Advantages and Disadvantages of Bi-Weekly Payroll

Biweekly payroll refers to the payroll payment that pays employees every other week on a decided day. The employees get paid every two weeks in bi-weekly pay. Every calendar year has 52 weeks, hence there are 26 payments applicable for bi-weekly payroll (52/2 = 26).

Table of Contents:

- Advantages of Biweekly Payroll – For Employers and Employees Separately

- Disadvantages of Biweekly Payroll – For Employers and Employees Separately

- Definition of Bi-Weekly Payroll

- Pay Period & Pay Days of Bi-Weekly Payroll

- How to Calculate Bi-Weekly Payroll with Examples

- What are the Other Types of Payroll Schedules (Methods) Available

- Difference Between Bi-Weekly, Semi-Monthly, and Bi-Monthly Payroll Schedules

- Best Practices for Managing Payroll Periods

- Which Industries uses the Bi-Weekly Payroll?

- Frequently Asked Questions (FAQs)

- Bi-Weekly Payroll Calendar for 2024, 2025, & 2026 Years

The following are the Advantages and Disadvantages of the Biweekly Payroll, in the perspective of employers and employees separately.

Advantages (Pros / Positives / Benefits) of Biweekly Payroll

Advantages for Employees

1. Employees Feel More Consistent

A bi-weekly pay schedule pays employees every two-week basis. Employees will know the payment will happen on the same day (e.x. Friday) every other week. This is pretty much consistent for the employees when compared with semi-monthly payment, which payment happens every month but the date will be different.

Employees can better consider how much they need to spend on routine household expenses like groceries, food, and gas for the coming two weeks. Bi-weekly payroll will help the employees to plan and manage the expenses & savings for the next two weeks easily.

2. Employees will Receive More Paychecks

The employees get a paycheck every two weeks basis in bi-weekly pay. Every calendar year has 52 weeks, hence there are 26 paychecks received for an employee on each year in bi-weekly payroll (52/2 = 26).

But in semi-monthly pay, the number of paychecks received is 24 (there are two payments applicable in each month, hence 2 x 12 = 24).

The employee will receive more paychecks in bi-weekly payments, even though the yearly total amount is the same. The employee will feel comfortable planning the expenses and saving money using the additional two paychecks received.

Employees can plan and avoid late charges with the more paychecks received.

3. Good Overtime Limit Coverage

For employers using the biweekly pay period, the overtime limits per pay period would cover both weeks instead of just one. This is another advantage for employees who can plan and cover more overtime.

Advantages for Employers

4. Easy Overtime Payment Calculation

In biweekly payroll, employee time entry verification for overtime calculation is easy because it is with a set duration of two weeks. When compared with the semi-monthly payroll which the time entry verification happens in the mid of the week (without a set duration), it is quite easy with biweekly payroll to handle the overtime payment-related calculation.

As an example, if semi-monthly payroll is used and employee overtime hours fall between two different pay periods, the company should make adjustments that are complex to manage.

5. Increase in Payroll Processing Efficiency

The company does the payroll processing every two weeks instead of one, which makes this more efficient. The HR department does the payroll processing steps consistently on the same day of each week. It is easier to plan and manage the administration work as a routine.

Disadvantages (Cons / Negatives / Drawbacks) of Biweekly Payroll

Disadvantages for Employees

1. Paycheck will be Comparatively Less

When compared with bi-weekly payroll, the value of the individual payment will be less. Employees receive two extra paychecks per year (26 – 24) as an opposite for this.

As an example, if the employee’s annual total payment is $78,000 then,

- If the employee receives the payment via a bi-weekly method he/she will receive $3,000 per paycheck ($78,000 / 26 pay periods).

- If the employee receives the payment via a semi-monthly method he/she will receive $3,250 per paycheck ($78,000 / 24 pay periods).

2. Difficulty in Personal Budgeting

Some people are used to monthly budgeting like getting the monthly salary and dividing that by month-based payments like rental, utilities, gas, etc. In these cases, such employees may feel difficulties in personal budgeting when bi-weekly payment is there.

3. Promotes More Spending for Employees

Bi-weekly payments could encourage more spending for certain employees. As an example, the employee will feel that they will get the next payment in two weeks, hence rather than planning to save, the mindset could shift to spend more. This means the employee gets the payment on more frequent occasions hence unable to plan the savings properly.

