Opportunity Cost – Definition, Examples, and Formula

Opportunity Cost Definition

Opportunity cost is the value of the next-best alternative when a decision is made to proceed with one alternative. Opportunity cost is the loss that bears to make a gain, choosing one choice out of another.

Opportunity costs represent the potential benefits missed when selecting one option over another. When a business or individual chooses one investment over another, analysis of opportunity cost allows better decision-making.

Understanding Opportunity Cost with Examples

Opportunity cost is the value of what you lose when picking one option between two or many. As a simple example, if you spend time and money to go out and eat your favorite pizza, you cannot spend that same forgone time at home watching a movie, and you can’t use that same money on something else.

Example 1: A farmer chooses to plant corn on his farm. The opportunity cost here is planting a different crop like wheat or another alternative.

Example 2: A professional worker takes a train to work instead of driving his car. It takes 1 hour and 30 minutes to travel to work by train. But it takes only 30 minutes and $20 extra if he drives to work. The opportunity cost is an hour spent and a gain of $20.

Example 3: The investor thinks of whether to sell his shares or hold onto them to sell later. If an investor sells his shares now then he will lose any gains which he can enjoy in the future.

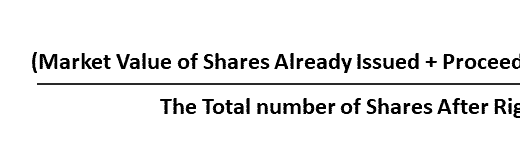

Opportunity Cost Formula

Following is the Formula to calculate the Opportunity Cost,

Opportunity Cost = FO − CO

FO= Return on the best-forgone alternative

CO= Return on the chosen alternative

Example: A farmer chooses to plant corn on his farm so that he can make a profit of $50,000. The opportunity cost here is planting wheat which he can make a profit of $45,000.

Opportunity Cost = FO – CO = $45,000 – $50,000 = -$5,000

Read More:

- Fixed Cost – Explanation, Formula, Calculation, and Examples

- Variable Cost – Explanation, Formula, Calculation, Examples

- Marginal Cost – Explanation, Formula, Curve, Examples