How to Calculate Theoretical Ex-Rights Price (TERP)

What is the Right Issue of Shares?

A right issue of shares (rights offering) is where a company provides an offer to their existing shareholders to purchase additional shares at a discounted price in a particular ratio proportionate to their existing shareholding. Shareholders have the option to purchase shares at a lower price on or before a specific date in order to keep their existing shareholding percentage (without dilution).

What is Ex-Right?

“Ex-Right” refers to the time when a company’s stock is traded without the option to participate in a rights issue. A rights issue lets current shareholders buy more shares at a lower price. The ex-right date is the first day the stock trades without this option. If you buy the stock on or after this date, you don’t get the chance to buy additional discounted shares. On this date, the stock price usually drops to reflect the lost value of the rights. Knowing about the ex-right period helps investors make informed decisions, as it affects whether they can take part in the rights issue and impacts the stock’s price.

What is the Theoretical Ex-Rights Price (TERP) of a Share?

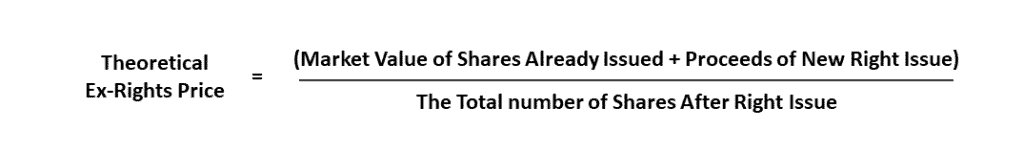

Usually, the share price will be changed after conducting the right issue. The new share price after the right issue is known as the theoretical ex-rights price (also known as ex-right price or TERP). It is calculated by sum the market value of existing shares and proceeds of right issues divided by the total number of shares after the right issue.

Formula to Calculate the Theoretical Ex-Rights Price (TERP)

Theoretical Ex-Rights Price (TERP) = [ Market Value of Shares Already Issued + Proceeds of New Right Issue ] / The Total number of Shares After Right Issue

Step 01 – Determine the market value share price: Find the current market price of the stock before the rights issue.

Step 02 – Calculate the market value of shares already issued – Multiply the number of current shares by the market value of a share. This will provide the market value of all shares already issued.

Step 03 – Identify the subscription price: This is the price at which existing shareholders can purchase additional shares through the rights issue.

Step 04 – Calculate the proceeds of new right issue: Multiply the subscription price by the number of shares newly issue. This will provide the total proceeds of the new right issue.

Step 05 – Calculate the total number of shares after right issue: Simply sum the number of shares already issues with the new number of shares going to issue. This will provide the total number of shares after right issue.

Step 06 – Calculate the total value after the rights issue: Add the proceeds from the new shares (subscription price multiplied by the number of new shares) to the total value before the rights issue.

Step 07 = Compute the TERP: Divide the total value after the rights issue by the total number of shares after the rights issue.

Example Calculation

- Current share price: $50

- Subscription price: $40

- Number of existing shares: 1,000,000

- Number of new shares: 200,000 (if the rights issue is 1 new share for every 5 existing shares)

- Proceeds of new right issue = $40 x 200,000 = $8,000,000

- Total number of shares after right issue = 1,000,000 + 200,000 = 1,200,000

- Total value after the right issue = ($50 x 1,000,000) + ($40 x 200,000) = $50,000,000 + $8,000,000 = $58,000,000

- TERP = $58,000,000 / 1,200,000 = $48.33

What Happens to the Share Price after the Right Issue?

Usually, the share price will be decreased than the market price which was available before the right issue, but not less than the right issue subscription (discounted) share price.

Value of a Right = Theoretical Ex-Rights Price – Right Issue Subscription (Discounted) Share Price

Importance of Theoretical Ex-Right Price (TERP)

- Price Adjustment: TERP provides an estimate of what the stock price should be after the rights issue, reflecting the dilution effect. This helps investors understand how the issuance of additional shares at a discounted price will impact the overall value of the shares.