Disadvantages for Employers

4. Complicated Cash Forecasting for Companies

In bi-weekly payroll, there are 26 pay periods in a year. This means there will be two months which has three pay periods. The company will be in a much more difficult situation to forecast the monthly cash flow to pay three times in a given month. Extra effort will be needed to plan exceptional situations like this.

5. Difficultly in Monthly Company Budgeting Process

There will be two extra paychecks on a given two months per year when using bi-weekly pay. The company finance department will be in a difficult situation with budgeting since there will be three paychecks given in two months per year. The company should verify in advance whether adequate money is there is planned properly to avoid any last-minute hassle.

6. High Expenses in Payroll Run Administration

Whether the company is administrating the payroll in-house or outsourcing, the bi-weekly payment will incur additional expenses in the payroll run, since there are two additional pay periods in bi-weekly pay. This will result in higher annual payroll management expenses for companies that use biweekly pay frequency.

7. Additional Paper Work Requirement

When compared with semi-monthly pay, there is additional paperwork required for bi-weekly pay since there are more payrolls to be run per year.

Definition of Bi-Weekly Payroll

Biweekly payroll is when employees receive their pay every other week on an agreed day. There are 26 payments applicable for bi-weekly payroll, usually twice a month.

The entire year will be split into 26 separate pay periods in a biweekly schedule. Hence the employees get paid every two weeks instead of every week. In some months, the employees will get paid three times in one month with the payment schedule. There are always two months each year in which three paychecks are distributed and the other 10 months have two paychecks distributed.

Biweekly pay is the common pay period that many employers use in the USA and other countries.

Pay Period & Pay Days of Bi-Weekly Payroll

Biweekly pay is when an employer pays the employees every other week on a specific day of the week. Biweekly pay contains 26 pay periods per year (Every calendar year has 52 weeks, hence 52/2 = 26).

An employer chooses a specific day to pay employees in a biweekly schedule. The most common payday is Friday.

How to Calculate Bi-Weekly Payroll with Examples

As an example, let’s assume that an employee joined at an annual salary of $78,000. There are 26 pay periods of biweekly payroll. Hence for each pay, the employee will get $3,000 ($78,000 / 26). The employee’s paysheet will indicate the gross salary of $3,000 on each bi-weekly payday.

Some months there are two pay days per month and for some months there are 3 pay days per month. Hence,

- For 10 months in the year, the employee will get $6,000 each month (2 Pay Days per month hence $3,000 X 2 = $6,000).

- For 2 months in the year, the employee will get $9,000 each month (3 Pay Days per month hence $3,000 X 3 = $9,000).

For hourly employees, the amount they get per pay period varies with the number of hours worked and overtime calculation.

Detail step by step guide to process bi-weekly payroll provided below,

- Pay Periods: In a biweekly payroll system, there are 26 pay periods in a year, as there are 52 weeks in a year divided by 2.

- Payroll Processing: Employers typically establish a payroll schedule, specifying the pay period start and end dates, as well as the payday. For example, if the pay period starts on a Monday and ends on a Sunday, payday might be the following Friday.

- Hours Worked: Throughout the pay period (two weeks), employees track their hours worked. This tracking could happen through manual time-sheets or electronic time-tracking systems.

- Calculating Wages: The employer calculates each employee’s wages based on their hourly rate or salary at the end of each pay period, while considering any overtime hours worked as applicable.

- Deductions: Various deductions are then subtracted from the gross pay, including taxes, insurance premiums, retirement contributions, and any other withholding required by law or agreed upon with the employee.

- Net Pay: The resulting amount after deductions is the employee’s net pay. This is the amount they will receive in their paycheck.

- Payment Distribution: Employees may receive their pay through direct deposit into their bank accounts, physical checks, or electronic pay cards, depending on the employer’s payment method.

- Taxes and Withholding: Employers are responsible for withholding federal, state, and local income taxes from employees’ paychecks, as well as Social Security and Medicare taxes. The amount withheld depends on various factors such as the employee’s filing status, allowances claimed, and any additional withholding requested by the employee.

- Record Keeping and Reporting: Employers must maintain accurate records of each pay period, including hours worked, wages paid, and deductions made. They also need to file payroll tax returns and provide employees with pay stubs detailing earnings and deductions.

