Initial Public Offering (IPO): Explanation, Steps & Examples

What is an Initial Public Offering (IPO)?

An initial public offering (known as IPO) is the process of the share offering of a private company to public investors for the first time, in which the transaction is traded via the share market.

Why Do Companies Go Public?

A company is considered private before an IPO. An IPO is a considerable step in a company’s journey since it is possible to raise significant capital through a public share offering. The company’s shares are traded on a stock exchange after IPO is completed.

Following are the reasons why companies go public,

An IPO provides flexibility to the company in terms of capital, to grow and expand with future strategies. This is the main benefit of a company consider go public.

- Improvement of company reputation which can help to obtain additional debt borrowing, partner with other companies, hire good talent, and onboard new customers

- Grab the advantage of the higher company equity valuation.

- When a company grows to a certain stage and believes it is mature to meet SEC regulations, has a potential future growth strategy, and is responsible to the public shareholders, the company can begin the process to go public via IPO.

Why Do Current Investors Decide to Offer an IPO?

The previously owned private shares convert to the public during an IPO. The value of the existing private shareholders’ shares will match the public trading price.

Following are the reasons why current investors decide to offer an IPO,

- Realize gains of their private investment. Usually, the initial public share price includes a share premium for current private investors. Investors can hold their shares in the public market to keep the investment to gain future potential high returns.

- Investors can exist from the investment. The company’s founders and early investors can sell their shares and gain cash returns for their investments.

- Investors can sell a portion of their public shares to gain a partial cash return. They can hold certain shares to keep the proportion of initial investment to gain future potential high returns.

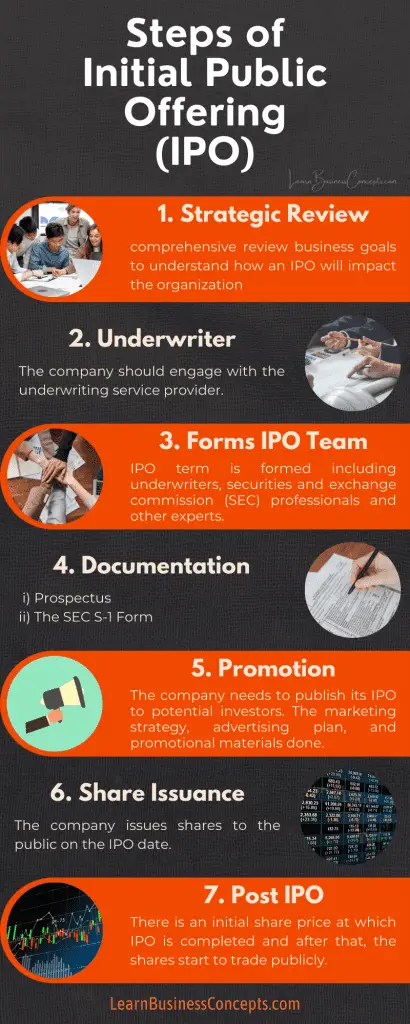

What Are the Steps / Process of IPO?

There are two milestones of an IPO process, the first one is the pre-marketing milestone and the second is the offering milestone.

Following is the steps/process of an IPO,

1. Strategic Review

The initial step is for an organization to do a comprehensive review of operations and business goals to understand how an IPO will impact the organization.

- Engage with the Financial Institution that does Underwriting Service

- The company should engage with the underwriting service provider. These underwriting services are typically provided by large financial institutions, such as banks, insurance companies, and investment houses.

- The underwriter will do an in-depth analysis of the company’s credit and financial background to determine IPO eligibility. Underwriters present proposals which consist of the share offer price, number of shares to offer, and estimated timeline of IPO.

2. Forms the IPO Team

IPO term is formed including underwriters, securities and exchange commission (SEC) professionals, certified accountants, and expert lawyers.

3. Documentation

i) Prospectus – The prospectus is the document that contains the company’s financial status and the number of shares planned to issue, and potential opportunities/challenges that the company will face.

ii) The SEC S-1 Form – This is the initial registration form for new securities required by the SEC for public companies that are based in the U.S. This form will be revised often throughout the pre-IPO process. After this is filled, it is generally referred to as the company filing for an IPO.

4. Marketing and Promotion

The company needs to publish its IPO to potential investors. The marketing strategy, advertising plan, and promotional materials will be done. Underwriters and the IPO team will estimate demand, plan the issuance date, and establish the final share offer price. These will be revised throughout this process. Underwriters can make revisions to their financial analysis throughout the marketing process.

5. Share Issuance

The company issues the shares to public on the IPO date. On the accounting aspect, the total capital gained from IPO is received as cash and recorded as stockholders’ equity in the Statement of Finance Position (known as Balance Sheet).

6. Post IPO

There is an initial share price at which IPO is completed and after that, the shares start to trade publicly.

Usually, a specified time frame will be given to the Underwriters to buy additional shares after the IPO. Also, the company should form processes to meet the financial reporting regulations (quarterly/yearly) imposed by SEC for all public companies.

Regulatory Requirements of an IPO

Companies must accomplish certain regulatory requirements imposed by the exchanges and the Securities and Exchange Commission (SEC) to hold an IPO. These regulations include filing a registration statement, preparing a prospectus, and applying to be listed on a stock exchange, which is explained under the “Steps / Process of IPO“.

Can Anyone Invest in an IPO?

IPO is generally available for any individual investor, through their trading account aligned with the stockbroker. The public means any individual or institutional investor who has the interest to invest in the company through IPO purchase.

But in certain instances, some large stockbroker companies will not allow the first investment to be an IPO. They provide IPO investments to the established individuals/institutions who were with them in the longer term.

How Is Initial Share Price Defined?

The company will discuss with the underwriting institutions and other experts to analyze the potential demand and techniques to set the IPO price. In technical terms, the IPO price is based on the valuation of the company using discounted cash flow or other applicable techniques.

Overall, the number of shares the company sells and the price for which shares sell are the generating factors for the company’s new shareholders’ equity value. Shareholders’ equity still represents shares owned by investors when it is both private and public, but with an IPO, the shareholders’ equity increases significantly with cash from the primary issuance.

Generally, when the IPO decision is made, the prospects for future growth are likely to be high, and public investors’ interest will be there. IPO share price is usually discounted and it will be below the potential share price value to attract investors and ensure sales.

Real World Examples of Successful Large IPOs

1. AT&T Wireless IPO in 2000

This IPO is considered one of the largest in U.S. history. AT&T Wireless Group raised a record $10.6 billion through an offering of 360 million shares. The company could easily expand to cover a larger portion of the United States and develop faster wireless data services using the large capital raised.

Read more:

2. Airbnb IPO in 2020

Airbnb IPO is considered one of the recent largest IPOs in the world. IPO price per share was stared at $68. But when IPO started, the initial share price started at $146 which is above the starting price and the stock even hit a high of $165. The company was able to earn over $100 billion from this IPO.

Read more:

3. Warner Music Group IPO in 2020

It was announced the pricing of 77,000,000 applicable shares at $25 per share, and the market capitalization value was around $12.7 billion. During the early trading, it was increased to 15% and it was possible to generate nearly $15 billion.

Read more:

Why Do Investors Choose IPOs?

IPOs are popular with investors because generally, the share price will increase after IPO, due to the discounted price and the potential future returns to be made. Hence, investors can gain large returns. There are certain instances where it could also produce large losses.

The investors usually analyze various factors including financial circumstances, industry analysis, and future projects in the company to judge whether to invest or not.

Learn More with LearnBusinessConcepts.com

- Bonus Issue: Explanation, Calculation & Real World Examples

- Advantages and Disadvantages of Bonus Issue