Variable Cost: Explanation, Formula, Calculation, Examples

Variable Cost Definition

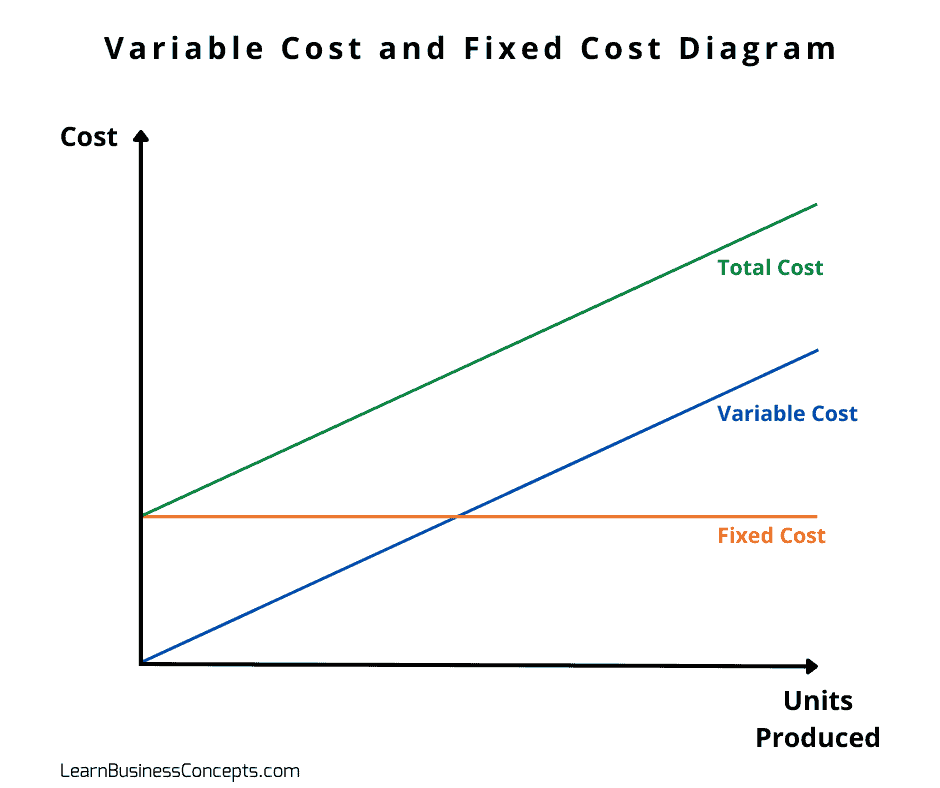

Variable costs are expenses that the amount depending on the volume of goods or services produces. In simple terms, variable cost is changing based on the production/service output quantity/volume. When the volume of activities boosts, variable cost increases, and when the volume of activities reduces variable cost decreases.

Companies with low fixed costs and high variable costs have to produce comparatively lesser output to break even. Also, they will have lower profit margins compared with the companies with high fixed costs. Variable costs vary with the production output. The more variable costs, the lower the profit margin. The less variable cost, the higher the profit margin.

Understanding Variable Cost with Examples

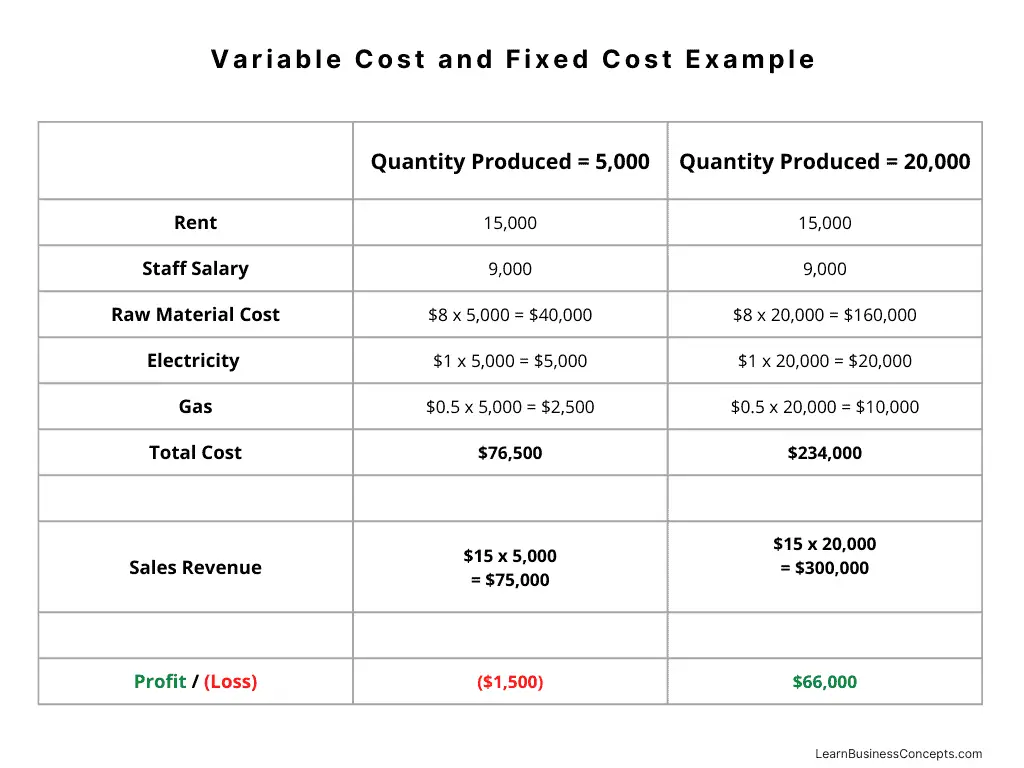

Rickey owns a small pastry restaurant. He wants to analyze the profitability of the business. Rickey identified that there are types of expenses such as raw material costs (flour, cooking oil, meat, etc..) staff salary, rent, electricity, and gas.

Rickey identified that certain types of costs are consistent despite the production output, which are fixed costs. Some types of costs directly vary with the production output, which is variable costs.

Fixed Cost: Rent, Staff Salary

Variable Cost: Raw Material Cost, Electricity, Gas

Following are the amounts of the expenses bone by Rickey’s pastry company,

Rent = $15,000

Staff Salary = 3 x $3,000 = $9,000

Raw Material Cost = $8 (Assigned For 1 Product)

Electricity = $1 (Assigned For 1 Product)

Gas = $0.5 (Assigned For 1 Product)

The price of a product in Rickey’s shop is $25. Rickey wants to identify how many products he needs to produce to obtain a profit.

It is obvious to Rickey that if he sells 5,000 pastry products then it is not sufficient to obtain a profit. He will not be able to cover $1,500 of expenses. But if he produces 20,000 pastry products then he can enjoy a profit of $66,000.

Variable Cost Calculation Formula

Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output

Total Variable Cost = Total Cost – Total Fixed Cost

Average Variable Cost = Sum of Variable Costs / No of Units Produced

Variable Cost Per Unit = Total Variable Costs / No of Units Produced

Variable Cost Examples

Following are some examples of variable costs:

- Raw Material Cost

- Saff Salaries / Wages

- Sale Commissions

- Utility Costs (Electricity / Gas / Water)

- Billable Labor

- Delivery Cost

- Packaging Cost

Read More:

- Fixed Cost – Explanation, Formula, Calculation, and Examples

- Marginal Cost – Explanation, Formula, Curve, Examples