Private Placement vs Public Offering (IPO)

A private placement is a fundraising method where the stocks are sold to pre-selected investors and institutions rather than on the open market. Private placements are generally offered to a limited pool of investors.

An initial public offering (IPO), also known as a public offering, relates to the process of allowing shares of a private corporation to trade for the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors via a stock exchange.

The company is named as ‘private’ earlier to the public offering (IPO) because its shares are only available to pre-selected investors. Share ownership is opened out to the wider stock exchange market after an IPO. Companies should meet the specified requirements of the Securities and Exchange Commission (SEC) to accommodate an initial public offering (IPO).

Difference Between Private Placement and Public Offering (IPO)

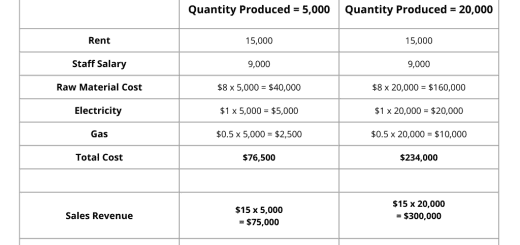

Differences between Private Placement and Public Offering (IPO) are explained in the below table,

| Private Placement | Public Offering (IPO) |

|---|---|

| The company does not offer its stocks through a public offering (shares not available to the general public). | The company offers its stocks through a public offering. |

| Shares are privately owned or held by pre-selected investors. | Shares are available for the public to buy from the stock exchange. |

| Less regulated when compared to a public offering. | More regulated when compared to a private placement. |

| Securities and Exchange Commission’s (SEC) enrolment is not required. | Securities and Exchange Commission’s (SEC) enrolment is required. |

| Companies mostly choose this because the company forecasted an excellent opportunity for rapid growth, which demands extra capital. | Companies mostly choose because the company needs to attract a large investor pool. |

| Reason for the company to choose this is because the company is unable to attract a large number of institutional or retail investors. | Reason for the company to choose this is because the company can attract a large number of institutional or retail investors. |

Comparison of Private Placement and Public Offering (IPO)

1) A private placement is a fundraising method where the stocks are sold to pre-selected investors and institutions rather than on the open market.

An initial public offering (IPO), also known as a public offering, relates to the process of allowing shares of a private corporation to trade for the public in a new stock issuance.

2) In Private Placement, the company does not offer its stocks through a public offering (shares not available to the general public).

In Public Offering (IPO), the company offers its stocks through a public offering.

3) Shares are privately owned or held by pre-selected investors in a private placement.

Shares are available for the public to buy from the stock exchange in a public offering.

4) Private placements are less regulated when compared to a public offering. Public Offerings (IPO) are more regulated when compared to a private placement.

5) Securities and Exchange Commission’s (SEC) enrolment is not required for private placement. Securities and Exchange Commission’s (SEC) enrolment is required for public offering.

6) Companies mostly choose private placement because the company forecasted an excellent opportunity for rapid growth, which demands extra capital.

Companies mostly choose public offerings (IPO) because the company needs to attract a large investor pool.

7) Reason for the company to choose private placement is that the company is unable to attract a large number of institutional or retail investors.

The reason for the company to choose public offerings (IPO) is because the company can attract a large number of institutional or retail investors.

Learn More:

- Definition of Private Placement

- Why Company Choose Private Placement

- Usage of Private Placement Investment

- Real Examples of Private Placement

- Private Placement Advantages

- Private Placement Disadvantages

- Difference Between Private Placement and Public Offering (IPO)

- Difference Between Rights Issue and Private Placement