What are the Other Types of Payroll Schedules (Methods) Available

1. Bi-Monthly Payroll Schedule

Bimonthly payroll means that the company pays its employees once every two months. Employees in bi-monthly pay receive a salary every two months (six times a year). Bimonthly pay is when an employer pays the employees once every two months. Bimonthly pay contains 6 pay periods per year (Every calendar year has 12 months, hence 12/2 = 6).

Pay day of Bimonthly Payroll is usually the last day of two months. For the November and December months, the payday usually is 31st December. But it can vary based on the company policies.

2. Semi-Monthly Payroll Schedule

Semi-monthly payroll is when a business pays the employees twice a month, usually on the 15th and last day of the month. The payment generally happens out on the proceeding Friday if these dates fall on a weekend. Furthermore, employees’ annual salaries are split into 24 pay periods, results 24 equal payments throughout the year.

3. Weekly Payroll Schedule

Weekly payroll means employees are paid once every week on a specific day. This results 52 payments per calendar year. Friday is the most common day which the payment happens.

Payroll administrators can easily calculate the overtime with the weekly pay schedule since the workweek is the same as the pay period. Employees also can verify the overtime payment easily since calculation considered on weekly basis.

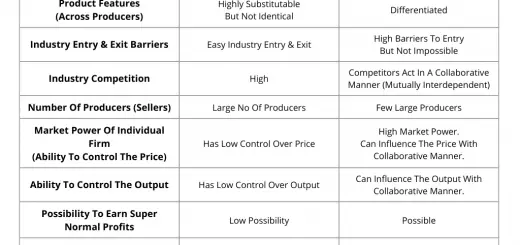

Difference Between Bi-Weekly, Semi-Monthly, and Bi-Monthly Payroll Schedules

| Biweekly Payroll | Semimonthly Payroll | Bimonthly Payroll | |

|---|---|---|---|

| Pay Period | Every Other Week | Twice A Month | Once Every Two Months |

| Number of Payments Per Year | 26 | 24 | 12 |

| Number of Payments Per Month | For 10 Months 2, For 2 Months 3 | 2 Payments Per Month | 1 Payment Per 2 Months |

| Payment Usually Happens on a Specific Day of a Week | Yes | No | No |

| Practical for Non-Exempt Employee Payment | Yes | No / Difficult | No / Difficult |

| Payment Amount Per Pay Period As Example. Assumption: Annual Salary of $78,000 | $78,000 / 26 = $3,000 | $78,000 / 24 = $3,250 | $78,000 / 12 = $6,500 |

| Best Advantage As an Employee | Employees Feel More Consistent | Payment Method is Easy to Understand | Paycheck Amount will be Comparatively High |

| Biggest Disadvantage As an Employee | Paycheck will be Comparatively Less | Not Practical with Non-Exempt Employees | Difficulty in Personal Budgeting |

Best Practices for Managing Payroll Periods

Here are some payroll period best practices to follow,

- Consistency: You should maintain a regular and consistent payroll schedule to provide predictability for employees.

- Compliance: You have to ensure compliance with federal, state, and local laws regarding pay frequency, overtime pay, and tax withholding.

- Accurate Record-Keeping: You have to maintain accurate records of hours worked, wages paid, and deductions to facilitate payroll processing.

- Communication: You should clearly communicate payroll schedules, pay rates, deductions, and any changes to employees in advance to avoid confusion and ensure transparency.

- Automation: It is great if you can utilize payroll software or systems to automate payroll processing, reduce errors, and increase efficiency.

- Review and Audit: You have to regularly review and audit payroll processes and records to identify and correct any errors or discrepancies promptly.

- Employee Self-Service: It is a good practice if you can provide employees with access to self-service tools or portals to view their pay stubs, update personal information, and access relevant payroll documents.

- Training and Education: You have to train payroll staff and managers on relevant laws, regulations, and best practices to ensure compliance and accuracy in payroll processing.

- Vendor Management: If you are outsourcing payroll, carefully select and manage payroll service providers to ensure reliability, security, and compliance with legal requirements.

- Feedback and Improvement: You can obtain solicit feedback from employees and stakeholders to identify areas for improvement in payroll processes and address any concerns or issues promptly.

Which Industries uses the Bi-Weekly Payroll?

Biweekly payroll schedules are prevalent across a wide range of industries, with some sectors more commonly adopting this payment frequency than others. Retail industry stands out as one of the most significant users of biweekly payroll. Despite large chains or smaller Retail establishments, they often find biweekly pay schedules to be practical and efficient for managing their workforce.

