Internal vs External Economies of Scale – Detail Explanation with Examples

What is Economies of Scale?

Economies of Scale is which the company grows bigger and better it will experience cost decreases along with the increase in its level of output. Simply the cost per unit of an individual item decreases when increasing the scale of production.

This is related to operational efficiencies and synergies as a result of an increase in the level of production. The simple meaning is that companies tend to do things more efficiently with increasing size.

What is Internal Economies of Scale?

Internal economies of scale refer to the cost advantages that a company experiences when it increases its production scale internally, leading to a reduction in average costs per unit. These efficiencies arise from various factors within the firm itself, such as improved production techniques, better managerial expertise, and more efficient use of resources. As firms grow larger, they can invest in advanced technology and machinery, which, although initially expensive, reduce the cost per unit over time due to higher productivity and efficiency. This is often seen in industries like automobile manufacturing, where assembly lines and automation significantly lower production costs.

Managerial economies of scale occur when a firm expands and can afford to hire specialized managers for different departments, enhancing operational efficiency. These specialized managers bring expertise that improves decision-making and coordination within the company. Additionally, large firms benefit from marketing economies of scale by spreading the cost of advertising and promotional activities over a larger output, reducing the cost per unit of marketing. Bulk purchasing of raw materials at discounted rates further reduces costs due to higher bargaining power.

Financial economies of scale are another aspect, where larger firms have better access to capital markets and can secure loans at lower interest rates due to perceived lower risk. They can also use more sophisticated financial instruments and strategies to manage risks and costs effectively. Risk-bearing economies come into play as larger firms can diversify their product lines and markets, spreading risks and reducing the impact of poor performance in any single area. This diversification stabilizes overall performance and enhances the firm’s resilience to market fluctuations.

Examples of Internal Economies of Scale

1. Automobile Manufacturing

Companies like Toyota and Ford benefit from internal economies of scale by mass-producing vehicles. They use highly efficient assembly lines, bulk purchase materials, and employ specialized managers to streamline operations, significantly reducing per-unit costs.

2. Retail Chains

Retail giants like Walmart achieve economies of scale through their massive purchasing power, efficient supply chain management, and advanced inventory systems. They buy products in bulk at discounted rates, optimize logistics to minimize transportation costs, and use data analytics to manage inventory more effectively, all of which lower operating costs and enhance profitability.

3. Technology Firms

Companies like Apple and Samsung benefit from economies of scale in their production processes. They invest heavily in state-of-the-art manufacturing facilities and automation technologies, which increase production efficiency and lower costs. Their large scale also allows them to spread research and development costs over millions of units, reducing the per-unit cost of innovation.

4. Pharmaceutical Companies

Large pharmaceutical firms such as Pfizer and Johnson & Johnson achieve economies of scale through extensive R&D capabilities, large-scale production of drugs, and global distribution networks. Their ability to produce drugs in large quantities reduces the cost per unit, while their extensive sales and marketing networks help spread these costs over a larger revenue base.

Sources of Internal Economies of Scale

- Technical Economies – Technical economies arise from efficiencies gained through advanced machinery and technology. Larger firms can afford high-capacity, sophisticated equipment that boosts production efficiency and reduces the average cost per unit. For instance, automated assembly lines in the automotive industry allow for faster, more consistent production, minimizing labor costs and waste.

- Managerial Economies – As firms grow, they can hire specialized managers for different departments, enhancing overall efficiency and effectiveness. Specialized managers, such as those in finance, marketing, and production, improve strategic decision-making and optimize operations. For example, a marketing manager can create targeted campaigns, while a production manager can streamline manufacturing processes.

- Marketing Economies – Marketing economies of scale occur when advertising and promotional costs are spread over a larger output. Large firms can negotiate better rates for bulk advertising, reducing the cost per unit of marketing. For example, a national advertising campaign costs the same whether it reaches one million or ten million customers.

- Financial Economies – Larger firms often have better access to capital markets and can secure financing at lower interest rates due to their perceived lower risk. They can also use sophisticated financial instruments to manage risks and optimize their capital structure. This access to cheaper financing reduces the overall cost of capital, allowing these firms to invest more in growth opportunities and operational improvements, enhancing their competitive edge.

