Vertical Integration: Definition, Benefits, Types, Examples

Definition of Vertical Integration

Vertical integration is where the company obtains the ownership and control of more than one stage of the supply chain. The type of vertical integration could be to move forward to the end consumer, or else, move backward to raw materials production. It simply means where a company controls multiple stages of its supply chain, from production to distribution.

The goal of vertical integration is to expand and gain control of the entire supply chain. This refers to the process of acquiring or starting the business operations within the same production vertical to take control over one or more stages in the value chain.

Types of Vertical Integration

There are two types of Vertical Integration,

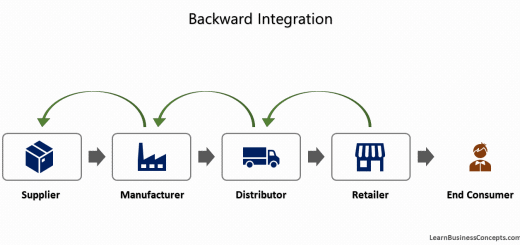

Backward Integration

This involves a company taking control of its supply chain by acquiring or merging with its suppliers. For instance, a watch manufacturer might purchase a company that produces the movements or dials used in its watches. This allows the manufacturer to have greater control over the quality, cost, and availability of key components.

Forward Integration

This involves a company moving downstream in its supply chain by acquiring or merging with distributors or retailers. For example, a watch manufacturer might open its own retail stores or buy a chain of watch stores. This strategy helps the manufacturer gain better control over how its products are marketed and sold, often leading to improved customer experiences and brand loyalty.

Why do Companies Follow Vertical Integration?

Companies follow vertical integration for several strategic reasons that can offer significant advantages. Here are the primary reasons,

1. Control the Overall Cost

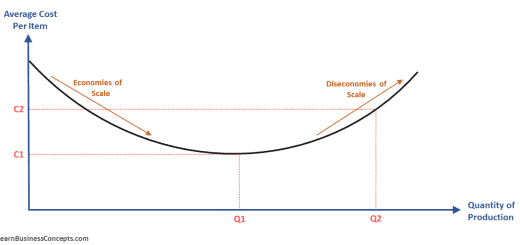

Companies follow vertical integration to reduce costs associated with purchasing from external suppliers and dealing with intermediaries. By owning various stages of the supply chain, they can eliminate supplier markups and achieve economies of scale, leading to significant cost savings. This control over production and distribution costs allows companies to price their products more competitively while maintaining healthy profit margins.

2. Improve and Control the Quality

Vertical integration allows companies to maintain consistent quality standards across all stages of production. By directly overseeing the manufacturing processes, companies can enforce strict quality controls and ensure that every component meets their specifications. This consistency in quality not only enhances the overall product but also helps in maintaining and improving the brand’s reputation for excellence.

3. Make the Supply Chain More Reliable

Owning various stages of the supply chain ensures a stable and reliable supply of critical components, reducing the risk of disruptions. This integration allows companies to better manage inventory levels and timing, leading to improved operational efficiency. By having direct control over the supply chain, companies can respond more swiftly to market demands and mitigate the impact of external supply chain issues.

4. Increase the Market Power

Vertical integration increases a company’s bargaining power with both suppliers and customers by reducing its dependency on external entities. This enhanced control over the supply chain allows companies to manage market dynamics more effectively, giving them a competitive edge. Greater market power also enables companies to influence pricing, distribution, and marketing strategies, further strengthening their market position.

How does Vertical Integration Work?

Vertical integration works by a company expanding its control over multiple stages of its supply chain, either by acquiring or developing capabilities to manage these stages internally. This can include backward integration, where the company controls its suppliers, or forward integration, where it controls its distribution and retail operations. By doing so, the company aims to reduce costs, improve quality control, increase market power, and streamline operations.

Simply companies achieve vertical integration in two ways,

- Take ownership and control of more than one stage of the supply chain. Simply this means getting control of business activities that are behind in the company’s value chain. To move backward to raw materials production.

