Definition & Calculation of Compound Annual Growth Rate (CAGR)

What is Compound Annual Growth Rate (CAGR)?

Compound annual growth rate (CAGR) provides the annual growth rate at which an investment grows each year for the entire duration. Simply CAGR indicates the annual growth rate over multiple periods.

This is generally known as the best method to calculate and determine financial returns for any kind of investment that can grow or decline in value over time. The compound annual growth rate method is useful when comparing the growth for several years.

How to Calculate Compound Annual Growth Rate (CAGR)?

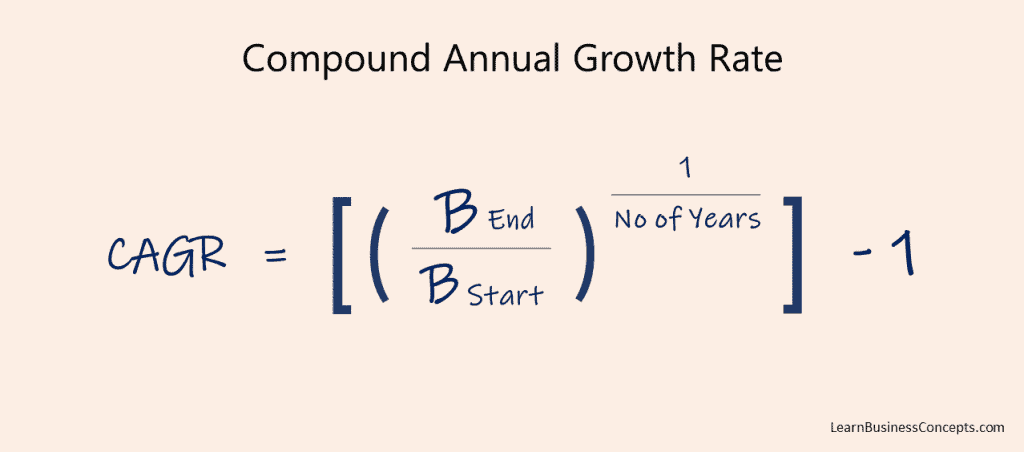

Formula to calculate the growth rate using compound annual growth rate method,

CAGR Formula = [ ( Ending Balance / Beginning Balance ) 1 / No of Years ] – 1

Why does Compound Annual Growth Rate (CAGR) important?

Compound annual growth rate (CAGR) is a method that smoothes the annual gains in investment over a specified number of years. This provides the compound annual rate in the growth rate of an investment over time.

As an example, assume that investment returns follow over time as below,

| Year | Return | Annual Growth (Previous Year vs Current Year) |

|---|---|---|

| Year 01 | $20 Million | |

| Year 02 | $25 Million | 25% |

| Year 03 | $40 Million | 60% |

| Year 04 | $44 Million | 10% |

As you could see, the separate calculations of the annual growth rate vary from 10% to 60%. The compound annual growth rate (CAGR) method smooths this.

CAGR = [ ( Ending Balance / Begining Balance ) ] 1 / No of Years ] – 1

CAGR = 31%

This is the value of smoothened annual gain of the investment.

Learn More About Growth Rate:

- What is Year-Over-Year Growth Rate?

- How to Calculate Year-Over-Year Growth Rate?

- Examples of Year-Over-Year Growth Rate

- Pros of Year-Over-Year Growth Rate

- Alternative Options for Year-Over-Year Growth Calculation

- Sample Spreadsheets (Excel) for Year-Over-Year Growth Calculation

- How To Calculate Growth Rate Using Different Methods/Formulas