- Risk-Bearing Economies – Risk-bearing economies emerge from the ability of large firms to diversify their products, services, and markets. By spreading operations across various segments, they can mitigate the impact of a downturn in any single area. For example, a multinational corporation with a diverse product portfolio can offset losses in one product line with profits from another. This diversification reduces overall risk exposure, stabilizes income streams, and ensures consistent financial performance.

- Labor Economies – Large firms can attract and retain skilled and specialized labor due to better compensation packages, career development opportunities, and job security. Skilled employees contribute to higher productivity and efficiency, reducing the per-unit cost of production. Additionally, larger firms can implement comprehensive training and development programs, improving employee performance and adaptability. This investment in human capital drives down operational costs and enhances the firm’s ability to innovate and compete effectively.

What is External Economies of Scale?

External economies of scale refer to the cost advantages that accrue to a firm due to factors outside of the company itself, often arising from the overall growth and development of the industry or region in which it operates. Unlike internal economies of scale, which are achieved through a company’s own efforts and growth, external economies of scale benefit all firms within a particular industry or geographical area. These benefits typically result from improved infrastructure, availability of skilled labor, advancements in technology, and the establishment of a network of suppliers and ancillary businesses. As industries cluster and grow in specific regions, companies within these areas can access shared resources and services more efficiently, leading to lower costs and enhanced productivity.

A prime example of external economies of scale is seen in technology hubs like Silicon Valley. The concentration of tech companies, research institutions, and a highly skilled workforce in this region creates a favorable environment for innovation and efficiency. Firms benefit from the proximity to suppliers, specialized services, and a pool of talent, which reduces costs related to recruitment, training, and logistics. Additionally, the shared knowledge and collaborative opportunities within the industry foster continuous improvement and innovation, further driving down costs and improving competitive advantages for all firms in the area. Thus, external economies of scale contribute significantly to the overall efficiency and growth potential of firms within a thriving industry or region.

Examples of External Economies of Scale

1. Technology Hubs (e.g., Silicon Valley)

Silicon Valley is a prime example of external economies of scale where the concentration of tech companies, research institutions, and a highly skilled workforce creates a supportive ecosystem for all firms within the region. Companies benefit from the proximity to suppliers, access to a pool of specialized talent, and shared knowledge, which reduces recruitment and training costs. This clustering fosters innovation and efficiency, allowing firms to benefit from advancements in technology and collaborative opportunities that drive down costs and enhance productivity.

2. Financial Centers (e.g., Wall Street)

Wall Street in New York City exemplifies external economies of scale in the financial industry. The concentration of financial institutions, investment firms, and regulatory bodies creates an environment where firms benefit from shared resources and infrastructure. Access to a highly skilled labor force, specialized services such as legal and consulting, and advanced communication networks reduce operational costs. The dense network of financial activities and institutions also enhances market efficiency, liquidity, and the flow of information, benefiting all firms in the sector.

3. Hollywood (Entertainment Industry)

Hollywood, as a hub for the entertainment industry, provides external economies of scale through its concentration of film studios, production companies, and talent agencies. This clustering allows firms to share resources like sound stages, post-production facilities, and specialized labor, reducing individual production costs. The presence of a well-established network of suppliers and service providers, such as set designers, costume makers, and technical experts, further enhances efficiency and drives down costs for all industry participants.

4. Automobile Industry Clusters (e.g., Detroit)

Detroit, historically known as the heart of the American automobile industry, demonstrates external economies of scale through its concentration of car manufacturers, parts suppliers, and skilled labor. This industrial cluster allows firms to benefit from a well-developed supply chain, access to specialized knowledge and skills, and shared infrastructure like transportation networks and research facilities. The collaboration and competition within this concentrated area spur innovation and efficiency, reducing costs and benefiting all firms involved.