- Take ownership and control of more than one stage of the distribution chain. Simply this means getting control of business activities that are ahead in the company’s value chain. To move forward toward the end consumer.

The company can either choose one of the above options or can choose both options to move forward with the vertical integration.

Real Industry Examples for Vertical Integration

1. Zara Designs Clothes in-house and Manufactures in their Plants

Zara is a hugely popular globally renowned clothing brand headquartered in Spain. The company changes its clothing designs every two weeks on average, while competitors change their designs every two or three months.

The company has done successful vertical integration and operates through its large retail stores across the world. Zara does their design and manufactures in their plants. Due to such vertical integration in their value chain, the company can ensure a change of wardrobe and style based on season and has the fastest inventory turnover. The company had achieved economies of scale as much while enjoying the excellent profit. Zara is having a higher competitive advantage in the industry.

More information: Zara Clothing Company Supply Chain

2. Tesla, Inc.

Tesla manufactures its own electric vehicle components, including batteries and electric drivetrains, in its Gigafactories (backward integration). It also sells cars directly to consumers through its own network of showrooms and online channels (forward integration). This strategy allows Tesla to innovate rapidly, control production costs, and deliver a consistent brand experience. Tesla uses both the Forward and Backward Integration.

More information: Tesla’s vertical integration and efficiency show why they’re the leader in EVs – notateslaapp.com

3. Introduction of “Amazon Publishing”

Amazon started as an online book retailer (internet bookstore) in 1995, procuring books from publishers. Amazon started “Amazon Publishing” in 2009 which allows them to publish books. After the above, Amazon may receive a cut on both as publisher and as bookseller if a reader buys one of its titles.

More information on this acquisition:” The Amazon Publishing Juggernaut” – Article Published in The Atlantic, “How To Self-Publish Your Book Through Amazon” – Article Published in Forbes

4. Carnegie Steel Company constructed its Own Blast Furnaces

Carnegie Steel Company is a steel-producing company. The company needs ‘coke’ to produce steel. Several nearby suppliers own ‘blast furnaces’ to produce coke. However, these suppliers were unable to consistently meet the demand for Carnegie’s mills. Then the company moved to construct its own ‘blast furnaces’ for coke production, cutting out the dependency on their suppliers and ensuring reliable and cheap supply.

More information: Article Published about “Carnegie Steel” in Harvard Business School Digital Initiative

5. McDonald’s acquired Dynamic Yield to improve their Digital Customer Experience

In 2019, McDonald’s acquired a tech company called Dynamic Yield. The company was planned to improve its digital customer experience touchpoints with this acquiring. The technology allows menus at McDonald’s drive-thrus to change based on various factors such as weather, current traffic, and more.

More information: Dynamic Yield Joins the McDonald’s Family

6. Walt Disney

The Walt Disney Company was a movie production company. The Walt Disney Company introduced Disney+ in 2019, which enables them to stream on-demand videos directly to their end customers.

Disney creates and produces its own content through its studios (backward integration) and distributes it via its own television networks, streaming services like Disney+, and theme parks (forward integration). This control over content creation and distribution helps Disney maximize revenue from its intellectual properties and maintain strong brand consistency.

More information: Disney+ and the Streaming Revolution

7. Apple Inc.

Apple designs its own hardware and software, and manufactures key components like processors in-house (backward integration). It also operates its own retail stores and online platforms, selling directly to consumers (forward integration). This integration allows Apple to maintain tight control over the quality and user experience of its products, ensuring a seamless ecosystem of devices and services. Apple uses both the Forward and Backward Integration.

8. ExxonMobil

ExxonMobil is vertically integrated from oil exploration and extraction (upstream activities) to refining, marketing, and selling petroleum products (downstream activities). By controlling every stage of the oil supply chain, ExxonMobil can manage costs, ensure quality, and maximize profitability across its operations.

Synergies of Vertical Integration

Vertical integration creates synergies that enhance operational efficiency by ensuring better coordination between different stages of the supply chain. This approach reduces lead times and eliminates inefficiencies, allowing companies to synchronize production schedules and minimize inventory holding costs. Cost savings are another significant benefit, achieved through economies of scale and reduced transaction costs. By avoiding supplier markups and leveraging bulk purchasing, companies can lower production costs, pass on savings to consumers, and reinvest in the business for growth.

