Diseconomies of Scale | Definition, Examples, Categories, Types

- What is Diseconomies of Scale?

- How does Diseconomies of Scale occur?

- Categories of Diseconomies of Scale

- Types of Internal Diseconomies of Scale

- Types of External Diseconomies of Scale

- Difference Between Economies of Scale and Diseconomies of Scale

- Real World Examples

- Factors Affecting Diseconomies of Scale

- Solutions for Diseconomies of Scale

- FAQs

What is Diseconomies of Scale?

Diseconomies of scale are which the company experiences an increase in average unit cost when the production output increases. The production process starts to become less efficient after a specific point in production output. The company will experience an increase in average per-unit cost when they start to produce an additional unit of output beyond a certain level.

The firm normally experiences the economies of scale first, where unit cost decreases when the level of output increases. There will be an optimum minimum average unit cost at a certain level of output. Company experience Diseconomies of Scale when they try to produce more than this optimum output quantity and company will experience an increase of the average per-unit cost.

Diseconomies of scale are which the marginal cost of production increases with the output, which results in a reduction of profitability. Opposite of economy of scale happens and costs increase with the production of each additional unit.

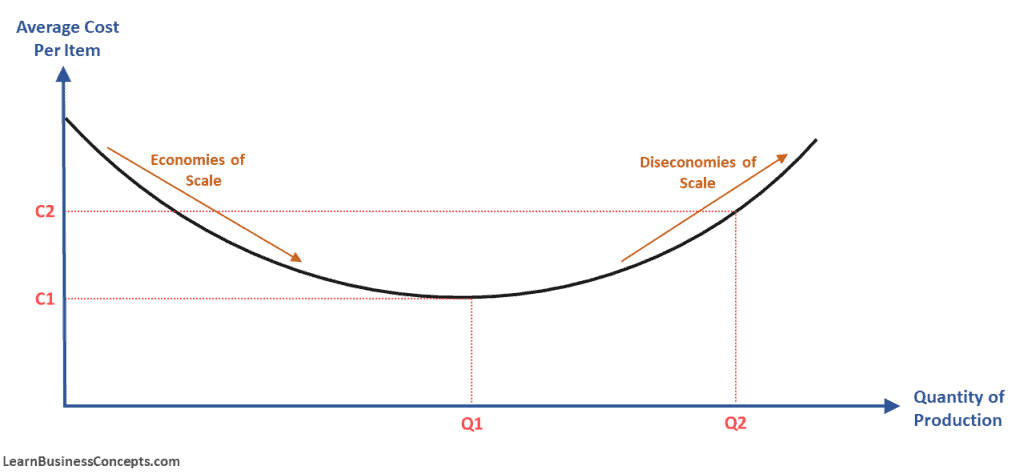

The diagram below illustrates both the economy of scale and the diseconomy of scale concepts. The company is producing at the point of lowest average unit cost in the Quantity Q1. The average cost per unit will be higher if the Production Quantity is less than or more than Q1.

When the production quantity is higher than Q1 then the average unit cost will increase with experiencing diseconomies of scale.

How does Diseconomies of Scale occur?

Diseconomies of scale occur when a company’s growth leads to increased per-unit costs, reversing the benefits typically gained from expanding production. As a firm becomes larger, it often encounters greater complexity in managing operations, which can slow down decision-making, create communication barriers, and introduce inefficiencies in coordination. Additionally, larger organizations may struggle with bureaucratic red tape and rigid procedures, reducing their flexibility and responsiveness. Resource management becomes more challenging, leading to higher costs for raw materials or services, while regulatory compliance and increased competition can drive up operational expenses. These factors combine to erode the cost advantages of scaling, resulting in higher average costs and diminished profitability despite the company’s larger size.

Diseconomies of scale can involve factors internal to an operation or external conditions beyond a firm’s control.

Following are some internal factors that the company can cause diseconomies of scale,

1) Less Effective Coordination

As a company grows in size, it becomes more difficult to conduct inter-department coordination. Even it could be difficult to coordinate effectively within the same department. This will result in a decrease in production efficiency.

2) Loss of Focus by the Management

Management may lose focus when the company grows. There can be an increase in the number of problems and situations which management should attend to. Efficiency in decision-making and problem-solving can be reduced due to the same.

