Advantages and Disadvantages of Semi-Monthly Payroll

The semi-monthly method refers to the payroll payments that work as paying employees twice a month. The payment usually happens on the middle day of the month (15th) and the last day of the month. Employees’ annual salaries are split into 24 pay periods and it pays in 24 equal payments throughout the year in a semi-monthly payroll method.

Table of Content:

- Advantages of Semi-Monthly Payroll

- Disadvantages of Semi-Monthly Payroll

- Definition of Semi-Monthly Payroll

- Pay Period & Pay Days of Semi-Monthly Payroll

- Example of Semi-Monthly Payroll Calculation

- Other Types of Payroll Schedules (Methods) Available

- Semi-Monthly Payroll vs Bi-Weekly Payroll vs Bi-Monthly Payroll

- How to Choose the Best Payroll Schedule for My Company?

- Which Industries Mostly Uses the Semi-Monthly Payroll Schedule

- FAQs

The following are the Advantages and Disadvantages of the Semimonthly Payroll.

Advantages (Pros / Positives / Benefits) of Semi-Monthly Payroll

1. Company can manage the payroll cash flow well

The company is paying the employees 2 times a month. It is quite easy for the company to manage the receivables accordingly and link those with the employee payments. As an example, if an employee receives $4,000 as a monthly payment, in semi-monthly payment he/she will receive two paychecks per month for each $2.000.

2. Removes the odd day and leap year days

The bi-weekly payroll method has issues with odd days and leaps year days. But the semi-monthly payroll does not have odd days since the payment happens on the middle business day of a month and the last business day of a month, despite whether it is an odd or even day. Also, it eliminates the leap year days issue since both payments happen within the calendar month.

3. Easier to calculate accruals

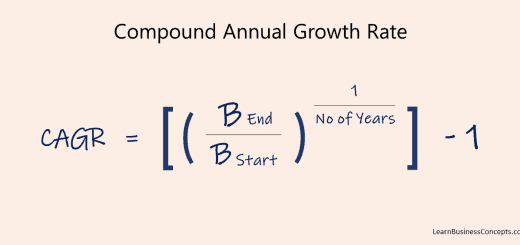

Semi-monthly payroll accruals are uncomplicated to proceed with. The company payroll department has to divide the agreed annual net payment by 24 and the amount is the net payment of each payroll.

4. Semi-monthly payroll method can be combined with other payroll methods

Most larger companies in the United States and other countries use different payroll methods with employee categories. Most companies use a bi-weekly method for employees with hourly-based pay and a semi-monthly/monthly-based method for employees with a fixed salary. The semi-monthly payroll method is flexible to cater to a certain type of employee as such and has a relevant method for others.

5. The payment plan and method are easy to understand

The semi-monthly method is very easy to understand. There are only two payments applicable in a given calendar month. Simply, the payment happens on the 15th of the month and the last business day of the month. It is simple to comprehend even for an average employee.

6. Company can save money on payroll administration

When compared with bi-weekly pay, there is very less hassle than semi-monthly pay in terms of payroll administration. There are fewer pay periods and it is simple as well. Hence the company can save the payroll processing cost.

Disadvantages (Cons / Negatives / Drawbacks) of Semi-Monthly Payroll

1. Employees could be confused with the method due to a lack of consistency

In the weekly or bi-weekly payroll processing method, the employee will get the payment on a given day within the week (e.g. Friday). But in the semi-monthly method, it could be any day within the week. Hence, the employee could be confused with the processing.

2. Not practical to implement with non-exempt employees.

Non-exempt employees are entitled to a minimum amount of compensation and on top, they will be entitled to overtime pay when they work more than agreed hours per week. It is not practical to implement semi-monthly payroll with non-exempt employees since the payroll period could start/end within the middle of the week (e.g. 15th and last day of the month could be any date within the week). Hence it is difficult to pay non-except employees using the semi-monthly payroll method.