Improved quality control is a critical synergy of vertical integration, as companies can directly oversee the production of key components, ensuring consistency and high standards in their final products. This control is particularly important in industries like luxury watches and high-end electronics, where product quality is a major differentiator. Vertical integration also fosters closer collaboration between R&D teams and manufacturing units, accelerating the innovation cycle by facilitating rapid prototyping and testing of new ideas. This enables companies to maintain a competitive edge through continuous innovation.

Additionally, vertical integration enhances a company’s ability to respond swiftly to market changes and consumer demands by controlling both supply and distribution channels. This agility is vital in fast-paced industries like fashion and consumer electronics. Managing multiple stages of the supply chain also allows companies to deliver a consistent and cohesive customer experience, building stronger brand loyalty. Furthermore, strategic flexibility enables companies to diversify their product offerings and expand geographically, while increased bargaining power with suppliers and customers strengthens their market position. These synergies collectively bolster a company’s competitive advantage and drive long-term success.

Advantages / Benefits of Vertical Integration

1. Cost Savings

Vertical integration reduces supply chain costs by eliminating external markups and achieving economies of scale. Companies can avoid extra costs from third-party suppliers, allowing for significant savings that can be reinvested into the business. Bulk purchasing and streamlined operations lower per-unit costs, enhancing overall production efficiency and competitiveness.

2. Improved Quality Control

Controlling multiple supply chain stages ensures consistent quality standards. Direct oversight allows for stringent quality measures, reducing the risk of defects and recalls. This is crucial for industries where product quality differentiates, such as luxury goods. Enhanced quality control protects the company’s reputation and fosters customer loyalty through reliable and high-standard products.

3. Supply Chain Reliability

Vertical integration increases supply chain reliability by giving companies greater control over the flow and availability of components. This minimizes disruptions from external suppliers, ensuring steady material supply and predictable production schedules. Enhanced reliability allows companies to meet customer demands consistently, maintaining a competitive edge through improved operational efficiency.

4. Increased Market Power

Controlling supply chain stages boosts a company’s bargaining power with suppliers and customers. Reduced dependency on external suppliers allows for better negotiation terms. Market control enables effective management of pricing, distribution, and marketing strategies. Direct customer interaction provides insights for targeted marketing, strengthening market position and competitive strength.

5. Enhanced Customer Experience

Vertical integration delivers a consistent customer experience by managing the entire supply chain. Companies ensure quality, branding, and service standards at every touchpoint, building stronger brand loyalty and satisfaction. Direct customer feedback helps in rapid improvements, enhancing the overall customer experience.

6. Innovation and R&D Synergies

Vertical integration fosters collaboration between R&D and manufacturing, accelerating innovation. Efficient communication and feedback loops enable quick prototyping and implementation of new ideas. Controlling both design and production phases ensures innovative products meet quality and performance standards, maintaining a competitive edge.

7. Strategic Flexibility

Vertical integration offers strategic flexibility to enter new markets or adapt to industry changes. Owning supply chain stages allows companies to diversify product offerings and expand geographically. This flexibility enables quick responses to market shifts, reducing reliance on external suppliers and distributors, and supporting innovation and evolution.

8. Risk Management

Vertical integration helps manage risks by reducing exposure to supply chain disruptions. Controlling supply chain stages ensures stability and predictability in operations, essential for continuous production and meeting customer expectations. It diversifies risk across the supply chain, ensuring issues in one area do not derail the entire process.

Disadvantages / Cons of Vertical Integration

1. High Initial Costs

Implementing vertical integration requires significant capital investment for acquiring or developing new capabilities and infrastructure, which can strain a company’s financial resources. This includes purchasing suppliers, building facilities, or developing in-house production capabilities, creating a substantial upfront financial burden and potential risk if the integration does not yield expected efficiencies or market advantages.