3) Inefficiency of Communication

Efficient communication is a vital factor to properly execute any business. When the company expands, the communication layers will be increase horizontally and vertically. As the company hierarchy grows, the company tends to depend on written communication more. This will result in a decrease in communication efficiency.

4) Lack of Motivation

Employees will feel isolated and less motivated when the business grows and the number of employees increased. An increase of the layers in the corporate hierarchy will have less interaction between employees and senior management.

Senior management will not see the ground-level problems of the company. Also, proper accurate employee performance appraisals could be challenging with a large workforce.

5) Increase of Business Risk

Impact of the business risk increases when the company scales its operations more. Any management mistake could cause a huge loss since the company operates on an expanded scale.

6) Over Production

Over-production can happen frequently when the company has a large production. Production could be more than the actual demand which would lead to a fall in prices. The company may have to make decisions to offer a high discount to clear their production stock.

7) Difficulty to Manage Finance Capital

A large corporate will require high capital to operate. Also debt level and the shareholder expectation of the profits can be huge. Also, these companies require a high amount of capital for business expansion. It would be hard to manage these situations in an optimal way.

8) Difficulty to Manage Human Capital

When the company expands the employee workforce will also expand. This will result in monopoly and boredom. Also, there could be the establishment of trade unions also. It will be difficult for the management to control these challenges in a large corporate.

What are the Categories of Diseconomies of Scale?

Diseconomies of Scale can be categorized as internal or external.

1) Internal Diseconomies of Scale

Internal diseconomies of scale occur when a company’s growth leads to inefficiencies within its own operations, resulting in higher average costs per unit of output. As a business expands, the benefits of increased production and efficiency often begin to taper off. One primary cause is the complexity that accompanies growth. Larger organizations require more elaborate management structures, which can slow down decision-making and create communication barriers between departments. This can lead to misalignment of goals, duplication of efforts, and slower responses to market changes, all of which contribute to increased operational costs.

Another factor driving internal diseconomies of scale is the challenge of maintaining employee productivity and motivation. In a small company, employees often feel closely connected to the company’s mission and are more engaged in their work. However, as the company grows, individual contributions may feel less impactful, leading to lower morale and productivity. Additionally, larger firms often face difficulties in maintaining a cohesive corporate culture, which can result in internal conflicts and reduced efficiency. These inefficiencies, combined with the challenges of managing more complex supply chains, larger inventories, and greater regulatory requirements, can erode the cost advantages that initially came with scaling up, ultimately leading to higher costs and reduced profitability.

2) External Diseconomies of Scale

External diseconomies of scale occur when a company’s growth leads to increased costs due to factors outside its control, typically arising from broader market or environmental conditions. As firms expand, they may encounter limitations or pressures from external factors such as increased competition, rising input costs, or regulatory changes. For instance, a larger company might face higher prices for raw materials as suppliers raise costs due to increased demand from multiple businesses. Additionally, expanding operations can strain local infrastructure, such as transportation and utilities, leading to higher costs and inefficiencies. These external pressures can diminish the cost advantages that typically come with scaling up.

Another example of external diseconomies of scale is the increased regulatory scrutiny that often accompanies business expansion. As companies grow, they might face more stringent regulations and compliance requirements, which can add to operational costs. Additionally, a larger presence in the market can attract more competition, potentially leading to a decrease in market share and increased marketing and promotional expenses to maintain a competitive edge. These external factors can undermine the benefits of scaling, resulting in higher costs and reduced profitability despite the company’s increased size.

What are the Types of Internal Diseconomies of Scale?

Below are the types of internal diseconomies of scale,

1) Technical Diseconomies of Scale

Technical diseconomies of scale occur when a company’s production becomes inefficient as it grows too large, leading to increased costs per unit. Initially, scaling up can reduce costs through advanced machinery and technology, but beyond a certain point, managing and maintaining these larger systems becomes challenging and costly. As production expands, complexities in operations, logistics, and workforce management can lead to inefficiencies, ultimately increasing costs and diminishing the benefits of further growth.

As an example, an existing production plant may be highly efficient, which promotes management’s decision to invest in a new production plant. After the investment, the new production plant may not be efficient as the first.

Technical diseconomies of scale are more related to physical capacity in the production cycle.