- Fair Valuation: TERP ensures a fair valuation for both existing and new shareholders. It helps in determining a balanced price that takes into account the new shares issued at a discount, ensuring that the market price adjusts appropriately.

- Investment Decisions: For potential investors, TERP serves as a useful benchmark. It helps them decide whether to buy the stock before or after the rights issue, based on the anticipated price adjustment and the value of the rights.

- Avoiding Arbitrage: By calculating TERP, the market can prevent arbitrage opportunities where traders might exploit price discrepancies between the cum-rights and ex-rights periods. This helps maintain market efficiency.

- Strategic Planning for Shareholders: Existing shareholders can use TERP to make informed decisions about whether to subscribe to the rights issue. Knowing the TERP helps them assess if the investment is worthwhile and how it will affect their portfolio value.

- Financial Analysis: Analysts and investors use TERP to perform a more accurate financial analysis and valuation of the company post-rights issue. It helps in adjusting models and forecasts to reflect the new capital structure.

- Market Stability: Understanding and anticipating the impact of rights issues on stock prices through TERP can contribute to market stability. Investors are less likely to react unpredictably when they have a clear expectation of the price adjustment.

- Communication with Stakeholders: Companies can use TERP to communicate the potential impact of a rights issue to their shareholders transparently. This helps in managing shareholder expectations and maintaining trust.

Factors Affecting TERP

Several factors can affect the Theoretical Ex-Rights Price (TERP). Understanding these factors is crucial for investors and analysts to accurately assess the impact of a rights issue on a company’s stock price.

- Current Share Price: The existing market price of the stock before the rights issue is a primary factor. A higher current share price generally results in a higher TERP, all else being equal.

- Subscription Price: The price at which new shares are offered to existing shareholders significantly influences TERP. A lower subscription price compared to the current share price will usually result in a lower TERP due to the dilution effect.

- Number of Existing Shares: The total number of shares already issued by the company before the rights issue affects TERP. The larger the base of existing shares, the smaller the relative impact of the new shares on the overall stock price.

- Number of New Shares: The number of new shares being issued plays a critical role. More new shares relative to existing shares will increase dilution, potentially lowering the TERP.

- Ratio of Rights Issue: The ratio at which new shares are offered (e.g., 1 new share for every 5 existing shares) affects TERP. A higher ratio means more shares are being introduced, which can lower the TERP due to increased dilution.

- Market Conditions: General market conditions and investor sentiment can also influence TERP. Positive market conditions may mitigate the dilution effect, while negative conditions could exacerbate it.

- Company Performance and Outlook: The perceived future performance and financial health of the company can impact how the rights issue is viewed by investors, subsequently affecting TERP. If investors believe the additional capital will lead to significant growth, the dilution impact might be lessened.

- Purpose of the Rights Issue: How the company intends to use the funds raised from the rights issue can influence TERP. If the funds are aimed at strategic investments that are expected to generate high returns, the negative impact on TERP might be reduced.

- Investor Participation: The level of participation by existing shareholders in the rights issue can affect TERP. Higher participation levels indicate confidence in the company, potentially leading to a smaller drop in the share price.

- Dividends and Earnings Prospects: Expectations regarding future dividends and earnings can affect investor sentiment and thus the TERP. If the rights issue is expected to enhance earnings or dividends, the negative impact on TERP might be mitigated.

The TERP is influenced by a combination of factors including the current share price, subscription price, number of existing and new shares, the rights issue ratio, market conditions, company performance, and the purpose of the capital raised. Understanding these factors helps in accurately estimating the post-rights issue stock price and making informed investment decisions.

Understanding Rights Offering

A rights offering, also known as a rights issue, is a method by which a company raises additional capital by offering its existing shareholders the right to purchase additional shares at a discount to the current market price. This mechanism allows the company to raise funds efficiently while providing shareholders with the opportunity to maintain their proportional ownership in the company. The process typically involves several key components and considerations that make it an advanced financial strategy.