2. Reduced Flexibility

Vertical integration can reduce a company’s operational flexibility, making it more challenging to adapt quickly to market changes or technological advancements. Companies heavily invested in their in-house processes and resources might struggle to adopt new production techniques or switch to alternative suppliers, which can be a disadvantage in fast-paced industries requiring rapid response to market trends.

3. Complex Management

Managing an expanded range of operations increases organizational complexity, requiring more sophisticated management structures and processes. This added complexity can lead to inefficiencies and higher operational costs, as companies need to oversee a broader spectrum of activities, from sourcing raw materials to retail operations, potentially creating managerial challenges and misalignment.

4. Risk of Overextension

Vertical integration can lead to overextension, where companies spread their resources too thin by managing too many supply chain stages. This can dilute core competencies and result in inefficiencies, reduced quality, and financial losses if the company struggles to effectively manage all integrated supply chain aspects.

5. Barrier to Entry for New Competitors

While vertical integration can create high barriers to entry, discouraging new competitors and reducing competitive pressure, this can lead to industry stagnation. Without new entrants, existing companies might become complacent, resulting in less innovation, higher prices, and fewer choices for consumers.

6. Regulatory and Antitrust Issues

Vertical integration can attract regulatory scrutiny and antitrust issues, as it may be seen as creating unfair market advantages or monopolistic practices. Regulatory bodies may impose restrictions or penalties, leading to costly and time-consuming legal challenges and potential divestitures to comply with antitrust laws.

7. Cultural and Operational Clashes

Merging different supply chain stages can lead to cultural and operational clashes within the organization, as each stage may have distinct practices and values. These differences can create internal conflicts, reduce morale, and hinder smooth integration, requiring careful and potentially costly management to address.

8. Limited Focus on Core Business

Vertical integration can divert attention and resources away from a company’s core business activities, leading to under-performance in primary areas of expertise. Companies might struggle to maintain innovation, quality, and efficiency in their core operations while managing the complexities of an integrated supply chain.

Difference Between Vertical Integration and Horizontal Integration

Vertical integration involves a company expanding its operations across different stages of its supply chain, from acquiring raw materials to manufacturing components and managing distribution. The main goal is to enhance control over production processes, improve quality control, reduce costs, and ensure a steady supply of materials. This approach allows companies to streamline operations, decrease dependency on external suppliers, and potentially achieve significant efficiencies. For example, a watch manufacturer that controls its movements, cases, assembly, and retail distribution exemplifies vertical integration, aiming to maintain consistent quality and brand integrity throughout its operations.

In contrast, horizontal integration involves a company expanding within the same stage of the supply chain by acquiring or merging with other companies that operate at the same level. The main goal is to boost market share, achieve economies of scale, and diminish competition. By integrating operations with comparable firms, companies can leverage synergies, streamline processes, and utilize combined resources to improve efficiency and profitability. Horizontal integration also enables access to new markets, diversification of product lines, and reinforcement of market presence. For example, a watch manufacturer merging with another watch company can merge technologies, distribution networks, and marketing strategies to lower costs and dominate a larger market share.

The key difference between vertical and horizontal integration lies in the direction of expansion within the supply chain. Vertical integration extends operations into different stages of the supply chain, aiming for greater control over production processes and supply chain reliability. In contrast, horizontal integration expands within the same stage of the supply chain to increase market share, achieve economies of scale, and reduce competition. While vertical integration focuses on internal control and efficiency improvements, horizontal integration concentrates on external growth and market dominance through consolidation and synergies with similar businesses.

Balance Integration of Vertical Integration

Balanced integration is a strategic approach in vertical integration where a company integrates both upstream (backward integration) and downstream (forward integration) in its supply chain, but in a balanced and controlled manner. This means that the company doesn’t fully own or control every part of its supply chain, but rather selectively integrates certain stages that provide the most strategic advantage. The goal is to balance the benefits of vertical integration with the flexibility of using external suppliers or distributors where it makes sense.

