Horizontal Integration Real Examples in the United States

Horizontal Integration is where two companies in the same industry merge to achieve positive business outcomes. Horizontal integration optimizes the consolidated strategic business activities and processes. The business combinations after horizontal integration may lead to industry consolidation.

Many American corporates followed the horizontal integration method to expand their business in the form of mergers and acquisitions. Following are the real industry examples for horizontal integration in the United States,

Real Industry Examples for Horizontal Integration in the United States

1) Facebook Acquisition of Instagram in 2012

The world’s largest digital social media corporate Facebook Inc acquired Instagram for approximately US$1 billion in cash and stock on 9th April 2012. Instagram was a very popular social media platform mainly with Generation Z.

Instagram was known as a competitor for Facebook. Facebook Inc has done a horizontal integration with Instagram, which was in the same industry as competitors. Facebook was able to focus development on improving both Facebook and Instagram instead of on competition with this acquisition.

Read More: Article of business-standard.com about Instagram Acquisition

2) Merger of Disney and Pixar

The American entertainment business giant, Walt Disney Company was founded in 1923 by brothers Walt and Roy Disney. It is one of the largest media and entertainment corporations in the world. Pixar was an American movie production company mainly focused on computer-animated filmmaking.

Robert A. Iger, President and Chief Executive Officer of The Walt Disney Company, announced in 2006 that Disney has agreed to acquire computer animation leader Pixar for $7.4 billion.

This acquisition combines Pixar’s creative and technological resources with Disney’s unparalleled portfolio of world-class family entertainment, characters, theme parks, and other franchises.

Read More: News Article by Disney, Article Published by Qrius

3) The Merger of Mobil and Exxon

Mobil and Exxon were the leading oil companies in the United States. These two companies once controlled approximately 90% of American oil production. Both companies merged in 1998 to achieve cost savings synergies as Exxon Mobil Corp.

The merged entity became the third-largest company in the world at the time of announcement. The merger created one of the world’s prominent oil corporations with revenues of $200 billion and worldwide production of 2.5 million barrels of oil a day

Read More: Article on Los Angeles Times Newspaper on this Merger

4) Merge of Hewlett-Packard and Compaq

Compaq was an American information technology company founded in 1982 that developed, sold, and supported computers and related products and services. Hewlett-Packard founded in the United States, provided a wide variety of hardware components, as well as software and related services to consumers and businesses.

Both companies merged to create an $87 billion global technology leader. The merger was expected to generate cost synergies of approximately $2.0 billion. Companies aimed to have the industry’s most complete set of IT products and services for both businesses and consumers.

The company expected that the new HP would be the #1 global player in servers, imaging & printing, and access devices. Also expected that new HP would be the Top 3 player in IT services, storage, and management software. The consolidated aim of the combined entity was to be the global technology leader using economies of scale.

Read More: Press Release by HP, Article by CRN Magazine

5) The Merger of United Airlines and Continental Airlines

United Airlines acquired Continental Airlines in 2010. Both were American airline corporations that operate both domestic and integrational route networks. The holding company for the new entity is named United Continental Holdings, Inc.

With these synergies, the airlines were able to improve their processes to provide more sophisticated customer service.

Read More: Article on jonesday.com about Continental Airlines and United merge

6) The Shell Oil Company and Texaco Inc Merger

Americal oil business giants Shell and Texaco merge their refining and marketing operations in 1997. The Synergysis of this merger was to reduce refining costs in the business with aiming for the potential price reduction.

Read More: Article on Los Angeles Times Newspaper on this Merger

Recommended Articles:

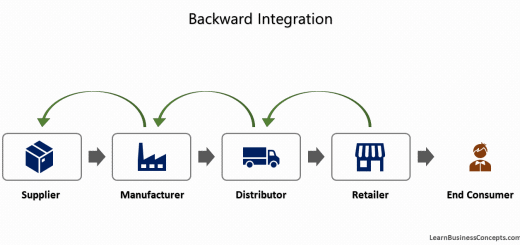

- Vertical Integration