Fixed Cost: Explanation, Formula, Calculation, and Examples

Fixed Cost Definition

Fixed cost is a type of cost that does not change with an increase or reduction in production quantity. The company has to pay the fixed cost despite the number of units produced. Rental expenses, monthly bank interest payments, and insurance payments are some examples of fixed costs.

Despite the business performance, production quantity, work in progress, or other factors, a fixed cost will always remain fixed.

Understanding Fixed Cost

Fixed costs can be understood as the types of expenses the company must pay, which are not dependent on any specific business activities. Fixed costs are generally considered as indirect since it is not applied to a company’s production level of any goods or services. These costs are constant over a specified time and the amount does not change with production output levels.

Fixed costs are usually established by contract agreements or schedules. As an example, for rent payment, there is a specific agreement that specifies the duration and the fixed amount which the company should pay. Fixed costs usually do not change throughout the agreement.

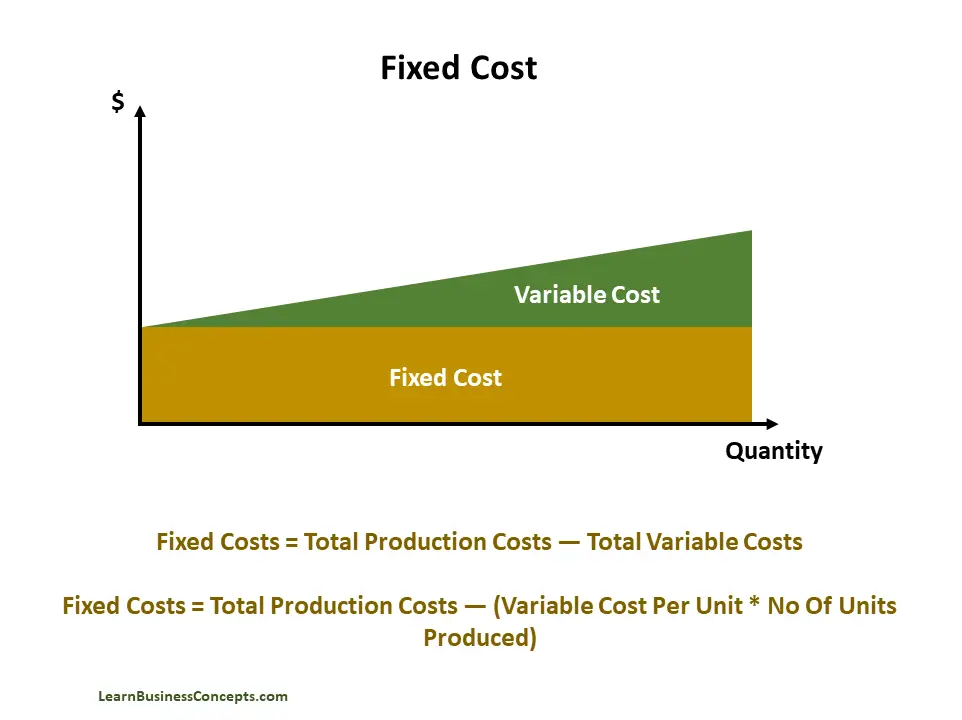

Fixed Cost Calculation Formula

Following are the formulas used to calculate fixed costs,

Fixed Costs = Total Production Costs — Total Variable Costs

Fixed Costs = Total Production Costs – (Variable Cost Per Unit * No Of Units Produced)

Fixed Cost Per Unit = Fixed Costs / No Of Units Produced

Explanation of the Formula: Total production cost is a combination of total fixed cost and total variable cost. The Total Fixed Cost can be derived by deducting Total Variable Costs by Total Production Costs.

Fixed Cost Examples

Following the examples of Fixed Costs,

- Salaries and Wages: The amount the company pays for the employees is consistent unless pay raise or commission.

- Insurance: Insurance costs like employee healthcare and property insurance are constant within the period of the agreement.

- Loan Interest: Interest on business loans will be stable if the fixed interest rate is agreed upon. If so, this can be considered a fixed cost.

- Utility Bills: Usually utility bill expenses like electricity, water, web hosting, and telecom will fluctuate very little throughout the year. Most utility bills can be considered fixed costs.

- Rental Expenses: The rent amount will be the same from month to month based on the agreement.

- Property Taxes: If the company owns the property, the tax expenses for the property are quite consistent.

Read More:

- Variable Cost – Explanation, Formula, Calculation, Examples

- Marginal Cost – Explanation, Formula, Curve, Examples