2) Organizational Diseconomies of Scale

Organizational diseconomies of scale occur when a company’s expansion leads to inefficiencies in management and operations, resulting in higher costs. As the company grows, its structure becomes more complex, with additional layers of management and more departments. This complexity can slow decision-making, reduce communication efficiency, and create bureaucratic delays, making it harder to coordinate activities effectively. Additionally, maintaining a cohesive corporate culture and keeping employees motivated becomes increasingly difficult in a larger organization, leading to internal conflicts and reduced flexibility. These factors contribute to higher operational costs and diminish the advantages of further growth.

There could be many inefficiencies such as

- De-motivation

- The rigid quick decision-making process

- Lack of accountability

- Communication Barriers

- Increase of Communication Layers

3) Purchasing Diseconomies of Scale

Purchasing diseconomies of scale occur when a company’s growth leads to higher costs in procurement, contrary to the expected benefits of bulk buying. As firms expand and increase their purchasing volume, they may face rising costs due to factors like over-dependence on specific suppliers, which can reduce bargaining power. Additionally, larger companies might need to source from more expensive suppliers to meet increased demand, or they may incur higher costs related to inventory management and storage. These challenges can erode the cost advantages typically associated with bulk purchasing, leading to higher overall procurement costs as the company scales up.

Following are some examples of Purchasing Disexonomies,

- Supplier Overreliance: As a company grows, it may become overly dependent on a few key suppliers, reducing its ability to negotiate better prices, leading to higher procurement costs.

- Quality Compromises: In scaling up, a company might have to source from multiple suppliers to meet demand, which can lead to inconsistent quality, resulting in higher costs for quality control and potential rework.

- Inventory Management Costs: Larger orders often require more extensive storage facilities and complex inventory management systems, increasing warehousing and handling costs.

- Supplier Price Increases: As demand from a large company grows, suppliers may raise prices due to the increased strain on their resources, leading to higher purchasing costs.

- Reduced Supplier Flexibility: Larger companies might face rigid terms from suppliers, such as longer lead times or minimum order quantities, reducing their ability to adapt quickly to market changes and increasing holding costs.

- Logistical Complexities: As procurement scales, the logistics of transporting larger volumes of goods become more complex and costly, especially if global suppliers are involved, leading to higher transportation and distribution expenses.

4) Competitive Diseconomies of Scale

Competitive diseconomies of scale occur when a company’s growth reduces its ability to compete effectively in the market, leading to higher costs and diminished performance. As a company expands, it may become less agile, slowing its ability to innovate or respond quickly to market changes and customer needs. This lack of flexibility can be exploited by smaller, more nimble competitors who can adapt more rapidly. Additionally, a larger company may face increased scrutiny from regulators and attract more competition, both of which can drive up operational costs. As a result, the company’s competitive edge weakens, leading to reduced market share and profitability despite its size.

5) Financial Diseconomies of Scale

Financial diseconomies of scale occur when a company’s growth leads to increased financial costs that outweigh the benefits of expansion. As a company becomes larger, it may face higher costs related to financing, such as increased interest rates due to perceived higher risks associated with managing a more complex and diversified operation. Additionally, larger firms often encounter greater difficulties in efficiently allocating capital across various projects or divisions, which can lead to inefficiencies and under performance. The complexities of managing a vast financial portfolio can also increase administrative costs and reduce the overall financial flexibility of the company, ultimately leading to higher expenses and reduced profitability.

What are the Types of External Diseconomies of Scale?

1. Increased Input Costs

As companies grow, they may drive up the demand for raw materials or components, leading suppliers to increase prices. Larger firms often face higher costs for inputs as suppliers leverage their pricing power due to the increased demand from multiple large customers. This situation can erode the cost advantages of scaling up, as the cost of acquiring essential resources rises, impacting the overall profitability and operational efficiency of the business.

2. Strain on Local Infrastructure

Expansion often places additional demands on local infrastructure, such as transportation networks, utilities, and public services. For instance, a larger company might contribute to congestion on local roads, leading to increased transportation and logistics costs. Similarly, the higher demand for utilities like electricity and water can result in higher costs or necessitate investment in expanded infrastructure, which can further strain the company’s resources and reduce the benefits of scaling.

