How Do Banks Profit from Mergers and Acquisition Advisory

Banks charge fees from the companies to act as advisors on mergers and acquisitions for both buyers and sellers of businesses. This fee will be a profit for the bank.

Leading investment banks do advisory services for large companies in the world for their Mergers and Acquisition activities. This is the process of assisting the enterprises to find, strategize, analyze, negotiate, finance, and complete the entire process of merger or acquisition exercises of their business.

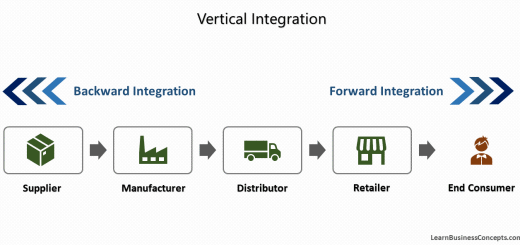

A merger is where two enterprises combined to join and move forward as one entity. An acquisition is where one enterprise buys another enterprise to expand its business.

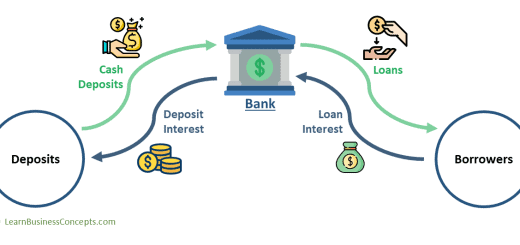

How do Banks Profit from Loan Interest

How do Banks Profit from Interchange

How do Banks Profit from Fees

How do Banks Profit from Capital Market Services