A practical example of balanced integration in the watch industry could be seen in a company like Omega. Omega produces many of its own movements and high-precision components in-house, ensuring the quality and innovation for which it is known. However, it may outsource other components or rely on external suppliers for non-core parts. Additionally, Omega may operate its own boutiques and flagship stores in key markets (forward integration) but still sell its watches through independent retailers and online platforms to reach a broader audience.

Following are the Benefits / Pros of Balanced Integration

- Optimized Resources

Companies can allocate resources and investment more efficiently by focusing on the most critical parts of their supply chain. - Innovation and Quality

Companies can ensure high quality and foster innovation by controlling key stages of production, - Market Responsiveness

Maintaining some level of external supply and distribution allows companies to quickly adapt to market changes without being locked into inflexible structures. - Risk Diversification

Spreading the supply chain across internal and external sources helps mitigate risks related to supply disruptions or market volatility.

How Acquisition and Mergers Result Vertical Integration

Acquisitions and mergers can lead to vertical integration by enabling a company to acquire or merge with businesses that operate in different stages of its supply chain. Through acquisitions, a company can gain direct control over upstream or downstream activities, such as raw material sourcing, manufacturing, or distribution channels. By merging with firms at various supply chain stages, companies consolidate their operations, streamline processes, and integrate resources more effectively.

This strategic move enhances control over production processes, improves quality management, reduces costs, and ensures a reliable supply of critical materials. Overall, acquisitions and mergers facilitate vertical integration by allowing companies to expand their operational footprint across multiple stages of the supply chain, thereby enhancing efficiency and competitiveness in the market.

Is Vertical Integration Good for Company?

Vertical integration can be advantageous for a company under the right circumstances. A company can gain greater control over its supply chain, from raw materials to distribution, which can lead to improved quality control, cost efficiencies, and better coordination across various stages of production by integrating vertically. This strategy can reduce dependency on external suppliers, mitigate supply chain risks, and enable faster responses to market changes. Additionally, vertical integration can enhance a company’s market power by consolidating operations and potentially increasing barriers to entry for competitors.

However, vertical integration requires significant investment, operational expertise, and careful management to realize these benefits effectively. It may not be suitable for every company or industry, as it can also lead to higher fixed costs, reduced flexibility, and regulatory challenges. Therefore, the decision to pursue vertical integration should be based on thorough strategic analysis and alignment with the company’s long-term goals and competitive environment.

When Should a Company Decide with Vertical Integration?

A company should consider vertical integration when several key factors align with its strategic objectives and market conditions, as explained below,

Firstly, vertical integration may be suitable when there are significant inefficiencies or quality issues in the current supply chain that can be better controlled internally. For instance, if a company relies heavily on a critical component that is subject to frequent shortages or quality variations from external suppliers, vertical integration could mitigate these risks by bringing production in-house.

Secondly, vertical integration is often beneficial when there is a strategic advantage in owning key stages of the supply chain. This could include gaining access to proprietary technology, achieving better economies of scale, or securing a competitive edge through superior control over product differentiation or pricing strategies.

Thirdly, vertical integration may be justified when market conditions support it, such as stable or growing demand for the company’s products or services, allowing for sufficient utilization of internal production capacity and resources. This stability can justify the upfront investment and ongoing operational costs associated with vertical integration.

Lastly, companies should consider vertical integration when it aligns with their long-term growth and sustainability goals. This includes enhancing market positioning, reducing supply chain risks, improving product quality and consistency, or achieving greater operational efficiencies that support overall profitability and resilience in competitive markets.

Ultimately, the decision to pursue vertical integration should be based on a comprehensive analysis of these factors, weighing the potential benefits against the associated costs, risks, and organizational capabilities required to successfully manage and integrate additional supply chain activities internally.