5. Textile Industry in South Asia

Regions in South Asia, such as Sri Lanka, Bangladesh and India, where the textile and garment industry is heavily concentrated, exhibit external economies of scale. Firms in these regions benefit from a large, skilled labor force, specialized machinery suppliers, and a network of ancillary businesses that provide raw materials and logistical support. The high concentration of textile manufacturing also attracts investment in infrastructure improvements, such as transportation and power supply, which further reduce operational costs for all companies in the area.

Sources of External Economies of Scale

- Industry Clusters – Industry clusters refer to the geographic concentration of interconnected companies, suppliers, and associated institutions in a particular field. These clusters facilitate the sharing of knowledge and innovation, enhance collaboration, and create a competitive environment that drives efficiency. Firms benefit from proximity to suppliers and customers, reducing transportation costs and improving logistics. For example, Silicon Valley’s concentration of tech companies and talent creates a supportive ecosystem that benefits all firms within the region through shared resources and collaborative opportunities.

- Skilled Labor Pool – The presence of a large, skilled labor force in a specific area can lead to external economies of scale. Companies in such regions can easily find and hire qualified workers without incurring high recruitment and training costs. Educational institutions often align their programs with industry needs, ensuring a steady supply of skilled graduates. For instance, Wall Street benefits from the proximity of prestigious universities that produce a continuous stream of finance and business graduates, enabling financial firms to hire skilled professionals efficiently.

- Infrastructure Development – Improved infrastructure, such as transportation networks, telecommunications, and utilities, benefits all firms within a region. Good infrastructure reduces operational costs, improves efficiency, and enhances connectivity. For example, the advanced transportation networks and communication systems in major financial centers like London and New York allow firms to operate more efficiently, facilitating swift movement of goods and information, which reduces costs and improves productivity.

- Supplier Networks – A dense network of suppliers within a region allows firms to source raw materials and components more efficiently and at lower costs. The proximity of suppliers reduces lead times and transportation costs, enabling firms to respond quickly to market demands. In the automotive industry, regions like Detroit benefit from a well-developed supplier network that provides parts and components to manufacturers, enhancing production efficiency and reducing costs for all firms in the area.

- Research and Development (R&D) Synergies – The concentration of research institutions, universities, and corporate R&D centers in a particular region fosters innovation and technological advancements. Firms benefit from access to cutting-edge research, collaborative projects, and a flow of new ideas and technologies. For example, the close collaboration between companies and research institutions in biotech hubs like Boston accelerates innovation and reduces the cost of developing new products, benefiting all firms involved.

- Shared Services and Facilities – Regions with a high concentration of firms in a particular industry often develop shared services and facilities, such as testing labs, business incubators, and training centers. These shared resources reduce individual company costs and improve access to essential services. For instance, Hollywood benefits from shared production facilities, studios, and post-production services, which lower costs for all entertainment companies in the area and streamline the production process.

Difference Between Internal Economies of Scale and External Economies of Scale

The Below Table Illustrates the Difference Between Internal Economies of Scale and External Economies of Scale

| Internal Economies of Scale | External Economies of Scale |

|---|---|

| Economies of scale which unique within the company | Economies of scales for the industry as a whole |

| Purely based on the outcomes and the unique capabilities of the company | Purely based on the external factors which common for the entire industry |

| Unit cost advantages for the business when expanding their scale of production | Unit cost advantages for the business from the advancement of their industry |

| Internal economies of scale occur inside the company (company-specific) | External economies of scale occur outside of the company but within an industry/location area |

| Typically occur in large companies | Usually, it is commonly applicable across all size of companies in the industry |

| Example 01: A company has a patent for their unique production technology, which leads to lower the average cost of production compared with similar competitors | Example 01: The average cost of raw material in the country gets lower, the cost of production will reduce on all similar companies that require this supply |

| Example 02: A production company had forward integrated with the distribution of their products by acquiring the largest distributor. This results in a decrease in sale price compared to their competitors | Example 02: IT services delivery industry grows larger with the cultural changes and technology advancements, then the demand for the individual company also grows |

| Example 03: Apparel manufacturing company had conducted successful research about using robotics for their production which none of the other competitors looked into. They have implemented it which results in lowering the unit cost of production | Example 03: Assume if Alaska state in The United States reduces its taxes to attract companies to the area that will provide the most jobs. Then the advantage applicable for all companies located in Alaska |

Comparison of Internal Economies of Scale and External Economies of Scale

- Internal economies of scale are unique within the company whereas external economies of scale apply to the industry as a whole.

