintain profitability and financial stability during challenging times.

- Efficiency and Productivity: Economies of scale drive efficiency and productivity improvements within organizations. Standardization of processes, optimization of resources, and specialization of labor lead to higher output per unit of input, enhancing operational efficiency and productivity levels.

- Sustainable Growth: Economies of scale support sustainable growth by enabling businesses to expand operations, increase market share, and capture economies of scope. Sustainable growth enhances business resilience, creates value for stakeholders, and contributes to long-term success and prosperity.

Overall, economies of scale play a vital role in enhancing competitiveness, profitability, and growth opportunities for businesses across various industries. Leveraging scale advantages effectively enables firms to optimize costs, maximize profits, and create long-term value for shareholders, customers, employees, and other stakeholders.

What Causes Economies of Scale?

Economies of scale result from various factors that contribute to cost efficiencies as businesses increase their scale of operations. Some key causes of economies of scale include:

- Spreading Fixed Costs: As production volumes increase, fixed costs such as machinery, equipment, and facilities can be spread over a larger number of units. This leads to a lower average fixed cost per unit, reducing the overall cost of production.

- Specialization and Division of Labor: Larger-scale production allows for greater specialization and division of labor within the organization. Specialized workers can focus on specific tasks, leading to increased efficiency and productivity. This specialization reduces the time and resources required to produce each unit, resulting in cost savings.

- Bulk Purchasing Discounts: Larger firms often benefit from bulk purchasing discounts when buying raw materials, components, or other inputs in large quantities. Suppliers may offer lower prices per unit for larger orders, reducing the cost of production for the firm.

- Technological Advancements: Investments in advanced technology and capital-intensive production methods can lead to economies of scale. Automation, robotics, and other technological innovations can increase efficiency, reduce waste, and lower production costs per unit.

- Marketing and Distribution Efficiencies: Larger firms may enjoy economies of scale in marketing and distribution activities. They can spread marketing and distribution expenses over a larger volume of sales, reducing the average cost per unit. Additionally, larger firms may have greater bargaining power with suppliers and distributors, allowing them to negotiate more favorable terms and lower costs.

- Learning Curve Effects: As firms gain experience and expertise through repeated production, they often become more efficient at producing goods or delivering services. This learning curve effect leads to productivity improvements and cost reductions over time.

- Enhanced Bargaining Power: Larger firms often have greater bargaining power with suppliers, customers, and other stakeholders. This allows them to negotiate more favorable terms, such as lower prices for inputs or higher prices for outputs, further reducing costs and increasing profitability.

Overall, economies of scale arise from a combination of factors, including cost spreading, specialization, technological advancements, bulk purchasing discounts, marketing and distribution efficiencies, learning curve effects, and enhanced bargaining power. By leveraging these advantages effectively, businesses can achieve cost efficiencies, enhance competitiveness, and drive sustainable growth and profitability.

History of Economies of Scale

The concept of economies of scale has a rich history that spans centuries and has evolved alongside advancements in technology, industrialization, and business practices. Here’s an overview of the history of economies of scale,

- Early Origins – The principles underlying economies of scale can be traced back to ancient civilizations, where larger-scale production often led to cost efficiencies. Examples include the construction of monumental architecture, such as the pyramids of Egypt or the Great Wall of China, where large-scale labor and resources were utilized more efficiently than smaller projects.

- Industrial Revolution – The Industrial Revolution, which began in the late 18th century, marked a significant turning point in the history of economies of scale. The introduction of mechanized production methods, steam power, and mass production techniques revolutionized manufacturing processes, allowing businesses to achieve unprecedented economies of scale. Factories and mills emerged as centers of large-scale production, leading to cost efficiencies and productivity gains.

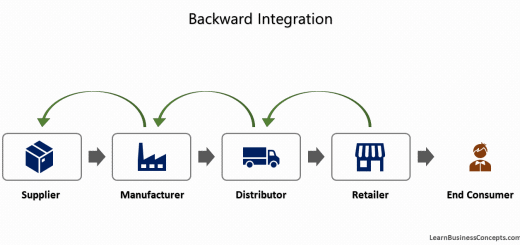

- Standard Oil – In the late 19th and early 20th centuries, the rise of large-scale corporations such as Standard Oil exemplified the power of economies of scale. Standard Oil, founded by John D. Rockefeller, dominated the oil industry through vertical integration, controlling various stages of the production and distribution process. By achieving economies of scale in refining, transportation, and marketing, Standard Oil drove down costs and prices, solidifying its market dominance.

- Mass Production – The early 20th century saw the widespread adoption of mass production techniques pioneered by Henry Ford and others. Ford’s assembly line revolutionized the automotive industry, allowing for the efficient production of standardized vehicles at scale. By optimizing production processes and achieving economies of scale, Ford was able to dramatically reduce costs and make automobiles affordable to the masses.

- Post-War Boom.- The post-World War II period witnessed a rapid expansion of economies of scale across various industries. Technological advancements, increased specialization, and globalization led to further efficiencies in production, distribution, and marketing. Large corporations such as General Electric, IBM, and General Motors capitalized on economies of scale to expand their operations and dominate global markets.

- Globalization and Technology – In the late 20th and early 21st centuries, globalization and technological innovations accelerated the pace of economies of scale. Advances in information technology, telecommunications, and supply chain management enabled firms to achieve greater efficiencies in production, procurement, and logistics on a global scale. Companies like Amazon, Walmart, and Apple leveraged economies of scale to build vast networks of production, distribution, and retail operations, driving down costs and expanding market reach.

Dis-economies of Scale

The concept of diseconomies of scale is the reverse of economies of scale. Considering the diagram illustrated above. After the quantity of production increase beyond the level of 10,000 (Q2) the average cost per item increases. Enterprises’ experiences cost disadvantages due to an increase in organizational size or output. That will result in the production of goods and services at increased per-unit costs. As enterprises get larger the complexity drives in.

Diseconomies of scale comprise factors both internal and external conditions beyond their control on an operation. As an example, diseconomies of scale could occur with conflict on the management decisions, conflict on inter-department communication, less motivation of staff, constraints on the supply of the goods, labor shortages, or technical issues on the production process.

Following are the factors Leading to Diseconomies of Scale,

- Coordination Challenges – Managing a larger organization can lead to inefficiencies in communication and decision-making.

- Increased Overheads – Growth often brings higher administrative costs, such as salaries for additional managers and support staff.

- Reduced Flexibility – Larger firms may struggle to adapt quickly to market changes due to rigid structures and processes.

- Employee Demotivation – Employees may feel disconnected or undervalued, leading to decreased productivity with more layers of hierarchy.

- Inefficient Resource Allocation – Scaling up might result in under-utilization or mis-allocation of resources across different departments.

- Communication Barriers – As organizations grow, maintaining clear and effective communication becomes more difficult, leading to misunderstandings or delays.

- Supply Chain Strain – Higher production demands can overwhelm suppliers, leading to delays or increased costs.

- Operational Complexity – A larger scale of operations can introduce complexities that are difficult and costly to manage effectively.

- Regulatory and Compliance Costs – Expanding businesses may face stricter regulations, resulting in additional costs and compliance burdens.

- Market Saturation – Increased production might exceed demand, leading to excess inventory and wasted resources.

As per the above graph, any increase in output beyond Q1 results increase in average cost per item. This is the typical example of diseconomies of scale. It will raise the average cost per item when production quantity increased beyond a certain level.

How to Overcome Diseconomies of Scale

To overcome diseconomies of scale, businesses must focus on optimizing operations and maintaining efficiency as they grow. Streamlining communication and decision-making processes is crucial to prevent delays and confusion in larger organizations. Investing in technology, such as automation and data analytics, can help manage complexities and improve operational efficiency. Following explains how companies can overcome diseconomies of scale,

- Improve Supply Chain Management – Build strong relationships with suppliers and diversify the supply chain to handle higher demand without delays.

- Streamline Communication – Implement clear and efficient communication channels to reduce misunderstandings and delays.

- Optimize Resource Allocation – Regularly evaluate resource use to ensure they are efficiently distributed across operations.

- Decentralize Decision-Making – Empower local teams and departments to make decisions, reducing bottlenecks in management.

- Invest in Technology – Use automation, data analytics, and collaboration tools to manage complexity and enhance efficiency.

- Focus on Employee Engagement – Create programs to motivate employees, recognize contributions, and maintain a strong company culture.

- Reduce Organizational Layers – Simplify hierarchy to speed up decision-making and reduce administrative costs.

- Monitor Performance Metrics – Track key indicators to identify inefficiencies and take corrective action promptly.

- Flexible Scaling Strategies – Expand gradually and test processes at each level of growth to mitigate risks.

- Adapt to Market Needs – Continuously assess market demand to align production with customer requirements, avoiding overproduction.

We have a separate comprehensive article about Diseconomies of Scale. You can read it to get more knowledge: Diseconomies of Scale.

Is it better for a Company to Grow Bigger and Bigger?

Whether it’s better for a company to keep growing bigger and bigger depends on various factors, including its ability to leverage economies of scale effectively. As a company grows, it can benefit from cost efficiencies, increased competitiveness, and higher profitability through economies of scale. However, there are limits to how much a company can grow while still realizing these benefits.

Beyond a certain point, diseconomies of scale may emerge, leading to inefficiencies, increased complexity, and reduced agility. Therefore, while growth can be advantageous, companies must carefully consider the trade-offs and balance the benefits of economies of scale with potential drawbacks to ensure sustainable success.

Frequently Asked Questions

How do economies of scale benefit businesses?

Economies of scale allow businesses to produce goods or services at lower average costs per unit as production volumes increase. This leads to cost efficiencies, enhanced competitiveness, higher profitability, and the ability to offer products at competitive prices in the market.

Why do economies of scale help achieve lower costs per unit?

Economies of scale help achieve lower costs per unit by spreading fixed costs over a larger number of units, increasing efficiency through specialization and division of labor, benefiting from bulk purchasing discounts, and leveraging technological advancements to streamline production processes. As production volumes increase, these factors lead to cost savings and efficiency gains, resulting in lower average costs per unit produced.

What factors contribute to economies of scale?

Several factors contribute to economies of scale, including spreading fixed costs, technological advancements, division of labor and specialization, supply chain efficiencies, marketing and distribution efforts, and globalization. These factors enable firms to achieve cost savings and efficiency gains as production volumes increase.

What are the limits to economies of scale?

While economies of scale offer significant advantages, there are limits to how much these benefits can be realized. Factors such as diseconomies of scale, resource constraints, complexity, technological limitations, and regulatory constraints may restrict further expansion and limit the benefits of economies of scale.

Why do small businesses charge higher for a similar product compared to large businesses?

Small businesses often charge higher prices for similar products compared to large businesses due to their inability to benefit from economies of scale. Small businesses operate at lower production volumes, which result in higher average costs per unit. They may face challenges in negotiating favorable terms with suppliers, lack access to bulk purchasing discounts, and have limited resources to invest in technology and automation. As a result, their production costs are higher, leading to higher prices for their products compared to larger competitors.

How can businesses leverage economies of scale effectively?

Businesses can leverage economies of scale effectively by optimizing production processes, investing in technology and innovation, streamlining supply chain operations, expanding market reach, and pursuing cost leadership strategies. Effective management of factors such as production levels, scope of operations, and market dynamics is essential to realizing the benefits of economies of scale.

Do economies of scale apply to all industries?

Economies of scale can apply to various industries, but the extent to which they are realized may vary depending on industry characteristics, competitive dynamics, regulatory environment, and technological advancements. Certain industries with high fixed costs, standardized products, and global reach may benefit more from economies of scale than others.

How do economies of scale affect consumers?

Economies of scale can benefit consumers by leading to lower prices, higher product quality, and greater product variety. Businesses that achieve cost efficiencies through economies of scale can pass on savings to consumers in the form of lower prices or improved product features, enhancing consumer welfare.

Are there any downsides to economies of scale?

While economies of scale offer many benefits, there are potential downsides such as the risk of diseconomies of scale, loss of flexibility, increased bureaucracy, and reduced innovation. Businesses must carefully manage growth and balance the advantages of economies of scale with potential drawbacks to maintain competitiveness and sustainability.

Learn More:

- Advantages and Disadvantages of Economies of Scale

- Types of Internal Economies of Scale with Industry Examples

- Difference Between Internal Economies of Scale and External Economies of Scale

- Detail Explanation of Diseconomies of Scale with Examples

Below given some articles for more information;

- Article Published by Harvard Business Review – Manufacturing’s New Economies of Scale by Michael E. McGrath and Richard W. Hoole: https://hbr.org/1992/05/manufacturings-new-economies-of-scale

This article is based on a case study of Xerox Corporation, designed and produced products in the United States for the U.S. market. - Advance Explanation on Economies of scale and scope in the securities industry: http://people.stern.nyu.edu/mkeenan/papers/jb&f_economicsofscale.pdf