Key Areas Company should consider before moving to Vertical Integration

Before embarking on vertical integration, companies should carefully evaluate several key areas to determine if this strategy aligns with their goals and capabilities:

- Strategic Fit and Objectives

Companies should assess whether vertical integration supports their strategic objectives. This includes considering how integrating upstream or downstream activities will enhance competitive advantage, improve market positioning, or mitigate risks in the supply chain. - Cost-Benefit Analysis

Conducting a thorough cost-benefit analysis is crucial. Companies should evaluate the potential cost savings, efficiencies, and revenue opportunities that vertical integration could bring compared to the costs of investment, operation, and management of additional supply chain activities. - Supply Chain Assessment

Analyzing the current supply chain is essential to identify inefficiencies, quality control issues, or vulnerabilities that vertical integration could address. Companies should assess whether internalizing certain activities will lead to better control over inputs, improve product quality, or ensure a more reliable supply of critical materials. - Market Dynamics and Demand

Understanding market dynamics and demand trends is critical. Companies should assess whether there is stable or growing demand for their products/services to justify the investment in vertical integration. Additionally, they should consider how integration will impact pricing strategies, market competitiveness, and customer relationships. - Capability and Expertise

Assessing internal capabilities and expertise is necessary to determine if the company has the necessary skills, resources, and management capacity to successfully operate additional supply chain activities. This includes evaluating technical expertise, operational capabilities, and potential gaps that may need to be addressed through training or hiring. - Risk Assessment and Mitigation

Vertical integration introduces new risks, such as operational complexities, regulatory challenges, and financial commitments. Companies should conduct a thorough risk assessment to identify potential risks and develop mitigation strategies to minimize these risks effectively. - Legal and Regulatory Considerations

Understanding legal and regulatory implications is crucial. Companies should assess whether vertical integration complies with antitrust laws, competition regulations, and industry standards. Legal counsel may be necessary to navigate potential challenges and ensure compliance with relevant laws. - Organizational Alignment and Culture

Vertical integration can impact organizational structure, processes, and culture. Companies should assess how integration will align with existing organizational structures and culture, as well as how to manage potential resistance or challenges from stakeholders affected by the change.

By thoroughly evaluating these key areas, companies can make informed decisions about whether vertical integration is a viable strategy that aligns with their long-term objectives and enhances their competitive position in the market.

FAQs of Vertical Integration

Q: What are the risks of vertical integration?

Risks include high initial and operational costs, reduced flexibility in adapting to market changes, complexity in managing multiple supply chain stages, and potential regulatory challenges.

Q: When should a company consider vertical integration?

Consider it when seeking better control over quality and costs, encountering inefficiencies or risks with external suppliers, having stable product demand, and possessing the capability to manage added supply chain activities effectively.

Q: What industries commonly use vertical integration?

Industries like manufacturing (automobiles, electronics), retail (supermarkets, fashion), and energy (oil and gas) often use vertical integration to control production and distribution for competitive advantage.

Q: What are some examples of successful vertical integration?

Examples include Apple, which designs, manufactures, and sells its hardware and software; Tesla, which internally produces electric vehicle components; and Amazon, which owns distribution networks and retail operations, improving logistics and customer service.

Q: How does vertical integration impact supply chain management?

Vertical integration impacts supply chain management by centralizing control over critical processes, reducing dependency on external suppliers, optimizing logistics and distribution, and enabling faster decision-making and response times to market demands.

Q: What role does technology play in vertical integration?

Technology plays a crucial role in enabling vertical integration by enhancing communication and coordination across supply chain stages, optimizing production processes, improving data analytics for informed decision-making, and facilitating seamless integration of operations.

Q: What considerations are essential for successful vertical integration?

Key considerations include thorough market and competitive analysis, strategic alignment with long-term business goals, assessment of internal capabilities and resources, careful evaluation of financial implications, and effective management of organizational and cultural changes.

Q: How can companies mitigate risks associated with vertical integration?

Companies can mitigate risks by conducting comprehensive risk assessments, diversifying suppliers and distribution channels, implementing robust contingency plans for supply chain disruptions, maintaining regulatory compliance, and continuously evaluating the effectiveness of integrated operations.

Q: What are some challenges companies may face when implementing vertical integration?

Challenges include integrating diverse organizational cultures and processes, navigating legal and regulatory complexities, managing increased operational complexities and costs, balancing short-term investment with long-term benefits, and adapting to evolving market conditions and consumer preferences.

Recommended Articles: