What is Marginal Cost? Explanation, Formula, Curve, Examples

Marginal Cost Definition

In economic terms, the marginal cost is the increase in total production cost when producing one additional unit. Simply this is the additional cost that a firm needs to bear when producing an additional unit. This is also known as incremental cost.

Marginal Cost Usage Explanation

The purpose of marginal cost is to determine at what point the firm can reach economies of scale. If the marginal cost of additional unit production is lower than the per-unit price, the firm can gain a profit.

The fixed cost of the company will not change whether it increases or decreases the production output. Hence the marginal costs are based on variable costs or direct costs (ex: labor, materials, and equipment cost).

The marginal cost of production helps the firm to optimize its production through economies of scale.

Marginal Cost Calculation with Formula

You can calculate the Marginal cost by dividing the change in total cost by the change in quantity.

Marginal Cost (MC) = Change in Total Cost / Change in Quantity

Calculation Example: Assume a firm is currently producing 1,000 units for a $20,000 total cost. The firm now produces an additional 10 units and the total cost increases by $180. Hence the marginal cost is derived as $18.

MC = $180 / 10 = $18

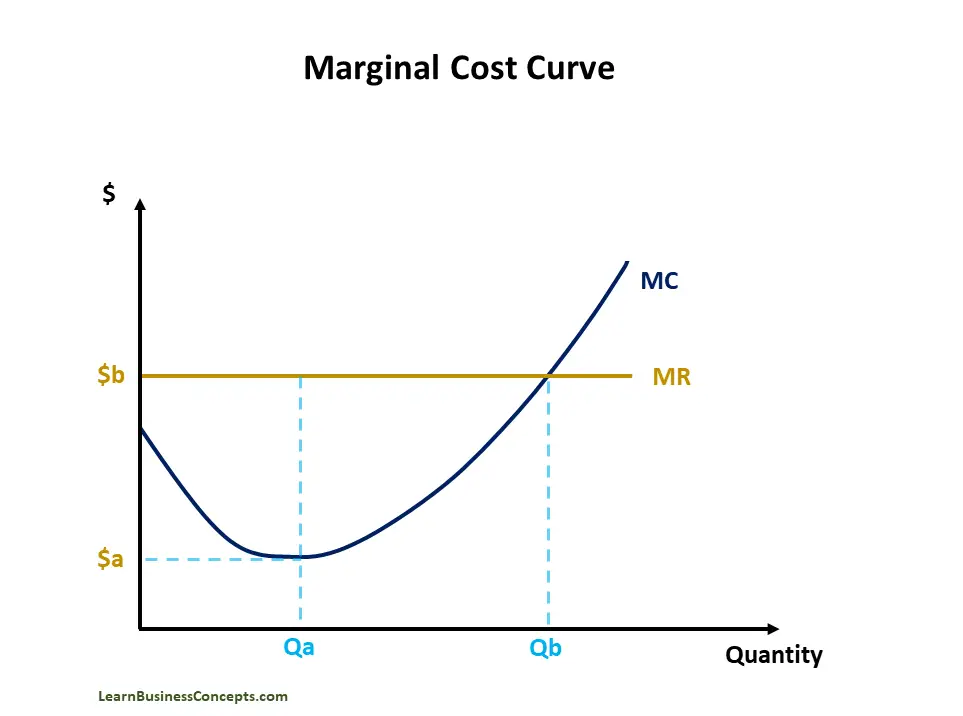

Marginal Cost Diagram / Curve

Firms use the marginal cost curve to determine two pieces of information,

- The optimum quality level of production – which the firm can benefit from with the lowest possible cost of production.

- The maximum quantity of production – the firm can understand the maximum quantity which they can produce with a profit. The firm can stop further production from this level.

Below is the Diagram / Curve for Marginal Cost,

MC = Marginal Cost

The marginal cost declines when quantity production increases. There is a point where the marginal cost will be the lowest possible rate (Qa / $a). At this point, the firm enjoys producing the unit at the highest marginal profit, which is the difference between $b and $a.

Then the marginal cost will increase and at a point, it will be equal to marginal revenue (Qb / $b). At this level, the firm should stop producing further because the cost of producing additional units will be more than the revenue of producing an additional unit.