Firstly, the company will announce the rights offering and set a record date, which determines which shareholders are entitled to participate. Each shareholder receives rights based on the number of shares they hold. These rights are often tradable on the stock market, providing liquidity and flexibility to shareholders who may not wish to exercise them but could sell them to other investors. The ratio of the rights issue, such as one new share for every five existing shares, is predetermined and indicates the level of dilution existing shareholders will experience.

The subscription price, set below the current market price, incentivizes shareholders to participate in the offering. This price discount is a crucial factor in the theoretical ex-rights price (TERP), which reflects the adjusted value of the stock post-rights issue. The TERP is calculated to balance the dilution effect and the capital infusion from the new shares, ensuring that the stock price reflects the combined value of old and new shares proportionally.

From a strategic perspective, rights offerings can be a preferable alternative to other forms of equity financing, such as public offerings, because they typically involve lower issuance costs and provide a faster route to raising capital. Furthermore, they signal to the market that the company is confident in its future prospects, assuming shareholders perceive the need for additional capital positively.

Rights offerings also allow companies to raise funds without incurring debt, thus maintaining a healthier balance sheet. This can be particularly advantageous in times of financial distress or when the company seeks to capitalize on growth opportunities that require significant investment. The capital raised can be used for various purposes, such as expanding operations, funding research and development, or refinancing existing debt.

For shareholders, a rights offering represents a mixed bag of opportunities and challenges. While they have the chance to buy additional shares at a discounted price, failing to participate can result in dilution of their ownership stake. However, the ability to trade rights provides an exit strategy for those who choose not to invest further, allowing them to realize some value from their entitlement.

In summary, a rights offering is a sophisticated financial tool that balances the needs of the company for capital and the interests of shareholders. By carefully managing the terms and execution of the offering, companies can enhance their financial flexibility while preserving shareholder value. The success of a rights offering hinges on clear communication, market conditions, and the perceived future prospects of the company, making it a nuanced and multifaceted approach to capital raising.

Difference Between Ex-Right and Cum-Right

The terms “Ex-Right” and “Cum-Right” refer to different periods in the trading of a company’s stock in relation to a rights issue. “Cum-Right” means “with rights,” indicating that the stock is being traded with the rights to participate in the rights issue still attached.

If you buy the stock during this period, you will receive the rights to purchase additional shares at a discounted price. On the other hand, “Ex-Right” means “without rights,” indicating that the stock is now being traded without the entitlement to the rights issue. If you buy the stock on or after the ex-right date, you will not receive the rights to buy additional shares. The stock price typically drops on the ex-right date to reflect the value of the rights being removed. Essentially, “Cum-Right” is before the cutoff date, and “Ex-Right” is after the cutoff date, affecting whether buyers are eligible for the rights issue.

Why Companies conduct the Right Issue of Shares?

Companies conduct a rights issue of shares primarily to raise additional capital. This method allows them to generate funds without incurring debt, thereby maintaining a healthier balance sheet. The capital raised can be used for various purposes, such as expanding operations, financing new projects, reducing debt, or improving liquidity.

By offering shares at a discount to existing shareholders, companies provide an incentive for them to invest more, while also giving them the opportunity to maintain their proportional ownership. This approach is cost-effective and quicker compared to public offerings, and it signals confidence in the company’s future prospects to the market.

Real World Examples of Theoretical Ex-Right Price (TERP)

Real-world examples of Theoretical Ex-Rights Price (TERP) can be observed in various rights issues conducted by companies. Here are a few examples,

British Airways (BA): British Airways, part of International Airlines Group (IAG), announced a rights issue in response to financial challenges exacerbated by the COVID-19 pandemic. The rights issue aimed to raise funds to bolster liquidity and navigate the crisis. Investors and analysts utilized TERP calculations to assess the potential impact on the company’s share price and evaluate the attractiveness of participating in the rights issue.

Reference: British Airways owner IAG in 2.7-billion-euro rights issue (reuters.com)

Barclays (BARC.L): Barclays, a global financial services company, undertook a rights issue in 2014 to strengthen its capital base in compliance with regulatory requirements. The rights issue was structured with a specific subscription price and ratio of new shares to existing shares. The TERP calculation played a crucial role in determining the fair market value of Barclays’ shares after the issuance of new shares.

Reference: Barclays Gets Strong Rights Issue Acceptance – The Wall Street Journal (wsj.com)

Tesla (TSLA): Tesla conducted a rights issue in 2020, offering existing shareholders the opportunity to purchase additional shares at a discounted price. The subscription price was set below the prevailing market price at the time of announcement. The TERP calculation helped investors and analysts estimate the adjusted stock price post-rights issue, considering the dilution effect of the additional shares.

Drawbacks / Limitations of Theoretical Ex-Right Price (TERP)

- Simplistic Assumptions: TERP calculations often rely on simplified assumptions about market behavior, such as the efficient market hypothesis, which assumes all information is reflected in stock prices instantly. In reality, market reactions can be more complex and influenced by various factors beyond the scope of TERP.

- Dynamic Market Conditions: Market conditions can change rapidly, especially during the period between the announcement of a rights issue and its execution. TERP calculations may not fully account for changes in investor sentiment, economic conditions, or sector-specific developments that impact stock prices.

- Impact on Shareholder Perception: Theoretical models like TERP may not fully capture the psychological impact on shareholders. Even if the TERP suggests a fair valuation post-rights issue, investor sentiment and confidence in management’s decisions can affect actual market behavior.

- Assumption of Perfect Information: TERP assumes that all investors have perfect information about the rights issue and its implications. In reality, not all investors may fully understand the details or implications of the rights issue, potentially leading to market inefficiencies or mispricing.

- Market Liquidity and Trading Dynamics: Rights issues can introduce liquidity challenges and affect trading dynamics, particularly when rights are tradable separately from the underlying shares. TERP calculations may not fully account for these liquidity impacts, which can influence actual market prices.

- Model Sensitivity: TERP calculations are sensitive to the inputs used, such as the current share price, subscription price, and number of new shares issued. Small changes in these inputs can lead to significant variations in the TERP estimate, making precise predictions challenging.

- Limited Scope of Dilution: TERP primarily focuses on the dilution effect of additional shares issued through the rights offering. It may not capture other potential impacts on shareholder value, such as changes in the company’s capital structure or strategic implications of the rights issue.

Similar Methods Like Theoretical Ex-Right Price (TERP)

When discussing methods similar to Theoretical Ex-Right Price (TERP), which is used in financial markets to determine the expected price of a stock after it has gone through a corporate action like a rights issue. There are a few analogous concepts:

- Ex-Dividend Pricing: This method calculates the expected decrease in a stock’s price once it goes ex-dividend. It considers the dividend amount that will be paid out to shareholders and adjusts the stock price downward accordingly on the ex-dividend date.

- Ex-Rights Price (ERP): Similar to TERP, ERP estimates the expected price of a stock immediately after a rights issue. It factors in the theoretical value of the subscription rights issued to existing shareholders and adjusts the stock price accordingly.

- Ex-Split Pricing: This method estimates the expected price of a stock after a stock split has occurred. It adjusts the price downward based on the increased number of shares outstanding resulting from the split.

- Ex-Bonus Price: In markets where bonus shares are issued, this concept estimates the expected price of a stock immediately after the bonus issue. It adjusts the stock price downward to account for the additional shares issued to existing shareholders.

These methods are all designed to help investors understand the potential impact of corporate actions on stock prices, allowing them to make informed investment decisions. Each method involves calculating a theoretical price adjustment based on the specifics of the corporate action in question.

Pros / Benefits of Theoretical Ex-Right Price (TERP)

1. Easy Capital Raise – Rights issues allow companies to raise funds from existing shareholders.

2. Ownership Maintenance – Existing shareholders can buy more shares to maintain their ownership percentage. Share percentage will not dilute if right issue is accepted

3. Liquidity Boost – Increasing shares can enhance stock liquidity, attracting more investors.

4. Debt Reduction – Proceeds can be used to pay off debt, improving financial health.

5. Control Retention – Companies can raise funds without losing control to external parties.

6. Cost-Efficiency – Rights issues are typically cheaper than other fundraising methods.

7. Confidence Signal to Investors – Conducting a rights issue can signal confidence in the company’s future.

Cons / Drawbacks of Theoretical Ex-Right Price (TERP)

1. Potential Dilution – Existing shareholders’ ownership may be diluted if they don’t participate in the right issue. Shareholding percentage will be reduced if an investor does not participate.

2. Share Price Impact – The share price will mostly decrease due to increased supply of shares. This is a common ripple effect after right issue.

3. Limited Investor Base – Rights issues are limited to existing shareholders, missing out on potential new investors.

4. Complexity and Time – Organizing a rights issue can be administratively complex and time-consuming.

5. Market Perception – A rights issue may be interpreted negatively by the market, signaling financial difficulties or undervaluation.

FAQs of Theoretical Ex-Right Price (TERP)

What is TERP (Theoretical Ex-Right Price)?

- TERP is a theoretical calculation used in finance to estimate the expected price of a stock immediately after a rights issue. It takes into account the theoretical value of the subscription rights issued to existing shareholders and adjusts the stock price accordingly.

Why is TERP important?

- TERP helps investors and analysts understand the potential impact of a rights issue on a company’s stock price. It allows them to evaluate whether the rights issue is beneficial or dilutive to existing shareholders.

What does TERP indicate to investors?

- TERP indicates the expected immediate impact on the stock price once the rights issue is executed. If TERP is higher than the current market price, it suggests that the rights issue may be favorable for existing shareholders. Conversely, if TERP is lower, it indicates potential dilution.

Is TERP guaranteed to predict the exact post-issue stock price?

- No, TERP is a theoretical calculation and actual market conditions may vary. Factors such as market sentiment, investor perception, and broader economic conditions can influence actual stock price movements post-rights issue.

How can investors use TERP in their decision-making process?

- Investors can use TERP to assess the fairness of a rights issue and its potential impact on their investment. By comparing TERP with the current market price, investors can make informed decisions on whether to exercise their rights, sell them, or adjust their portfolio accordingly.

Are there limitations to using TERP?

- Yes, TERP assumes rational market behavior and perfect information. Actual market reactions to rights issues may vary due to factors that are difficult to predict, such as investor sentiment and market volatility.

What happens if I don’t participate in a rights issue?

- You can either sell your rights in the market or allow them to expire worthless if you choose not to participate in a rights issue. Your ownership stake in the company will be diluted as a result of the issuance of new shares to other shareholders who do participate.

What are the benefits of participating in a rights issue?

- Participating in a rights issue allows shareholders to maintain their proportional ownership in the company, potentially acquire additional shares at a discounted price, and support the company’s growth initiatives.

What are the risks associated with a rights issue?

- Risks associated with rights issues include dilution of ownership for existing shareholders who do not participate, potential undersubscription leading to insufficient capital raised, and negative market reactions that could impact the company’s stock price and investor sentiment.

Learn more about Right Issue of Shares,

- What is the Right Issue of Shares?

- Why companies conduct the Right Issue of Shares?

- What is the benefit for the shareholders to subscribe to the Rights Issue of Shares?

- Why should a shareholder be careful about subscribing to a right issue?

- Benefit for the company to conduct the Right Issue of Shares?

- Rights Issue Example

- What Happens to the Share Price after the Right Issue?

- Advantages of Right Issue of Shares

- Disadvantages of Right Issue of Shares