Differences Between Semi-Monthly and Bi-Weekly Payroll

The distinction between semimonthly and biweekly pay schedules holds significant implications for both employers and employees alike. A detail examination reveals distinct differences in their frequency, timing, and impact on financial planning in these two payroll schedule. It is crucial fir the business professionals to understand these disparities for businesses to navigate effectively through the complexities of payroll administration. This article digs into the differences between semimonthly and biweekly payroll systems, shedding light on their respective advantages, drawbacks, and considerations for implementation.

Semimonthly and biweekly payroll systems differ primarily in their frequency and timing of pay periods. Semimonthly pay occurs twice a month, typically on specific dates such as the 15th and the last day of the month, resulting in 24 pay periods per year. In contrast, biweekly pay happens every two weeks, resulting in 26 pay periods per year.

While semimonthly pay offers consistency in pay dates but may lead to variable pay periods’ lengths, biweekly pay ensures a fixed number of work hours per pay period but may result in paydays falling on different weekdays each period. The choice between the two systems depends on factors such as budgeting preferences, cash flow management, and employee expectations.

Table of Contents:

- Differences Between Semimonthly Payroll and Biweekly Payroll

- Definition of Semimonthly Payroll

- Definition of Biweekly Payroll

- Factors to Consider when Choosing the Best Payroll Schedule for the Company

- Best Payroll Schedule for Employers out of Semi-Monthly and Bi-Weekly

- What Payroll Schedule does Employees Prefer Mostly

- What is the Most Popular Payroll Schedule in the US?

- Pros and Cons of Semi-Monthly Payroll

- Pros and Cons of Bi-Weekly Payroll

- Is there Any Pay Frequency/Length Requirements in the US?

Differences Between Semimonthly Payroll and Biweekly Payroll

Differences between Semimonthly Payroll and Biweekly Payroll are explained below table,

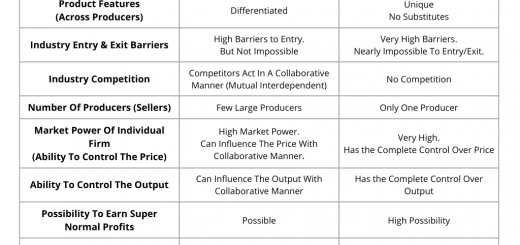

| Semimonthly Payroll | Biweekly Payroll |

|---|---|

| Semi-monthly payroll pays the employees twice a month. | Biweekly payroll payment happens every other week on an agreed day. |

| The pay period of semimonthly payroll is 24 times per year (12 months per year X 2 paydays per month = 24 paydays). | Biweekly pay contains 26 pay periods per year (Every calendar year has 52 weeks, hence 52/2 = 26). |

| If the employee’s annual salary is $96,000, the employee will get $3,250 ($78,000 / 24) on each payday. | If the employee’s annual salary of $96,000, the employee will get $3,000 ($78,000 / 26) on each payday. |

| Semimonthly payroll payment happens on the 15th and last day of the month. | In a Biweekly payroll, the most common payday is Friday (or else the employer can choose a specific day). |

| According to the U.S. Bureau of Labor Statistics, the Semimonthly payroll is the 3rd most popular payroll in the USA with an estimated 19% of U.S. private establishments paying their employees. | According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most popular in the USA with an estimated 43% of U.S. private establishments paying their employees. |

| Employees can manage their monthly expenses a bit easier on semi-monthly payroll because there are two payments received per month on the designated paydays. | Employees can very easily budget with biweekly payroll because the paydays are more consistent which are paid on a specific day every other week. |

| Semimonthly payroll is a bit difficult to administrate an employee time entry verification perspective because it is not with a set duration. The pay period can start/end within any day of a week. | Biweekly payroll is easier to administrate and process. Employee time entry verification is easy because it is with a set duration of two weeks. The company does the payroll processing every two weeks instead of one, which makes this more efficient. |

Differences between Semimonthly Payroll and Biweekly Payroll are explained in the below points,

1. Semi-monthly payroll pays the employees twice a month.

But in Biweekly payroll payment happens every other week on an agreed day.

2. The pay period of semimonthly payroll is 24 times per year (12 months per year X 2 paydays per month = 24 paydays).

But Biweekly pay contains 26 pay periods per year (Every calendar year has 52 weeks, hence 52/2 = 26).

3. In a semimonthly payroll, if the employee’s annual salary is $96,000, the employee will get $3,250 ($78,000 / 24) on each payday.

In a biweekly payroll, if the employee’s annual salary of $96,000, the employee will get $3,000 ($78,000 / 26) on each payday.

4. Semimonthly payroll payment happens on the 15th and last day of the month.

But in Biweekly payroll, the most common payday is Friday (or else the employer can choose a specific day).

5. According to the U.S. Bureau of Labor Statistics, the Semimonthly payroll is the 3rd most popular payroll in the USA with an estimated 19% of U.S. private establishments paying their employees.

According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most popular in the USA with an estimated 43% of U.S. private establishments paying their employees.

6. Employees can manage their monthly expenses a bit easier on semi-monthly payroll because there are two payments received per month on the designated paydays.

But employees can very easily budget with biweekly payroll because the paydays are more consistent which are paid on a specific day every other week.

7. Semimonthly payroll is a bit difficult to administrate an employee time entry verification perspective because it is not with a set duration. The pay period can start/end within any day of a week.

Biweekly payroll is easier to administrate and process. Employee time entry verification is easy because it is with a set duration of two weeks. The company does the payroll processing every two weeks instead of one, which makes this more efficient.

Definition of Semimonthly Payroll

Semi-monthly payroll is when a business pays the employees twice a month. Usually, the semimonthly payroll payment happens on the 15th and last day of the month. The payment generally happens out on the proceeding Friday if these dates fall on a weekend.

Please refer to the below article to understand more about Semimonthly Payroll,

Definition of Biweekly Payroll

Biweekly payroll is when employees receive their pay every other week on an agreed day. There are 26 payments applicable for bi-weekly payroll, usually twice a month.

Please refer to the below article to understand more about Biweekly Payroll,

Factors to Consider when Choosing the Best Payroll Schedule for the Company

Several factors should be carefully considered when selecting the optimal payroll schedule for a company, as mentioned below,

- Frequency of Payments: Assess the company’s cash flow and budgeting requirements. Semimonthly pay schedules may offer more predictable cash flow, while biweekly schedules might provide more frequent payments for employees.

- Administrative Efficiency: Evaluate the administrative burden associated with processing payroll. Biweekly schedules typically involve fewer pay runs per year, potentially reducing administrative overhead compared to semimonthly schedules.

- Employee Preferences: Consider employee preferences and financial obligations. Some employees may prefer the consistency of semimonthly paychecks, while others may appreciate the more frequent payments offered by biweekly schedules.

- Compliance Requirements: Ensure compliance with labor laws and regulations governing payroll schedules in your jurisdiction. Different regions may have specific requirements regarding pay frequency and timing.

- Impact on Budgeting: Evaluate how the chosen payroll schedule will impact both company budgeting processes and employees’ personal financial planning. Consistent pay dates can facilitate better financial planning for both parties.

- Workforce Dynamics: Consider the nature of the workforce and any potential impacts on morale or productivity. For example, employees with irregular work hours may benefit more from a biweekly schedule that provides a consistent number of work hours per pay period.

- Employee Communication and Education: Communicate openly with employees about the chosen payroll schedule and provide resources to help them understand how it works and how it may impact their finances.

- Technology and Payroll Systems: Ensure that the company’s payroll systems and technology infrastructure can support the chosen schedule effectively, including handling any complexities such as overtime calculations or variable pay rates.

Best Payroll Schedule for Employers out of Semi-Monthly and Bi-Weekly

The “best” payroll schedule for employers depends on various factors such as company size, cash flow, administrative efficiency, and employee preferences. Both semi-monthly and bi-weekly payroll schedules have their own benefits and drawbacks.

- Semi-Monthly Payroll:

- Employees are paid twice a month, typically on the 15th and last day of the month or on two fixed dates each month.

- This schedule is straightforward and predictable for both employers and employees.

- It aligns well with monthly budgeting cycles and can simplify accounting processes.

- However, some months may have more working days than others, potentially resulting in discrepancies in the pay periods.

- Bi-Weekly Payroll:

- Employees are paid every two weeks, usually on the same day of the week, such as every other Friday.

- This schedule results in 26 pay periods per year, meaning employees receive 26 paychecks instead of 24 with a semi-monthly schedule.

- Bi-weekly pay can help with budgeting for employees who have regular expenses.

- It can be slightly more complex administratively, especially during months with an extra pay period, which can occur once or twice a year depending on the specific calendar year.

What Payroll Schedule does Employees Prefer Mostly

Employees’ preferences regarding payroll schedules can vary significantly based on their individual financial situations, lifestyle preferences, and personal circumstances. However, bi-weekly, weekly, and semi-monthly payroll schedules offers distinct advantages that may appeal to different employees:

- Bi-weekly Pay: Bi-weekly pay cycles occur every two weeks, resulting in 26 pay periods per year. Many employees appreciate bi-weekly pay because it provides a consistent and predictable schedule for receiving income. With bi-weekly pay, employees often find it easier to budget for recurring expenses such as rent, groceries, and utilities, as they can rely on receiving a paycheck every two weeks. For example, if an employee is paid bi-weekly on Fridays, they know to expect a paycheck every other Friday, which can help them plan their finances accordingly.

- Weekly Pay: Weekly pay cycles involve receiving pay once a week, resulting in 52 pay periods per year. Some employees prefer weekly pay because it provides them with more frequent access to their earnings, allowing for better cash flow management. Weekly pay can be particularly beneficial for employees who have high-frequency expenses or irregular income streams, such as hourly workers or gig economy workers. For example, if an employee is paid weekly on Fridays, they receive a paycheck every Friday, which can help them cover expenses more easily and stay on top of their finances.

- Semi-monthly Pay: Semi-monthly pay cycles occur twice a month, typically on specific dates such as the 15th and the last day of the month, resulting in 24 pay periods per year. Some employees prefer semi-monthly pay because it provides them with a consistent schedule for receiving income while also aligning with monthly billing cycles for expenses such as rent or mortgage payments. For example, if an employee is paid semi-monthly on the 15th and the last day of each month, they know exactly when to expect their paychecks, which can help them budget and plan their finances accordingly.

Employee preferred payroll schedule will depend on factors such as their financial obligations, budgeting habits, and personal preferences. Employers should consider the needs of their workforce and strive to offer a payroll schedule that aligns with the diverse needs and preferences of their employees, promoting financial stability and satisfaction.

What is the Most Popular Payroll Schedule in the US?

According to the U.S. Bureau of Labor Statistics, The bi-weekly payroll is the most popular payroll in the USA with an estimated 43% of U.S. private establishments paying their employees. Semi-monthly payroll is the 3rd popular payroll with 19.8% of U.S. private establishments paying their employees.

Pros and Cons of Semi-Monthly Payroll

Semimonthly payroll, where employees are paid twice a month (typically on the 15th and the last day of the month), offers both advantages and disadvantages for both employers and employees:

Pros:

- Consistency: Semimonthly pay schedules provide employees with a predictable and regular income, which can simplify budgeting and financial planning. Knowing exactly when to expect paychecks can help employees manage their expenses more effectively.

- Alignment with Monthly Expenses: Semimonthly pay cycles often align well with monthly expenses such as rent or mortgage payments, utility bills, and loan payments. This can make it easier for employees to budget and ensure that they have sufficient funds to cover their obligations.