3. Some local states do not allow semi-monthly payroll method

Some states in the US and other countries do not allow semi-monthly payroll methods. As an example, in New Hampshire, employers must pay employees wages on a weekly or bi-weekly schedule. Semi-monthly and monthly pay frequencies must be approved by the New Hampshire Department of Labor (NHDOL).

4. New employees have to wait around 2 weeks to receive the first paycheck

Unlike the weekly payroll method which pays employees every week, the semi-monthly payment happens around 2 weeks. The newly joined employee has to wait for around 2 weeks if he/she joins at the beginning of the month.

Definition of Semi-Monthly Payroll

Semi-monthly payroll is when a business pays the employees twice a month, usually on the 15th and last day of the month. The payment generally happens out on the proceeding Friday if these dates fall on a weekend. Furthermore, employees’ annual salaries are split into 24 pay periods, results 24 equal payments throughout the year.

Pay Period & Pay Days of Semi-Monthly Payroll

The pay period of semimonthly payroll is 24 times per year. It is a simple math to calculate with 12 months per year multiplied by 2 paydays per month = 24 paydays. This also means that semimonthly payroll produces 24 consistent earnings per year.

Pay dates of semimonthly payroll are commonly the 1st and 15th of each month or the 15th and the last day of each month.

Example of Semi-Monthly Payroll Calculation

As an example, let’s assume that an employee joined at an annual salary of $96,000. There are 24 pay periods of semimonthly payroll. Hence for each pay, the employee will get $4,000 ($96,000 / 24). The employee’s paysheet will indicate the salary of $4,000 on each semimonthly payday. The employee will get $8,000 each month (2 Pay Days per month hence $4,000 X 2 = $8,000).

Below are the steps to calculate semi-monthly wages:

- Determine the Annual Salary: Start by determining the employee’s annual salary (example: $96,000). This is usually provided in the job offer or contract.

- Convert Annual Salary to Monthly: Divide the annual salary by 12 to get the monthly salary. For example, if the annual salary is $96,000, the monthly salary would be $50,000 / 12 = $8,000.

- Divide Monthly Salary by 2: Since the employee is paid twice a month, divide the monthly salary by 2 to get the semi-monthly payment. Using the example above, $8,000 / 2 = $4,000.

- Calculate Deductions and Taxes: Deduct taxes, social security contributions, insurance premiums, and any other applicable deductions from the semi-monthly payment depending on the applicable tax laws and company policies. This will give you the net pay.

- Adjustments for Overtime or Bonuses: If the employee is entitled to overtime pay or receives bonuses, make appropriate adjustments to the semi-monthly payment.

- Verify Dates and Payment Frequency: Confirm the specific pay dates with the company’s payroll schedule to ensure accurate and timely payment.

- Document and Report: Keep records of the calculations for each pay period and generate pay stubs or statements for the employee’s reference. Ensure compliance with labor laws and regulations regarding wage payments and reporting.

Other Types of Payroll Schedules (Methods) Available

1. Bi-Monthly Payroll Schedule

Bimonthly payroll means that the company pays its employees once every two months. Employees in bi-monthly pay receive a salary every two months (six times a year). Bimonthly pay is when an employer pays the employees once every two months. Bimonthly pay contains 6 pay periods per year (Every calendar year has 12 months, hence 12/2 = 6).

Pay day of Bimonthly Payroll is usually the last day of two months. For the November and December months, the payday usually is 31st December. But it can vary based on the company policies.

2. Bi-Weekly Payroll Schedule

Biweekly payroll is when employees receive their pay every other week on an agreed day. There are 26 payments applicable for bi-weekly payroll, usually twice a month.

The entire year will be split into 26 separate pay periods in a biweekly schedule. Hence the employees get paid every two weeks instead of every week. In some months, the employees will get paid three times in one month with the payment schedule. There are always two months each year in which three paychecks are distributed and the other 10 months have two paychecks distributed.