3. Regulatory Compliance Costs

As companies grow, they are subject to more stringent regulations and compliance requirements from government agencies. Larger firms may face increased scrutiny and need to adhere to additional regulations, such as environmental standards or labor laws. These regulatory demands can lead to higher administrative costs, increased legal fees, and potential fines for non-compliance, which can outweigh the cost advantages gained from business expansion.

4. Market Saturation

Expanding a business can lead to market saturation, where the increased supply of products or services exceeds the demand. In such cases, a larger company might experience a drop in prices or find it challenging to maintain its market share. This saturation can intensify competition, forcing the company to invest more in marketing and promotional activities to sustain its position, which can increase operational costs and reduce overall profitability.

5. Increased Competition

As a company grows and gains a larger market presence, it often attracts more competitors. Larger firms may face increased competition from both existing and new market entrants who seek to capitalize on the growing market. This heightened competition can drive up costs associated with acquiring and retaining customers, such as through increased advertising and promotional expenses, ultimately diminishing the cost benefits of scaling up.

6. Environmental and Social Impact Costs

Growing companies can have significant environmental and social impacts that attract scrutiny and require mitigation efforts. As a business expands, it may face increased costs related to environmental regulations, waste management, and community relations. Addressing these externalities, such as implementing sustainable practices or managing the social impact of large-scale operations, can add to operational expenses and reduce the overall cost efficiency of scaling.

Difference Between Economies of Scale and Diseconomies of Scale

Economies of scale are cost reductions experienced by companies when they increase their level of output. Simply the cost per unit of an individual item decreases when increasing the scale of production. This concept is related to operational efficiencies and synergies as a result of an increase in the level of production. The simple meaning is that companies tend to do things more efficiently with increasing size.

When a company’s production output increases, there is an increase in the average unit cost, which is known as diseconomies of scale. The production process starts to become less efficient after a certain point in production output. The company will experience an increase in average per-unit cost when they start to produce an additional unit of output beyond a certain level.

Real World Examples of Diseconomies of Scale

1. Walmart’s Supply Chain Issues

Walmart, known for its vast supply chain network, has faced challenges as it has grown. The complexity of managing a massive inventory and coordinating with numerous suppliers has occasionally led to inefficiencies, such as stockouts or overstock situations. The company’s size can also result in logistical issues and higher costs associated with maintaining and operating its extensive distribution centers.

Read More: A Case Study of Walmart’s Green Supply Chain Management – Linkedin Article

2. General Electric’s Overexpansion

General Electric (GE) experienced diseconomies of scale in the early 2000s as it expanded into a wide range of industries beyond its core competencies. The complexity of managing diverse business units led to inefficiencies and operational challenges. Eventually, GE had to restructure and divest many of its non-core businesses to refocus and improve efficiency.

3. British Airways’ Operational Challenges

British Airways faced diseconomies of scale when it expanded rapidly through mergers and acquisitions. The integration of different airline systems and processes created operational challenges, including increased costs for training, maintenance, and coordination across a larger network. The complexities of managing a more extensive operation led to inefficiencies and higher per-unit costs.

4. Amazon’s Warehouse Costs

Amazon’s rapid growth has led to significant investments in its fulfillment centers. As the company expanded its warehouse network, it encountered higher costs related to maintaining large facilities, managing a growing workforce, and handling logistical challenges. The complexity of running these massive warehouses has occasionally led to increased operational costs.

5. Enron’s Financial Issues

Enron’s aggressive expansion into various markets and complex financial instruments contributed to its downfall. The company’s growth led to increased complexity in financial reporting and risk management. The lack of transparency and inefficiencies in handling its vast operations and financial strategies played a role in its infamous collapse.

6. Uber’s Regulatory and Legal Costs

As Uber expanded into new cities and countries, it faced significant regulatory and legal challenges. The complexities of navigating different legal environments and compliance requirements led to increased costs. Uber’s rapid growth and the subsequent legal battles over regulations and driver classifications contributed to higher operational expenses and financial strain.

Why Dis-economies of Scale Occurs? (Factors Affecting Diseconomies of Scale)

Diseconomies of scale occur when the growth of a company leads to increased per-unit costs, reversing the benefits typically associated with scaling up. This phenomenon arises due to several key factors:

1. Increased Complexity

As a company grows, its operations become more complex, requiring more elaborate management structures and coordination among departments. This added complexity can result in slower decision-making, communication breakdowns, and operational inefficiencies, which increase costs.