Also the bi-weekly payroll is commonly used in hospitality industry, encompassing restaurants, hotels, and entertainment venues. The employees on these industries demands biweekly pay schedules for their staff, including servers, kitchen staff, and housekeeping personnel.

In addition to retail and hospitality, healthcare is another industry where biweekly pay schedules are commonly utilized. Hospitals, clinics, and other healthcare facilities often rely on this payment frequency for their diverse workforce, which includes nurses, medical technicians, and administrative personnel.

While these industries represent significant users of biweekly payroll, the flexibility and simplicity of this payment frequency make it a popular choice across various sectors, including manufacturing, education, nonprofit organizations, and government agencies.

Frequently Asked Questions (FAQs)

Q: Does Biweekly Payroll Most Popular in the US?

A: According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most popular in the USA with an estimated 43% of U.S. private establishments paying their employees. Usually, bi-weekly payroll applies to non-exempt employees, casual hourlies, and undergraduate and graduate student workers.

Most companies in the USA choose a combination of payrolls, using the semimonthly approach for fixed salaried employees and a biweekly payroll for hourly employees.

Q: How does bi-weekly payroll differ from semi-monthly payroll?

A: Bi-weekly payroll occurs every two week. Semi-monthly payroll happens twice a month, usually on mid day of the month (such as the 15th) and the last day of the month. This means semi-monthly pay periods can vary in length.

Q: When does usually employees receive their bi-weekly pay?

A: Employees on a bi-weekly payroll schedule usually receive their paychecks or direct deposits every other week, on the same day of the week. Most common pay-day is Friday.

Q: How should employers calculate overtime on a bi-weekly payroll?

A: Overtime calculation on a bi-weekly payroll typically follows federal and state labor laws. Employees are entitled to overtime pay for hours worked over 40 in a workweek. Please note that some states may have additional regulations regarding overtime.

Q: What are the key differences of bi-weekly when compared with semi-monthly payroll schedule?

A: The key differences is their frequency and timing. Bi-weekly payroll occurs every two weeks, resulting in 26 pay periods per year, while semi-monthly payroll involves paying employees twice a month. Bi-weekly pay periods have a consistent duration of two weeks, whereas semi-monthly pay periods can vary in length depending on the number of days in each month. Additionally, bi-weekly paychecks are usually issued on the same day of the week, while semi-monthly pay dates may fall on specific calendar days, regardless of the day of the week.

Q: What are the key similarities of bi-weekly when compared with semi-monthly payroll schedule?

A: Both bi-weekly and semi-monthly payroll schedules involve paying employees multiple times within a month. Both schedules also offer employees regular and predictable paychecks, contributing to financial stability and easier budgeting. Additionally, both bi-weekly and semi-monthly pay frequencies are commonly used by businesses and are recognized under labor laws and regulations, ensuring compliance with payment standards. However, the main similarity lies in their aim to provide employees with consistent and timely compensation for their work.

Q: Can an employee switch from monthly or semi-monthly payroll to bi-weekly?

A: Yes, you can switch your payroll frequency anytime you like. But it’s essential to communicate the change clearly with your employees and ensure that the transition is smooth and complies with labor laws.

Q: How should I communicate to my employees if I changing my payroll from semi-monthly to bi-weekly?

A: First you should send out a clear announcement detailing the reasons for the change, the new pay schedule, and any adjustments to pay amounts or frequency of deductions. Provide ample notice period for your employees, address common concerns upfront, offer support channels for questions or clarifications, and update relevant documentation to reflect the new payroll frequency. Emphasize the benefits of bi-weekly pay and assure employees of your commitment to a smooth transition.

Q: How do I handle holidays on a bi-weekly payroll schedule?

A: Holiday pay on a bi-weekly schedule depends on your company’s policy and state regulations. Typically, if a holiday falls on a payday, you may need to adjust the payroll processing date or pay employees early.

Q: Why do companies prefer bi-weekly payroll schedule?

A: Companies often prefer bi-weekly payroll schedules because they align with regular workweeks, making it easier to track and manage employee hours. Bi-weekly pay periods are also simpler to administer than weekly schedules, requiring fewer payroll runs and reducing administrative burden. Additionally, bi-weekly paychecks provide employees with a consistent and predictable income, contributing to financial stability and employee satisfaction.

Q: What is the best payroll schedule for a small business?