3. Weekly Payroll Schedule

Weekly payroll means employees are paid once every week on a specific day. This results 52 payments per calendar year. Friday is the most common day which the payment happens.

Payroll administrators can easily calculate the overtime with the weekly pay schedule since the workweek is the same as the pay period. Employees also can verify the overtime payment easily since calculation considered on weekly basis.

Semi-Monthly Payroll vs Bi-Weekly Payroll vs Bi-Monthly Payroll

Following table presents the key differences in Semi-Monthly, Bi-Weekly, and Bi-Monthly Payroll.

| Semimonthly Payroll | Biweekly Payroll | Bimonthly Payroll | |

|---|---|---|---|

| Pay Period | Twice A Month | Every Other Week | Once Every Two Months |

| Number of Payments Per Year | 24 | 26 | 12 |

| Number of Payments Per Month | 2 Payments Per Month | For 10 Months 2, For 2 Months 3 | 1 Payment Per 2 Months |

| Payment Usually Happens on a Specific Day of a Week | No | Yes | No |

| Practical for Non-Exempt Employee Payment | No / Difficult | Yes | No / Difficult |

| Payment Amount Per Pay Period As Example. Assumption: Annual Salary of $78,000 | $78,000 / 24 = $3,250 | $78,000 / 26 = $3,000 | $78,000 / 12 = $6,500 |

| Best Advantage As an Employee | Payment Method is Easy to Understand | Employees Feel More Consistent | Paycheck Amount will be Comparatively High |

| Biggest Disadvantage As an Employee | Not Practical with Non-Exempt Employees | Paycheck will be Comparatively Less | Difficulty in Personal Budgeting |

How to Choose the Best Payroll Schedule for My Company?

Choosing the best payroll schedule for your company depends on various factors including your company’s cash flow, the frequency of your employees’ pay, administrative efficiency, and employee preferences. Here are some steps and tips to help you choose the most suitable payroll schedule,

- Assess your cash flow: You have to consider your company’s financial situation and determine how frequently you can afford to pay your employees. A more frequent payroll schedule, such as weekly or bi-weekly, may require a more consistent cash flow compared to a monthly or semi-monthly schedule.

- Consider employee preferences: You have to consider the preferences of your employees when choosing a payroll schedule. Some may prefer more frequent paychecks to better manage their finances, while others may prefer less frequent paychecks if they are used to monthly budgeting.

- Evaluate administrative efficiency: Consider the administrative workload involved in processing payroll. A more frequent payroll schedule may require more time and resources for payroll processing, whereas a less frequent schedule may be more efficient administratively.

- Review legal requirements: Make sure to comply with federal, state, and local labor laws regarding payroll frequency. Some jurisdictions may have specific requirements regarding the minimum frequency of paychecks. As example, in the United States, payroll schedules must comply with federal, state, and local labor laws

- Test different schedules: You can consider testing different payroll schedules on a trial basis to see which one works best for your company and employees, if possible. This can help you assess the impact on cash flow, administrative efficiency, and employee satisfaction.

- Consult with professionals: Consider consulting with payroll experts or financial advisors who can provide insights and recommendations based on your company’s specific needs and circumstances.

Ultimately, the best payroll schedule for your company will depend on a combination of factors, and it’s important to weigh these factors carefully to make an informed decision that meets the needs of both your company and your employees.

Which Industries Mostly Uses the Semi-Monthly Payroll Schedule

Semi-monthly payroll schedules are commonly used across many industries worldwide. It is mostly common in certain sectors where this payment frequency aligns well with business needs or employee preferences. Here are some of the industries where semi-monthly payroll schedules are frequently used,

- Professional Services: Industries such as accounting firms, law firms, consulting companies, and other professional services often use semi-monthly payroll schedules for their employees.

- Education: Schools, colleges, and universities frequently adopt semi-monthly payroll schedules for faculty and staff, as these institutions often have regular pay periods that align with academic calendars.