- Reduced Administrative Burden: For employers, semimonthly payroll may result in fewer pay runs per year compared to weekly or bi-weekly schedules, reducing administrative overhead associated with processing payroll.

Cons:

- Irregular Pay Period Lengths: Pay periods may vary in length, leading to inconsistencies in the number of workdays included in each pay period. This can complicate calculations for overtime, especially for non-exempt employees who are paid hourly.

- Cash Flow Management: Semimonthly pay cycles may present challenges for employees who rely on a consistent cash flow to cover expenses. There may be longer gaps between paychecks compared to weekly or bi-weekly schedules, potentially causing financial strain for some employees.

- Potential for Budgeting Challenges: While semimonthly pay cycles can align well with monthly expenses, they may pose challenges for employees who budget on a weekly basis. Some employees may find it more difficult to manage their finances effectively with less frequent pay periods.

- Less Frequent Paydays: Compared to weekly or bi-weekly pay schedules, semimonthly payroll results in fewer paydays per year. This can affect employees’ perception of their overall compensation and may impact their ability to meet short-term financial goals or obligations.

Pros and Cons of Bi-Weekly Payroll

Employees are paid every two weeks in the bi-weekly payroll. This offers several advantages and disadvantages for both employers and employees:

Benefits:

- Consistent Schedule: Bi-weekly pay cycles provide employees with a regular and predictable schedule for receiving income. Employees can rely on receiving a paycheck every other week, which can simplify budgeting and financial planning.

- Ease of Administration: Bi-weekly payroll may be easier for employers to administer compared to weekly pay schedules, as it typically involves fewer pay runs per year. This can reduce administrative overhead associated with processing payroll, such as calculating hours worked and preparing paychecks.

- Alignment with Workweeks: Bi-weekly pay cycles often align well with standard workweeks, making it easier to calculate overtime and ensure compliance with labor laws. This can streamline payroll processing and reduce the risk of errors in wage calculations.

- More Frequent Paydays: Compared to semi-monthly or monthly pay schedules, bi-weekly payroll results in more frequent paydays throughout the year. This can provide employees with a steady stream of income and may help alleviate financial strain between pay periods.

Drawbacks:

- Variable Pay Period Lengths: One drawback of bi-weekly payroll is that pay periods may vary in length, resulting in inconsistencies in the number of workdays included in each pay period. This can complicate calculations for hourly employees, especially when determining overtime.

- Cash Flow Challenges: Bi-weekly pay cycles may present challenges for employees who rely on a consistent cash flow to cover expenses. There may be longer gaps between paychecks compared to weekly pay schedules, which can lead to financial strain for some employees.

- Budgeting Complexity: While bi-weekly pay cycles offer more frequent paydays, they may require employees to budget over longer periods compared to weekly schedules. Some employees may find it more challenging to manage their finances effectively with less frequent pay periods.

- Potential for Overtime Calculations: Calculating overtime for bi-weekly pay cycles can be more complex than for weekly schedules, as it may involve different combinations of regular and overtime hours within each pay period. This can increase the risk of errors in wage calculations and require careful monitoring to ensure compliance with labor laws.

Is there Any Pay Frequency/Length Requirements in the US?

According to CPA Practice Advisor, there are no pay frequency requirements at the American federal level. But some U.S. states have specific pay frequency requirements as following examples,

In New Hampshire, employers must pay employees wages on a weekly or bi-weekly schedule. Semi-monthly and monthly pay frequencies must be approved by the New Hampshire Department of Labor (NHDOL).

In California and Michigan, the frequency of pay depends on the occupation. In California, wages must be paid at least twice during each calendar month on the days designated as paydays (with some exceptions).

Read More:

- Bi-Weekly Payroll

- Bi-Monthly Payroll

- Semi-Monthly Payroll

- Differences of Payroll Methods