- Internal economies of scale are purely based on the outcomes and the unique capabilities of the company whereas external economies of scale are purely based on the external factors which common for the entire industry.

- Internal economies of scale are typically the unit cost advantages for the company when expanding their scale of production whereas external economies of scale are typically the unit cost advantages for the company from the advancement of their industry.

Further Explanation of Economies of Scale

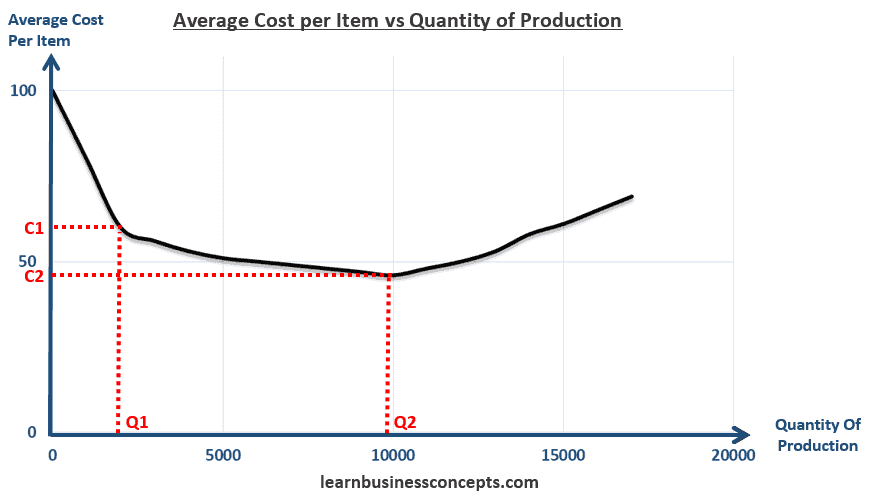

The above diagram shows that if a company increases output from Q1 to Q2, the average cost decreases from C1 to C2. Economies of scale reduce both per-unit fixed cost and per-unit variable cost. The fixed cost gets spread over more output than before when production increases. Also, the variable cost gets deducted with the efficiency of the production process when expanding the scale of production. However, the total fixed cost of production will remain unchanged.

How Companies Achieve Economies of Scale?

Companies achieve economies of scale by increasing their production volume and optimizing their operations to reduce per-unit costs. One primary way to achieve this is through investment in advanced technology and automation, which boosts efficiency and productivity. By producing goods in larger quantities, firms can spread fixed costs, such as machinery, buildings, and administrative expenses, over a greater number of units, thus reducing the average cost per unit. Additionally, bulk purchasing of raw materials and components at discounted rates due to higher order volumes also contributes to cost savings. Streamlining production processes, improving supply chain management, and enhancing distribution networks further enable companies to reduce costs and operate more efficiently at a larger scale.

Another way companies achieve economies of scale is through the specialization and division of labor. As firms grow, they can hire specialized managers and skilled workers for different departments, improving overall operational efficiency and decision-making. Companies also benefit from learning and experience effects, where repetitive production processes lead to improved skills, faster production times, and reduced waste. Furthermore, larger firms can spread marketing and advertising costs over a larger output, reducing the per-unit cost of these activities. By expanding their market reach and tapping into new customer bases, companies can increase sales volumes, further driving down costs and achieving greater economies of scale.

Sources of Economies of Scale (also called as Types of Economies of Scale)

- Technical Economies

Use of advanced machinery and technology to increase production efficiency and reduce per-unit costs. - Managerial Economies

Employment of specialized managers to improve operational efficiency and decision-making within the company. - Marketing Economies

Spreading the cost of advertising and promotional activities over a larger output, reducing the per-unit marketing cost. - Financial Economies

Access to lower interest rates and better financing options due to larger size and perceived lower risk. - Risk-Bearing Economies

Diversification of products and markets to spread risk and stabilize income streams. - Labor Economies

Attraction and retention of skilled labor due to better compensation and career opportunities, enhancing productivity. - Bulk Purchasing

Buying raw materials and components in large quantities at discounted rates, reducing per-unit costs. - Research and Development (R&D)

Spreading the high costs of R&D over a larger production base, making innovation more cost-effective. - Supply Chain Integration

Streamlining supply chain processes to reduce costs and improve efficiency through better coordination with suppliers and distributors. - Learning and Experience

Gaining efficiencies from improved skills and faster production times through repetitive manufacturing processes.

Pros / Benefits of Economies of Scale

- Cost Reduction

Economies of scale enable companies to produce goods at a lower average cost per unit as production volume increases. This cost reduction enhances profitability and competitiveness in the market. - Increased Efficiency

Larger scale operations often lead to efficiencies in production processes, resource allocation, and overall management, allowing companies to operate more smoothly and effectively. - Enhanced Profit Margins

Lower per-unit costs mean that companies can maintain or increase profit margins even when selling goods at competitive market prices, improving financial performance. - Competitive Pricing

Economies of scale allow companies to offer competitive pricing, attracting more customers and gaining market share by providing affordable products or services. - Greater Investment Capacity

Reduced costs free up capital that can be reinvested in expanding operations, innovation, research and development (R&D), or improving product quality, fostering long-term growth. - Improved Access to Resources

Larger firms can negotiate better terms with suppliers and access capital markets more easily, enhancing their ability to secure resources needed for expansion and development. - Diversification Opportunities

Economies of scale provide financial stability and flexibility, enabling firms to diversify their product lines or enter new markets without significantly increasing operational costs. - Risk Mitigation

Spreading fixed costs over larger production volumes and diversified product lines reduces the impact of market fluctuations or changes in demand, enhancing overall business resilience. - Technological Advancements

Larger firms often invest in advanced technologies and innovation, driving industry advancements and maintaining a competitive edge through continuous improvement. - Brand Recognition

Economies of scale can support investments in marketing and branding efforts, increasing brand visibility and customer loyalty through widespread market presence and competitive pricing strategies.

Cons / Drawbacks of Economies of Scale

- Decreasing Marginal Returns

As production increases, the marginal benefit of each additional unit of output may decrease, leading to diminishing returns and reduced efficiency gains. - Complexity in Management

Larger organizations may face challenges in coordinating and managing operations across multiple departments or locations, potentially leading to bureaucratic inefficiencies and slower decision-making processes. - Risk of Over-Expansion

Pursuing economies of scale may tempt companies to expand too quickly or beyond their core competencies, leading to overextension, financial strain, and increased operational risks. - Vulnerability to External Shocks

Larger firms heavily reliant on economies of scale may face greater vulnerability to disruptions in supply chains, changes in market conditions, or regulatory changes, affecting their ability to adapt quickly. - Quality Control Issues

Maintaining consistent product or service quality can become challenging as production volumes increase, potentially leading to quality control issues and customer dissatisfaction. - Erosion of Entrepreneurial Spirit

Large-scale operations may stifle innovation and entrepreneurial initiatives within the organization, as bureaucratic processes and hierarchy can discourage risk-taking and creativity. - Higher Fixed Costs

While spreading fixed costs over larger volumes can reduce per-unit costs, it also means higher overall fixed costs. This can pose financial challenges during periods of economic downturn or reduced demand. - Loss of Flexibility

Large firms may find it more difficult to quickly respond to changes in consumer preferences, technological advancements, or competitive pressures due to their size and established processes. - Environmental Impact

Economies of scale can lead to increased resource consumption and environmental impact, as larger production volumes may result in higher energy consumption, waste generation, and carbon emissions. - Antitrust Concerns

In some cases, achieving economies of scale may lead to market dominance or monopolistic practices, raising antitrust concerns and regulatory scrutiny, which can impact business operations and growth strategies.

Effects of Economies of Scale on Production Costs

Economies of scale have several effects on production costs:

- Decreased Average Costs

As production volume increases, economies of scale allow firms to spread their fixed costs (such as machinery, buildings, and administrative expenses) over a larger number of units. This reduction in average costs per unit makes production more efficient and lowers the overall cost structure of the firm.

- Increased Efficiency

Larger scale operations often lead to improved production processes, resource allocation, and management efficiencies. Companies can leverage economies of scale to streamline operations, optimize supply chains, and adopt advanced technologies, all of which contribute to lower production costs and improved productivity.

- Competitive Pricing

Lower production costs due to economies of scale enable firms to offer competitive pricing in the market. By reducing their cost per unit, companies can set more attractive prices for consumers while maintaining profitability, which enhances their competitiveness and market share.

- Expansion Opportunities

Economies of scale provide firms with the financial resources and flexibility to invest in expansion initiatives, such as entering new markets, diversifying product lines, or increasing production capacity. This growth potential is fueled by the cost efficiencies gained through economies of scale.

- Barriers to Entry

For new entrants into the market, established firms with economies of scale pose significant barriers. Larger companies can produce goods at lower costs, making it challenging for smaller competitors to compete on price. This advantage can solidify the market position of firms benefiting from economies of scale.

Economies of scale play a crucial role in shaping production costs by reducing per-unit expenses, enhancing operational efficiency, enabling competitive pricing strategies, supporting growth and expansion, and influencing market dynamics by creating barriers to entry for potential competitors.

Diseconomies of Scale

The concept of diseconomies of scale is the reverse of economies of scale. Considering the diagram illustrated above. After the quantity of production increase beyond the level of 10,000 (Q2) the average cost per item increases. Enterprises’ experiences cost disadvantages due to an increase in organizational size or output. That will result in the production of goods and services at increased per-unit costs. As enterprises get larger the complexity drives in.

To read more about diseconomies of scale.

FAQs about Economies of Scale

Here are some frequently asked questions (FAQs) about economies of scale,

1. What are economies of scale?

Economies of scale refer to the cost advantages that companies achieve as they increase their production volume. These advantages typically result from spreading fixed costs over a larger output, improving efficiency, and benefiting from bulk purchasing discounts.

2. How do economies of scale benefit businesses?

Economies of scale benefit businesses by lowering their average costs per unit of production. This cost reduction allows firms to increase profitability, offer competitive pricing, invest in growth and innovation, and improve overall efficiency.

3. What are examples of economies of scale?

Examples include reduced per-unit production costs due to efficient use of machinery, economies in purchasing raw materials, streamlined production processes, and lower average costs of marketing and distribution as output increases.

4. Do economies of scale apply to all industries?

Economies of scale are more pronounced in industries with high fixed costs and significant cost savings from increased production. Industries like manufacturing, technology, and logistics often benefit greatly from economies of scale due to their operational nature.

5. Can small businesses benefit from economies of scale?

Small businesses can benefit from economies of scale through strategic partnerships, outsourcing non-core functions, adopting technology to improve efficiency, and participating in industry networks or clusters.

6. What challenges do economies of scale present?

Challenges include potential diseconomies of scale, where costs increase as firms grow too large, as well as complexities in managing larger operations, maintaining quality control, and adapting quickly to market changes.

7. How can businesses achieve economies of scale?

Businesses can achieve economies of scale by increasing production volume, optimizing production processes, investing in technology and infrastructure, improving supply chain efficiency, and expanding market reach.

8. Are economies of scale always beneficial?

While economies of scale generally lead to lower costs and improved profitability, they require careful management to avoid inefficiencies, maintain quality, and adapt to changing market conditions and customer preferences.

9. How do economies of scale impact consumers?

Consumers benefit from economies of scale through lower prices, improved product quality, increased product variety, and enhanced customer service as firms pass on cost savings from economies of scale.

10. What role do economies of scale play in global markets?

In global markets, economies of scale enable multinational corporations to achieve cost advantages, enhance competitiveness, expand market share, and adapt to diverse economic environments through efficient production and distribution networks.

Recommended Articles:

1. Meaning of Economies of Scale?

2. Diagram illustrates Economies of Scale

3. Types of Internal Economies of Scale with Examples

4. Advantages and Disadvantages of Economies of Scale

5. Diseconomies of Scale with Examples