2. Bureaucratic Inefficiencies

Larger organizations often develop more layers of bureaucracy and formal procedures, which can reduce flexibility and responsiveness. The increased administrative burden can slow down processes and lead to higher operational costs.

3. Resource Management Challenges

Managing a larger scale of operations can strain resource allocation. For instance, larger firms might face difficulties in efficiently managing inventory, maintaining quality, or sourcing materials, leading to increased costs.

4. Employee Motivation and Productivity

As a company expands, it may struggle to maintain employee motivation and a cohesive corporate culture. Larger firms might experience lower employee morale and reduced productivity, which can contribute to higher costs per unit.

5. Regulatory and Compliance Costs

Growing companies often face more stringent regulatory requirements and compliance costs. The complexity and costs associated with adhering to a broader range of regulations can increase operational expenses.

6. Market Saturation

Expansion can lead to market saturation, where the supply of products or services exceeds demand. This can force the company to invest more in marketing and promotional activities to maintain market share, driving up costs.

7. Increased Competition

A larger market presence can attract more competitors, leading to higher costs related to maintaining competitive advantages, such as through increased advertising and pricing strategies.

Solutions for Diseconomies of Scale

To address diseconomies of scale, companies can implement several strategies to manage and mitigate inefficiencies. Firstly, decentralizing management and delegating decision-making to smaller, more agile teams can help reduce bureaucratic delays and improve responsiveness. Implementing advanced technology and automation can streamline operations, enhance coordination, and lower operational costs.

Additionally, companies should focus on maintaining employee engagement and a strong corporate culture to boost productivity and morale. Effective resource management is crucial, so investing in better inventory systems and optimizing supply chains can help control costs. Moreover, companies can prioritize regulatory compliance by establishing robust legal and administrative frameworks to handle increased scrutiny. Regularly reviewing and adjusting business strategies to avoid market saturation and manage competitive pressures can also help sustain operational efficiency as the company scales. By addressing these key areas, businesses can better manage the challenges of growth and reduce the impact of diseconomies of scale.

FAQs of Diseconomies of Scale

Q1. What are diseconomies of scale?

Diseconomies of scale occur when a company’s growth leads to an increase in the average cost per unit of production. This typically happens when the company becomes too large, leading to inefficiencies and higher operational costs.

Q2. What causes diseconomies of scale?

Diseconomies of scale are caused by factors such as increased operational complexity, bureaucratic inefficiencies, challenges in resource management, reduced employee motivation, higher regulatory and compliance costs, market saturation, and increased competition.

Q3. How can a company identify diseconomies of scale?

A company can identify diseconomies of scale by monitoring key performance indicators such as rising production costs, declining profit margins, increased operational inefficiencies, and slower decision-making processes. Regular financial and operational reviews can help pinpoint areas where scaling is causing increased costs.

Q4. What are some common examples of diseconomies of scale?

Common examples include large retailers facing supply chain and inventory management issues, multinational corporations dealing with complex regulatory compliance, and companies experiencing reduced employee productivity and morale due to organizational size.

Q5. How can a company mitigate diseconomies of scale?

To mitigate diseconomies of scale, companies can decentralize decision-making, invest in technology and automation, improve resource management, maintain employee engagement and a positive corporate culture, and streamline regulatory compliance processes. Regularly reviewing and adjusting business strategies can also help manage growth challenges.

Q6. Is it possible for a company to recover from diseconomies of scale?

Yes, a company can recover from diseconomies of scale by implementing strategies to address inefficiencies, such as restructuring operations, improving management practices, and optimizing resource allocation. Strategic adjustments and continuous improvement efforts can help a company regain operational efficiency and profitability.

Q7. How do diseconomies of scale differ from economies of scale?

Economies of scale occur when increasing production leads to lower average costs per unit due to factors such as bulk purchasing and more efficient use of resources. In contrast, diseconomies of scale occur when further growth leads to higher average costs due to increased complexity and inefficiencies.

Q8. At what point do diseconomies of scale typically occur?

Diseconomies of scale typically occur when a company grows beyond an optimal size, where the benefits of scaling up are outweighed by the increased complexity and inefficiencies associated with larger operations. The specific point varies depending on the industry, company structure, and management practices.

Learn More: