How Do Banks Profit from Merchants

Following is an Explanation about How Banks Profit from Merchants

Banks offer point of sales (POS) and internet payment gateway (IPG) services for Merchants. Merchant can offer these facilities for their customers to pay for the purchase using their credit or debit card. This service is also known as Merchant Transaction Acquiring Service.

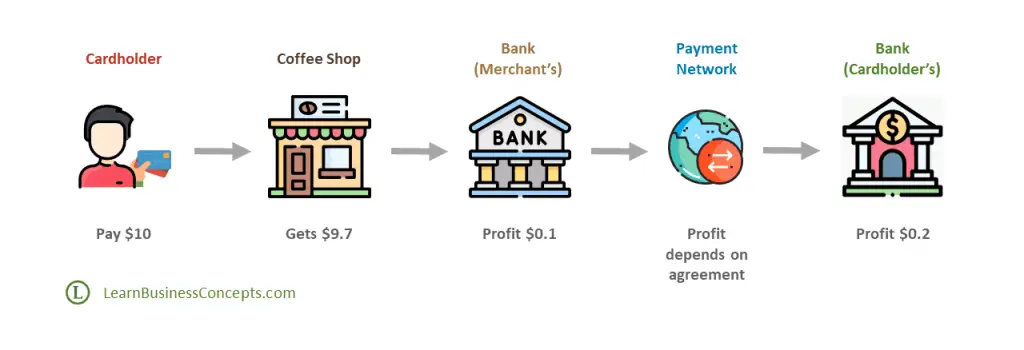

Merchant has to pay an interchange charge to the Bank when the cardholder uses the card in-store purchase (POS) or for online purchase (IPG). Banks charge this for offering their online payment facility.

This interchange charge will be a profit for the Cardholder’s bank and Merchant’s bank, as per the profit-sharing agreements with the payment schemes. Cardholder’s bank will get the majority of this interchange profit from a transaction. Merchant’s bank will get a comparatively lower interchange profit from a transaction.

The coffee shop will not get the exact $10 settled from their Bank for this transaction. They will get around $9.7 (97% of the transaction). The bank that provides the payment services for the Merchant (the Bank to which the Merchant’s POS device is connected) will get around $0.1 profit from this transaction. The cardholder’s bank will get around $0.2 profit from this transaction. Profit-sharing percentage values depend on the agreements between Bank and the Payment Networks.

Please note that hypothetical amounts/values are used for the above example.

Banks gain significant profit when thousands or millions of cards based transactions are processed on daily basis.

Recommended Articles:

- How do Banks Profit from Loan Interest

- How do Banks Profit from Interchange

- How do Banks Profit from Fees

- How do Banks Profit from Capital Market Services