Average vs Compound Annual Growth Rate (AAGR vs CAGR)

Difference Between Average Annual Growth Rate (AAGR) and Compound Annual Growth Rate (CAGR)

| Average Annual Growth Rate (AAGR) | Compound Annual Growth Rate (CAGR) |

|---|---|

| AAGR is the numerical mean of the sum of annual growth rates of investment | CAGR provides the annual growth rate at which an investment grows each year for the entire duration with considering compounding |

| A simple method for the calculation | A bit complex for calculation |

| Not adjusted for the effects of compounding | Adjusts for the effects of compounding |

| AAGR does not consider as a reliable method to estimate the growth of the investment | CAGR is considered as the most reliable method to estimate the growth of the investment |

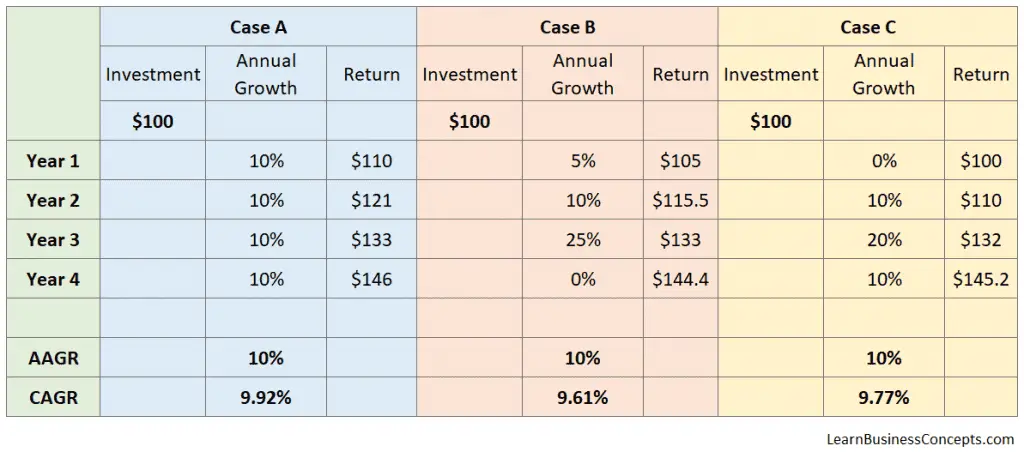

Case Based Example for the Difference Between AAGR and CAGR

Considering Case A

AAGR is 10% because the annual growth rate is steady as 10%. CAGR is 9.92% due to the compound factor.

Considering Case B

AAGR is 10% because the annual growth rate is averaged as 10%. But CAGR is lower than Case A as 9.61% due to the 0% growth in Year 4.

Considering Case C

AAGR is 10% because the annual growth rate is averaged as 10%. But CAGR is lower than Case A as 9.77% due to the 0% growth in Year 1.

This example clearly reflects that AAGR is not the best method for calculating annual growth rates and can often overrate the value in growth.

Differences between Average Annual Growth Rate (AAGR) and Compound Annual Growth Rate (CAGR) are explained in the below points,

- AAGR is the numerical mean of the sum of annual growth rates of investment.

whereas CAGR provides the annual growth rate at which an investment grows each year for the entire duration with considering compounding - AAGR is a simple method for the calculation

whereas CAGR is a bit complex for calculation - AAGR does not adjust for the effects of compounding

whereas CAGR adjusts for the effects of compounding - AAGR does not consider as a reliable method to estimate the growth of the investment

whereas CAGR is considered as the most reliable method to estimate the growth of the investment