A: For many small businesses, a bi-weekly payroll schedule tends to be the most practical choice. It strikes a balance between the frequency that employees appreciate for managing their finances and the administrative simplicity for the business. Bi-weekly pay periods typically align with regular workweeks and are easier to manage than weekly or monthly schedules, while still providing employees with a consistent and predictable payday.

Q: Are employees prefer to get paid on bi-weekly basis?

A: Yes, many employees prefer to be paid on a bi-weekly basis because it aligns with regular workweeks, making budgeting and financial planning more manageable. Bi-weekly paychecks provide a consistent and predictable income, contributing to financial stability for employees.

Q: What are the challenges of processing bi-weekly payroll compared with other schedules?

A: Processing bi-weekly payroll can present challenges such as increased frequency of payroll runs, which can demand more time and resources from payroll administrators. Additionally, bi-weekly pay periods may occasionally result in 27 pay periods in a year instead of the usual 26, which can impact budgeting and forecasting. Moreover, calculating overtime and handling holiday pay can be more complex on a bi-weekly schedule compared to other pay frequencies.

Bi-Weekly Payroll Calendar for 2024, 2025, & 2026 Years

- Bi-weekly pay schedule (payroll calendar) for the Year 2024 with Friday as the payday:

| Year | Month | Pay Date | Pay Day | Considered Date Duration |

|---|---|---|---|---|

| 2024 | January | 5 | Friday | December 23, 2023 – January 5, 2024 |

| 2024 | January | 19 | Friday | January 6, 2024 – January 19, 2024 |

| 2024 | February | 2 | Friday | January 20, 2024 – February 2, 2024 |

| 2024 | February | 16 | Friday | February 3, 2024 – February 16, 2024 |

| 2024 | March | 1 | Friday | February 17, 2024 – March 1, 2024 |

| 2024 | March | 15 | Friday | March 2, 2024 – March 15, 2024 |

| 2024 | March | 29 | Friday | March 16, 2024 – March 29, 2024 |

| 2024 | April | 12 | Friday | March 30, 2024 – April 12, 2024 |

| 2024 | April | 26 | Friday | April 13, 2024 – April 26, 2024 |

| 2024 | May | 10 | Friday | April 27, 2024 – May 10, 2024 |

| 2024 | May | 24 | Friday | May 11, 2024 – May 24, 2024 |

| 2024 | June | 7 | Friday | May 25, 2024 – June 7, 2024 |

| 2024 | June | 21 | Friday | June 8, 2024 – June 21, 2024 |

| 2024 | July | 5 | Friday | June 22, 2024 – July 5, 2024 |

| 2024 | July | 19 | Friday | July 6, 2024 – July 19, 2024 |

| 2024 | August | 2 | Friday | July 20, 2024 – August 2, 2024 |

| 2024 | August | 16 | Friday | August 3, 2024 – August 16, 2024 |

| 2024 | August | 30 | Friday | August 17, 2024 – August 30, 2024 |

| 2024 | September | 13 | Friday | August 31, 2024 – September 13, 2024 |

| 2024 | September | 27 | Friday | September 14, 2024 – September 27, 2024 |

| 2024 | October | 11 | Friday | September 28, 2024 – October 11, 2024 |

| 2024 | October | 25 | Friday | October 12, 2024 – October 25, 2024 |

| 2024 | November | 8 | Friday | October 26, 2024 – November 8, 2024 |

| 2024 | November | 22 | Friday | November 9, 2024 – November 22, 2024 |

| 2024 | December | 6 | Friday | November 23, 2024 – December 6, 2024 |

| 2024 | December | 20 | Friday | December 7, 2024 – December 20, 2024 |

| 2025 | January | 3 | Friday | December 21, 2024 – January 3, 2025 |

- Bi-weekly pay schedule (payroll calendar) for the Year 2025 with Friday as the payday:

| Year | Month | Pay Date | Pay Day | Considered Date Duration |

|---|---|---|---|---|

| 2025 | January | 3 | Friday | December 21, 2024 – January 3, 2025 |

| 2025 | January | 17 | Friday | January 4, 2025 – January 17, 2025 |

| 2025 | January | 31 | Friday | January 18, 2025 – January 31, 2025 |

| 2025 | February | 14 | Friday | February 1, 2025 – February 14, 2025 |

| 2025 | February | 28 | Friday | February 15, 2025 – February 28, 2025 |

| 2025 | March | 14 | Friday | March 1, 2025 – March 14, 2025 |

| 2025 | March | 28 | Friday | March 15, 2025 – March 28, 2025 |

| 2025 | April | 11 | Friday | March 29, 2025 – April 11, 2025 |

| 2025 | April | 25 | Friday | April 12, 2025 – April 25, 2025 |

| 2025 | May | 9 | Friday | April 26, 2025 – May 9, 2025 |

| 2025 | May | 23 | Friday | May 10, 2025 – May 23, 2025 |

| 2025 | June | 6 | Friday | May 24, 2025 – June 6, 2025 |

| 2025 | June | 20 | Friday | June 7, 2025 – June 20, 2025 |

| 2025 | July | 4 | Friday | June 21, 2025 – July 4, 2025 |

| 2025 | July | 18 | Friday | July 5, 2025 – July 18, 2025 |

| 2025 | July | 31 | Friday | July 19, 2025 – July 31, 2025 |

| 2025 | August | 15 | Friday | August 1, 2025 – August 15, 2025 |

| 2025 | August | 29 | Friday | August 16, 2025 – August 29, 2025 |

| 2025 | September | 12 | Friday | August 30, 2025 – September 12, 2025 |

| 2025 | September | 26 | Friday | September 13, 2025 – September 26, 2025 |

| 2025 | October | 10 | Friday | September 27, 2025 – October 10, 2025 |

| 2025 | October | 24 | Friday | October 11, 2025 – October 24, 2025 |

| 2025 | November | 7 | Friday | October 25, 2025 – November 7, 2025 |

| 2025 | November | 21 | Friday | November 8, 2025 – November 21, 2025 |

| 2025 | December | 5 | Friday | November 22, 2025 – December 5, 2025 |

| 2025 | December | 19 | Friday | December 6, 2025 – December 19, 2025 |

- Bi-weekly pay schedule (payroll calendar) for the Year 2026 with Friday as the payday:

| Year | Month | Pay Date | Pay Day | Considered Date Duration |

|---|---|---|---|---|

| 2026 | January | 2 | Friday | December 20, 2025 – January 2, 2026 |

| 2026 | January | 16 | Friday | January 3, 2026 – January 16, 2026 |

| 2026 | January | 30 | Friday | January 17, 2026 – January 30, 2026 |

| 2026 | February | 13 | Friday | January 31, 2026 – February 13, 2026 |

| 2026 | February | 27 | Friday | February 14, 2026 – February 27, 2026 |

| 2026 | March | 13 | Friday | February 28, 2026 – March 13, 2026 |

| 2026 | March | 27 | Friday | March 14, 2026 – March 27, 2026 |

| 2026 | April | 10 | Friday | March 28, 2026 – April 10, 2026 |

| 2026 | April | 24 | Friday | April 11, 2026 – April 24, 2026 |

| 2026 | May | 8 | Friday | April 25, 2026 – May 8, 2026 |

| 2026 | May | 22 | Friday | May 9, 2026 – May 22, 2026 |

| 2026 | June | 5 | Friday | May 23, 2026 – June 5, 2026 |

| 2026 | June | 19 | Friday | June 6, 2026 – June 19, 2026 |

| 2026 | July | 3 | Friday | June 20, 2026 – July 3, 2026 |

| 2026 | July | 17 | Friday | July 4, 2026 – July 17, 2026 |

| 2026 | July | 31 | Friday | July 18, 2026 – July 31, 2026 |

| 2026 | August | 14 | Friday | August 1, 2026 – August 14, 2026 |

| 2026 | August | 28 | Friday | August 15, 2026 – August 28, 2026 |

| 2026 | September | 11 | Friday | August 29, 2026 – September 11, 2026 |

| 2026 | September | 25 | Friday | September 12, 2026 – September 25, 2026 |

| 2026 | October | 9 | Friday | September 26, 2026 – October 9, 2026 |

| 2026 | October | 23 | Friday | October 10, 2026 – October 23, 2026 |

| 2026 | November | 6 | Friday | October 24, 2026 – November 6, 2026 |

| 2026 | November | 20 | Friday | November 7, 2026 – November 20, 2026 |

| 2026 | December | 4 | Friday | November 21, 2026 – December 4, 2026 |

| 2026 | December | 18 | Friday | December 5, 2026 – December 18, 2026 |

Read More:

- Bi-Weekly Payroll

- Bi-Monthly Payroll

- Semi-Monthly Payroll

- Differences of Payroll Methods