How do Banks Profit from Savings Accounts

How do Banks Profit from Savings Accounts

Following is an explanation about How Banks Profit from Savings Accounts,

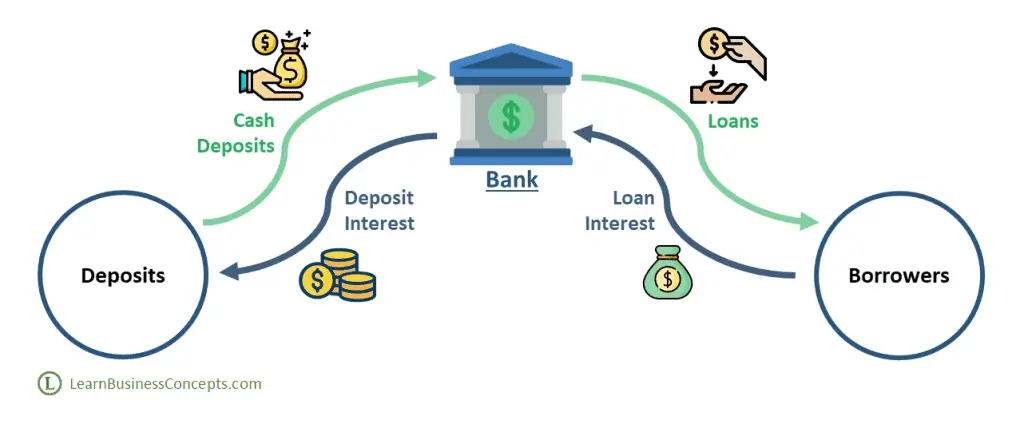

Customers make savings account deposits to the Bank. Borrowers request money from the Bank as loans. Both savings account deposits and loans are tied up with an interest component. Banks charge borrowers a higher interest rate and compensate the depositors with lower interest rates. Banks gain profit by lending cash to the borrowers for a higher interest rate than the deposit interest rate.

Interest related profit of the bank depends on various factors such as,

| Interest Received from Borrowers (Loan Interest) | XX,XXX.XX |

| ( – ) Interest Paid to the Depositors (Deposit Interest) | (XX,XXX.XX) |

| ( – ) Administration and Operation Cost of Loan Processing | (X,XXX.XX) |

| ( – ) Cost of Some Borrower’s Default | (X,XXX.XX) |

| Profit from Interest Income | X,XXX.XX |

Deposit interest income is the primary and traditional way for most banks to earn profit. Depositors gain certain interest over their deposit and also security for their funds. Bank lends those cash at a higher interest rate.

Recommended Articles:

- How do Banks Profit from Loan Interest

- How do Banks Profit from Interchange

- How do Banks Profit from Fees

- How do Banks Profit from Capital Market Services