- Healthcare: Hospitals, clinics, and other healthcare facilities may utilize semi-monthly pay periods for their employees, including doctors, nurses, and administrative staff.

- Manufacturing: Some manufacturing companies implement semi-monthly payroll schedules for their workforce, including both hourly and salaried employees.

- Non-Profit Organizations: Non-Profits organizations may find semi-monthly payroll schedules convenient for managing their finances and paying employees regularly.

FAQs

Q: Is it better for employees to get paid semi-monthly or monthly or bi-weekly?

A: The preference for semi-monthly, monthly, or bi-weekly pay frequencies largely depends on individual financial management and personal preferences. Semi-monthly payments offer a predictable schedule, aligning with monthly expenses, while bi-weekly payments provide consistency and may better match billing cycles. Monthly payments, though less frequent, offer simplicity and may suit those who prefer to budget on a longer time-frame. Ultimately, the best option depends on employees’ financial needs and preferences, with each frequency having its advantages and considerations.

Q: How can I convince my employees to get paid semi-monthly?

A: It is crucial to highlight the benefits of semi-monthly payroll to convince employees to switch to a semi-monthly pay schedule. You should communicate how semi-monthly payments provide more regularity and predictability, aligning with monthly expenses and facilitating better budgeting. Emphasize the convenience of receiving paychecks twice a month, which can help your employees manage their finances more effectively. Also showcase any administrative advantages the company may gain from this switch, such as simplified payroll processing. You have to inform that you are open to address any concerns or questions employees may have can also foster a smoother transition to a semi-monthly pay schedule.

Q: Do I need to pay more taxes when paid semi-monthly?

No, the frequency of pay does not directly impact the amount of taxes owed. Taxes are calculated based on your total annual income and relevant tax deductions, regardless of whether you’re paid semi-monthly, monthly, or bi-weekly. However, receiving more frequent paychecks might affect your tax withholding amounts per paycheck, potentially resulting in smaller withholding each pay period. This could impact your cash flow throughout the year, but the total tax liability remains the same regardless of pay frequency. It’s essential to review your tax withholding allowances periodically to ensure accurate withholding amounts based on your overall tax situation.

Q: Is semi-monthly payroll schedule suited well for a small businesses?

A: The suitability of a semi-monthly payroll schedule for a small business depends on various factors, including cash flow, administrative capacity, and employee preferences. Semi-monthly pay periods can offer consistency and may align well with monthly expenses for both the business and employees. However, they require careful budgeting to ensure sufficient funds are available for payroll twice a month. Additionally, managing payroll more frequently can increase administrative workload, especially for businesses with limited resources or personnel dedicated to payroll tasks. Small businesses considering a semi-monthly payroll schedule should assess their financial capabilities, operational needs, and employee expectations before making a decision.

Q: Factors I need to think about before choosing the best payroll schedule for my company?

A: You have to consider several factors such as cash flow management, administrative capacity, employee preferences, and legal requirements prior choosing a payroll schedule. You have to evaluate your business’s financial stability and ability to meet payroll obligations on different schedules. You should assess the administrative workload associated with each payroll frequency by considering your available resources and systems. Take into account the preferences of your employees and how different pay frequencies may impact their financial planning and satisfaction. Lastly, ensure compliance with labor laws and regulations governing pay frequency in your jurisdiction to avoid any legal issues.

Q: What are top challenges when processing semi-monthly payroll schedule?

A: The top challenges when processing a semi-monthly payroll schedule typically include managing cash flow effectively to ensure funds are available for more frequent payroll disbursements, handling increased administrative workload due to processing payroll twice a month, and ensuring accurate calculations and timely payments to employees to maintain compliance with labor regulations and employee expectations. Additionally, coordinating with financial institutions and software systems to facilitate seamless payroll processing can present logistical hurdles for businesses transitioning to a semi-monthly pay schedule.

Read More:

- Semi-Monthly Payroll

- Bi-Weekly Payroll

- Bi-Monthly Payroll

- Differences of Payroll Methods