Understanding Corporate Governance

Corporate governance is the system of rules, practices, and processes by which an organization is directed and controlled. Corporate governance essentially involves balancing the interests of a company’s many stakeholders, such as shareholders, executive management, customers, suppliers, regulators, government, and the public.

- What is Corporate Governance

- Importance of Corporate Governance

- General Best Practices of Corporate Governance

- Approaches/Forms to ensure Corporate Governance

- Does Corporate Governance is a General Practice Across all Countries?

What is Corporate Governance?

Corporate Governance is the system by which organizations are directed and controlled. Corporate governance ensures that the board of directors makes decisions to fulfill the long-term objective of the shareholders, rather than focusing on short-term objectives to meet the given targets. This is monitored and controlled in a way that the board of directors and other senior executives make decisions according to the best interest of the entire organization.

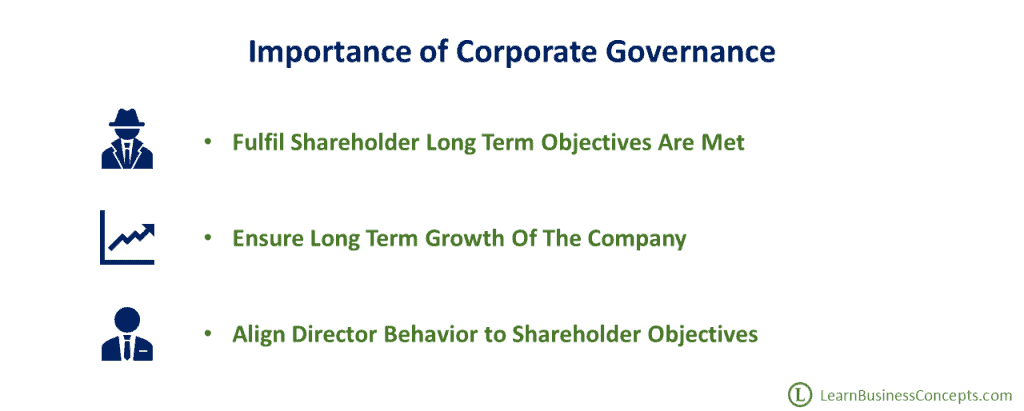

What is the Importance of Corporate Governance?

Corporate Governance is important because of the separation between the ownership and control of the companies. Shareholders own the company and they have their objective to maximize the profit of their investment while ensuring the sustainable long run of the company. Shareholders expect the directors to ensure their objectives to be met. But directors have their own objectives that contradict the objectives of shareholders.

As an example: Shareholders demand to maximize the profit. Directors gain bonuses based on the profit generated. Directors can indeed execute various methods to maximize the short-term profit of the company while having a negative long-term impact. Such examples are: cutting the cost of employee training, cutting research and development costs, onboarding low qualified low salaried staff, etc. These kinds of decisions will affect the long run of the organization.

Corporate Governance help in such a way that directors behave to ensure shareholder objectives are met. Corporate Governance focuses on the big picture like the structure of the board, roles of the directors, sub-committees of the board, remuneration of the directors, and internal controls.

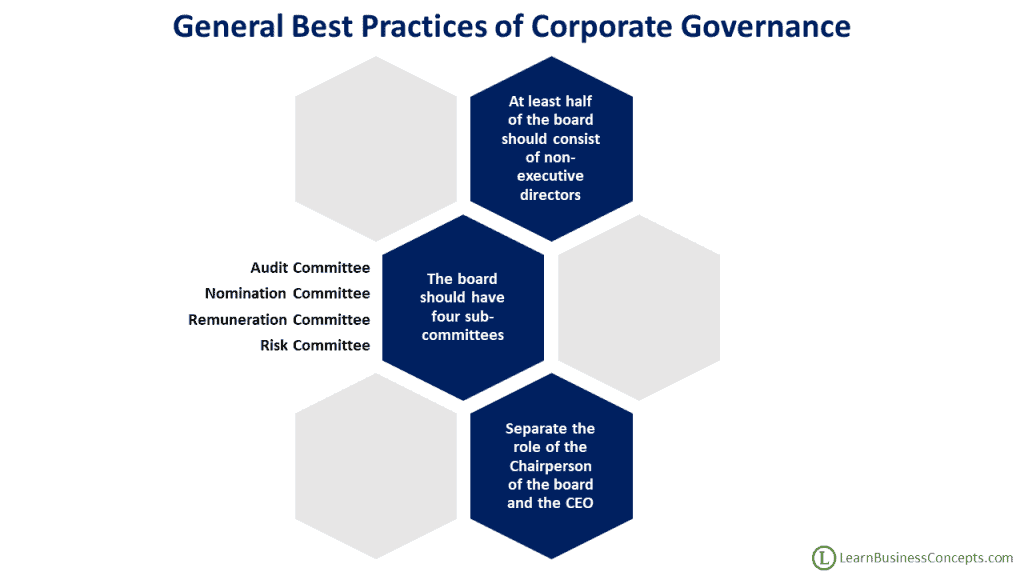

What are the General Best Practices of Corporate Governance?

