Definition & Calculation of Average Annual Growth Rate (AAGR)

What is the Average Annual Growth Rate (AAGR)?

The average annual growth rate (AAGR) is the numerical mean of the sum of annual growth rates of investment. This is the average annual growth in the value of an investment.

AAGR is a linear measure that does not account for the effects of compounding. Also, this will not provide any indication of the potential risk of the investment.

Average annual growth rate (AAGR) is commonly used in evaluating long-term trends of investment. This can be used to calculate the growth rate of returns, sales, profit, cash flow, expenses, operational cost, etc.

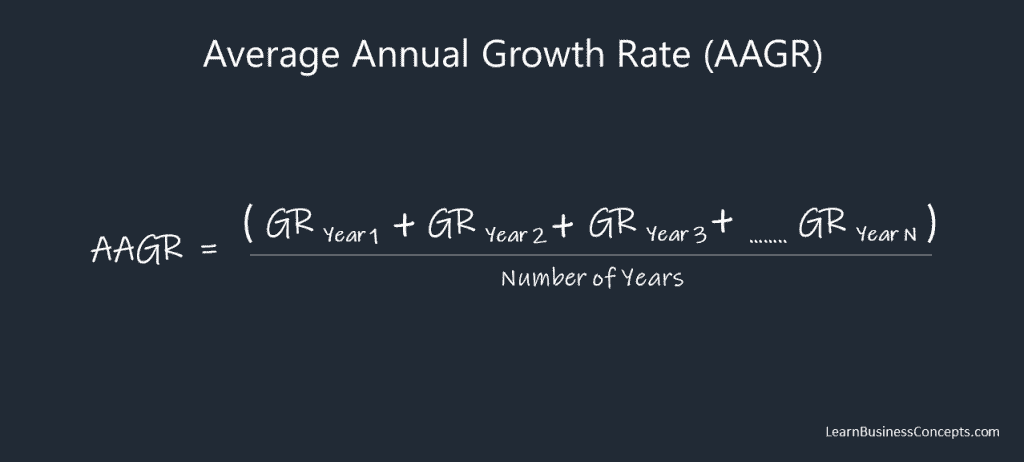

How to Calculate Average Annual Growth Rate (AAGR)?

Formula to calculate the growth rate using average annual growth rate (AAGR) method,

AAGR Formula = ( Growth Rate in Y1 + Growth Rate in Y2 + Growth Rate in Y3 + ….N ) / Total Number of Years

Step 01: Calculate the individual growth rate of each year. Formula = [ ( Vpresent – Vpast ) / Vpast ] x 100)

Step 02: Get the total of all the growth rates in the entire duration

Step 03: Divide this by the total number of years

What are the Drawbacks (Cons) of Average Annual Growth Rate (AAGR)?

Average Annual Growth Rate (AAGR) is the measurement of growth over a certain duration. It reflects the average value of the annual growth of an investment over the duration.

The biggest drawback of AAGR is that it does not provide any indication of the potential risk of the investment. Furthermore, unlike CARG, AAGR does not adjust for the effects of compounding.

Due to these factors, most analyst does not use AAGR is to measure growth. Instead, they use compounded annual growth rate (CAGR) for their calculations.