MR = Marginal Revenue

Marginal revenue will be constant for the firm. There is a unit price for the product and this is similar despite the production quantity.

Marginal Cost Examples

Example 1 – Apparel Industry

ABC Apparels is a newly established business.

In the first year: the firm produces 10,000 units. The total cost of production is $150,000.

In the second year: The firm produces 15,000 units. The total cost of production is $200,000.

First, let’s calculate the change in total cost. In this case, it is $50,000 (the difference between year 2 total cost of $200,000 and year 1 total cost of $150,000).

Secondly, let’s calculate the change in total quantity. In this case, it is 5,000 (the difference between year 2 total quantity of 15,000 and year 1 total quantity of 10,000).

Marginal Cost (MC) = Change in Total Cost / Change in Quantity

Marginal Cost (MC) = $50,000 / 5,000 = $10

Example 2 – Car Production Industry

XYZ Vehicle Productions is a newly established business.

In the first year: the firm produces 100 units. The total cost of production (fixed cost + variable cost) is $5,000,000.

In the third year: The firm produces 500 units. The total cost of production (fixed cost + variable cost) is $23,000,000.

First, let’s calculate the change in total cost. In this case, it is $23,000,000 – $5,000,000 = $18,000,000.

Secondly, let’s calculate the change in total quantity. In this case, it is 500 – 100 = 400.

Marginal Cost (MC) = Change in Total Cost / Change in Quantity

Marginal Cost (MC) = $18,000,000 / 400 = $45,000

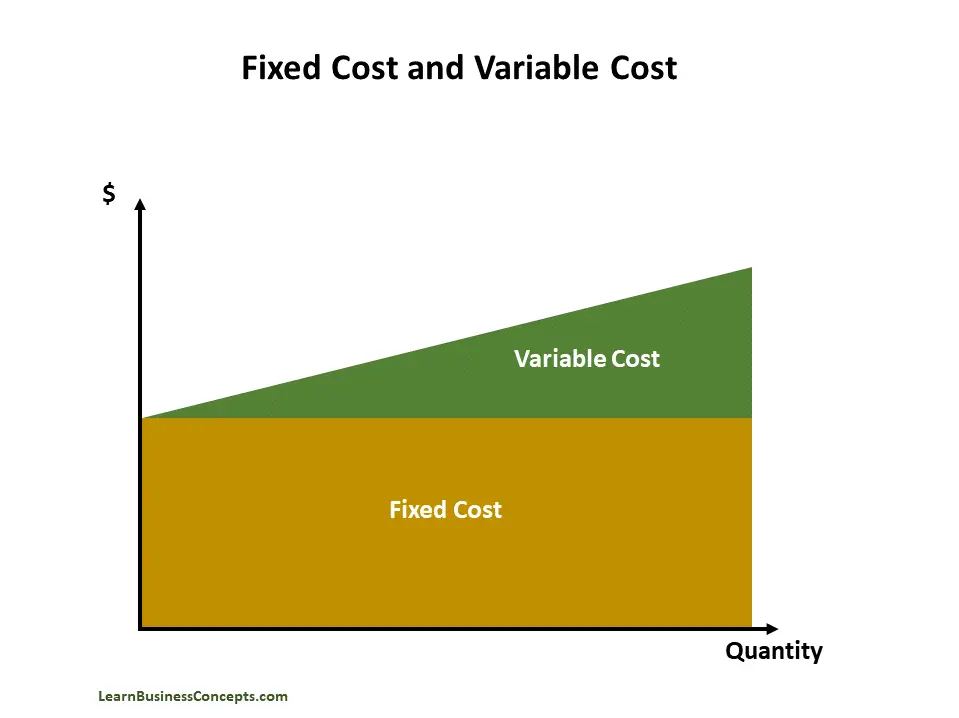

Fixed Cost and Variable Cost

Fixed costs remain the same despite increasing or decreasing the production output. As an example, fixed costs will include rental payments, insurance charges, lease payments, and bank interest payments.

Variable costs changes based on the production output. The variable cost usually increases when quantity production increases and decreases when quantity production is reduced. As an example, variable costs will include salaries, wages, sales commissions, and the cost of raw materials.

Read More:

- Fixed Cost – Explanation, Formula, Calculation, and Examples

- Variable Cost – Explanation, Formula, Calculation, Examples