Corporate governance practices are country-specific. But we can identify some general best practices of corporate governance which may applicable generally,

1. At least half of the board should consist of non-executive directors

Non-executive directors do not have any operational responsibility for the company. They are usually part-timers, remunerated with a salary, and very experienced professionals. They are there to represent the needs of the shareholders.

By having NEDs more than 50% of the board, it ensures that executive directors cannot dominate the decisions made by the board. This ensures the decisions will be made by looking at the business as a whole rather than focusing on a single department only.

2. Separate the role of the Chairperson of the board and the CEO

Chairperson is responsible to run the board. CEO is the manager of the executives in the business and responsible to run the business. These two should be separate roles and handled by two separate professionals.

This will ensure that lot of power is not given to one person which might be a concern on the decisions made by them.

3. The board should have Four Sub-Committees

i) Audit Committee

The primary objective of an audit committee is to provide overlooking of the financial reporting process, the audit process, the company’s practice of internal controls, the performance of the internal audit function, independence of the external auditors, and compliance with relevant laws and regulations.

The Audit Committee is made up of typically three non-executive directors which at least one should have recent financial experience.

Detailed Overview and Responsibilities of Audit Committee

ii) Nomination Committee

Nomination committee members typically work to evaluate the characteristics and performance of board members and are responsible for selecting the best candidates for each seat on the board.

The nomination committee is responsible to conduct recruitment for the board, annual board evaluations, link corporate strategy to board recruitment, and introducing/training of the new directors. This committee ensures the structure of the board, what are the number of total directors required in the board, do we need to promote people internally or consider from outside, and the diversity of the board.

Detailed Overview and Responsibilities of Nomination Committee

iii) Remuneration Committee

The remuneration committee ensures how directors are paid. They will look at the proportionate of fixed pay and also the performance-related pay. This needs to be sufficient to motivate directors but not cause them to take a high level of risks that compromise the long-term objectives of the company. It should be structured in such as way that directors are motivated to consider the long-term objectives of the shareholders. This will set the pay scale of the executive directors in the business.

List of Responsibilities of Remuneration Committee

iv) Risk Committee

The Risk Committee is responsible for overlook the risk management policies and practices of the organization’s global operations.

The risk committee overlooks the establishment of risk management governance, risk management procedures, and risk control infrastructure of the entire business operations. Also, the risk committee overlooks the processes of implementing and monitoring compliance with identifying and reporting risks, ensuring effective and timely implementation of actions to mitigate risks.

The risk committee also ensures the independence of the risk management function and integration of the risk management controls with corporate goals.

More Detailed Responsibilities of Risk Committee

What are the Approaches/Forms to ensure Corporate Governance in the Organization

There are two approaches or forms to ensure corporate governance in the organization

1) Rules-Based Approach

There will be legal requirements for companies to follow the rules laid down. Organizations to follow legislations such as USA Sarbanes-Oxley Act. There will be legal consequences if the board fails to follow the requirements mentioned in the Act. Practically it is difficult to set up rules that are suitable for every set of circumstances. Compliance or non-compliance Judgements are being made by the court by this method.

2) Principle-Based Approach

Best practices are laid out. Board can adhere to these best practices while having some room for flexibility in different circumstances.

This is a little bit more flexible approach compared with the rules-based approach. Compliance or non-compliance Judgements are being made by the owners of business in this method.

This is the usual approach which most organizations in the world are practicing.

As an example, in the United Kingdom (UK) company should agree to apply UK Code on Corporate Governance after the company is listed. Listed companies in the UK are required to state in their financial statements whether they fully comply with the code. If not, the company needs to mention the way in which they don’t and why. Investors will ultimately have the information they need to decide whether they are ok with the level of compliance of their company.

| Rules-Based Approach | Principle-Based Approach |

|---|---|

| Code of Corporate Governance is a set of legal requirements mentioned in the Act. | Code of Corporate Governance is a set of best practices that companies should follow. |

| Legal Requirement | Not a Legal Requirement |

| Practically it is difficult to set up rules that are suitable for every set of circumstances. | This is the usual approach which most organizations in the world are practicing. |

| Compliance or non-compliance Judgements are being made by the court. | Compliance or non-compliance Judgements are being made by the owners of the business (shareholders) |

| Non-compliance will result in heavy penalties in the form of fines. | Non-compliance will result in an explanation to the shareholders by the board. |

Does Corporate Governance is a General Practice Across all Countries?

Corporate governance is very on each country or jurisdiction specifically. But some codes expose the general best practices of corporate governance. As an example, ICGN and OECD codes which is quite a high-level sort of code that contains about rights of shareholders, obligations of directors, etc.